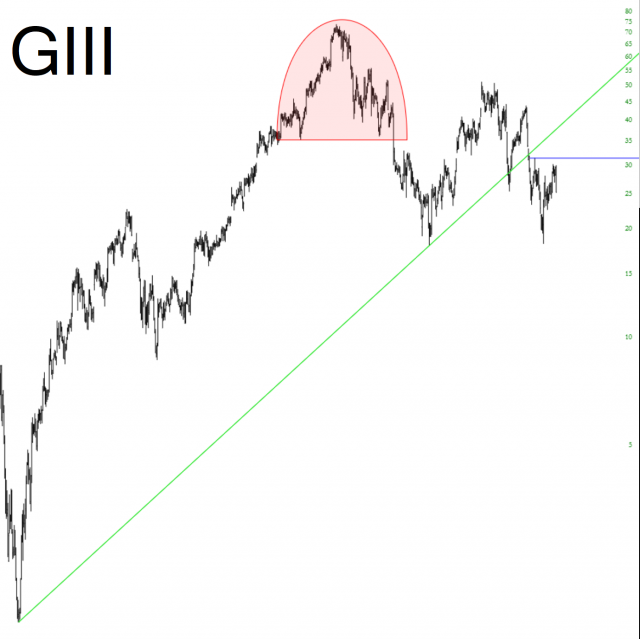

Just about the only good thing about today’s ridiculous “trade talks going well” horseshit is that I got out of my December options positions yesterday, since I really don’t like getting so close to expiration. One hero for the day, however, is GIII Apparel Group, which is having a nice 12% tumble. I’ve shown this one many times; the broken long-term trendline was the key.

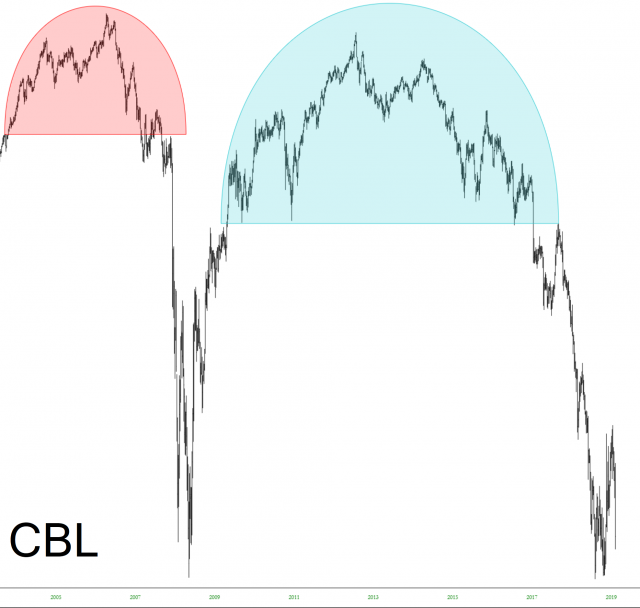

On a separate note, probably the stock I’ve cited over the past few years as an analog play more than any other is CBL Associates. Sadly, I didn’t have the patience (or guts) to hang on to this for the duration, but its achievement of the analog-like plunge was terrific. I’m hoping a few of you rode this one down.

As for my portfolio, I’ve trimmed back on a few equities that weren’t taking the heat today as well as I’d like, but I’m still in 80% of the shorts that I was in yesterday. 48 positions, 44 of them still profitable, 4 losers, with the most horrific loss being down a total of 0.3%.