“Coronachan” meme. Perhaps we’ll need an updated, India-themed one for the Delta Variant.

Return Of The State Of Fear

At the beginning of the year (New Year, State Of Fear), we referred to Michael Crichton’s observation about fear being used to facilitate control:

We concluded that COVID restrictions would linger for that reason:

Expect our masks and social distancing mandates to continue for for a while longer. Some cynics thought they’d end the day after November’s election. They weren’t cynical enough.

As it happened, the lingered for most of the first half of the year, depending on where you were. The mask mandate here in New Jersey finally ended on May 28th. Last week, though, the Biden administration indicated that they were considering renewed lockdowns as part of a strategy to counter the new Delta Variant.

Vaccines Versus Lockdowns

Presumably, the Biden administration has watched the anti-lockdown protests in Australia with some concern.

Given that, it seems likely that the federal and state governments in the U.S. will use the threat of lockdowns to pressure unvaccinated people to get vaccinated. A likely beneficiary of that will be one of our recent top names, BioNTech (BNTX).

A Surprising Top Name In May

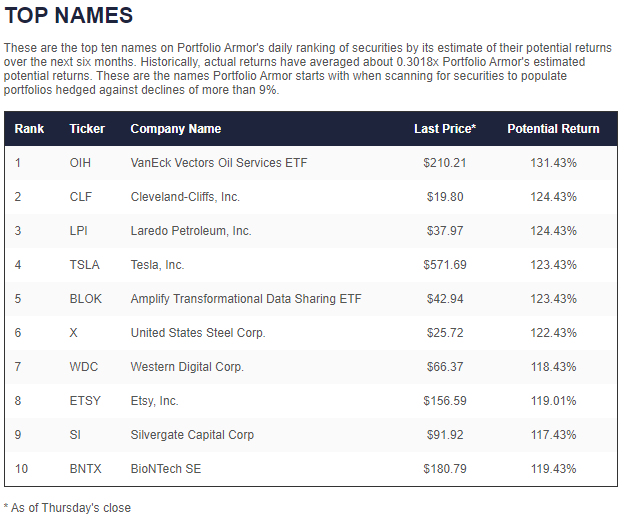

BioNTech hit our top ten on May 14th, which seemed to odd timing at the time.

Screen capture via Portfolio Armor on 5/13/2021.

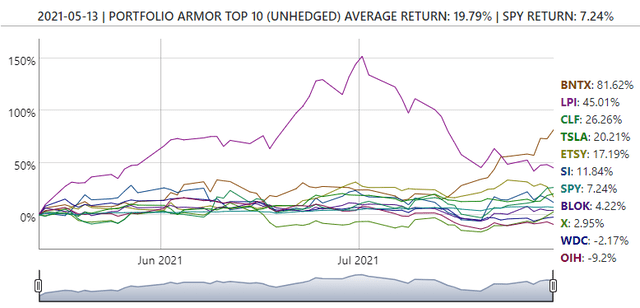

After all, news that the BioNTech-Pfizer (PFE) vaccine was effective broke just after the election in November (although, as Steve Sailer pointed out, the data demonstrating its effectiveness was available before the election). So it seemed weird that options market participants would put BNTX on our radar in mid-May. So far though, it looks like the options market got this one right. BNTX is up more than 81% since hitting our top ten in May.

If you’ve held the stock since then or longer, you’re sitting on some nice gains now. Let’s look at a way you can stay long while locking in most of those gains.

Locking In BioNTech Gains

Here’s a way you can stay long BioNTech and hold out for some additional gains, while strictly limiting your downside risk if the Delta Variant ends up having been overhyped.

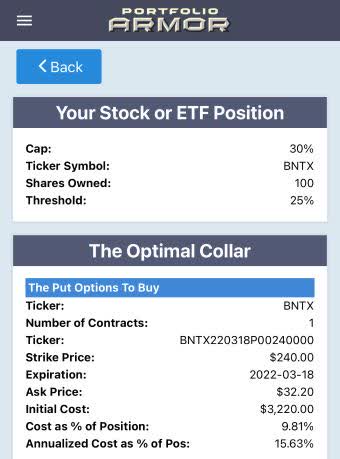

BioNTech was expensive to hedge with put options on Friday, but if you were willing to cap your possible upside at 30% by next March, this was the optimal collar to hedge 100 shares of BNTX against a greater-than-25% drop by then.

Screen captures via the Portfolio Armor iPhone app.

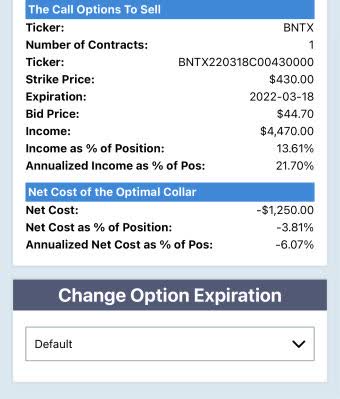

The net cost of that hedge was negative, meaning you would have collected a net credit of $1,250 when opening this collar.

Changing Option Expiration

We used our app’s default time to expiration setting in scanning for that optimal collar. If you don’t want to cap your upside until March, you can use it to select any available options expiration for BNTX. Checking a few expirations over the next month, it’s possible to hedge against a >25% drop using a 30% cap there too, though the net cost shifts to a slightly positive one (e.g., about $70 if you wanted to hedge out to September).