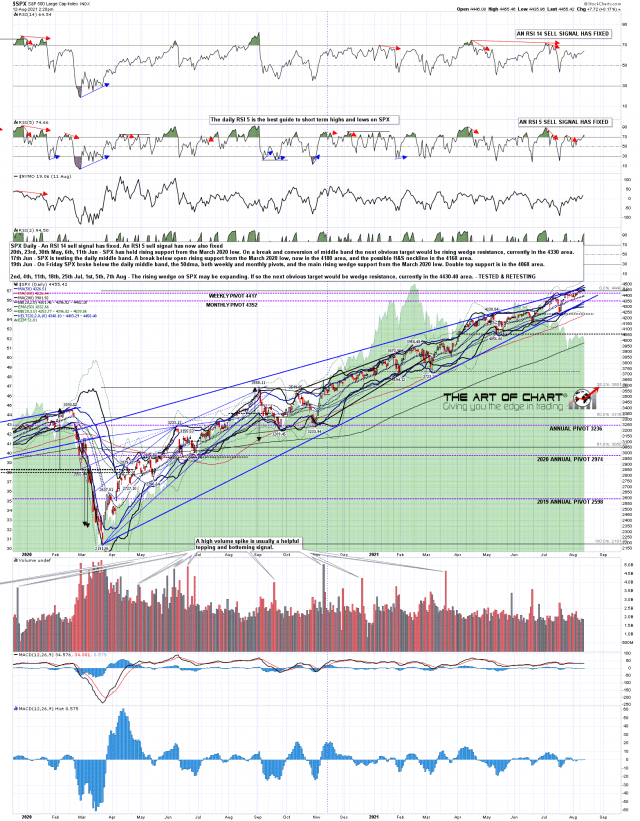

SPX has made new all time highs as expected and has gone to the resistance level I was talking about in my post a week ago. In the meantime though that trendline has risen and looks to be in the 4465-70 area now. There is no need to test that trendline, but it is strong trendline resistance if reached.

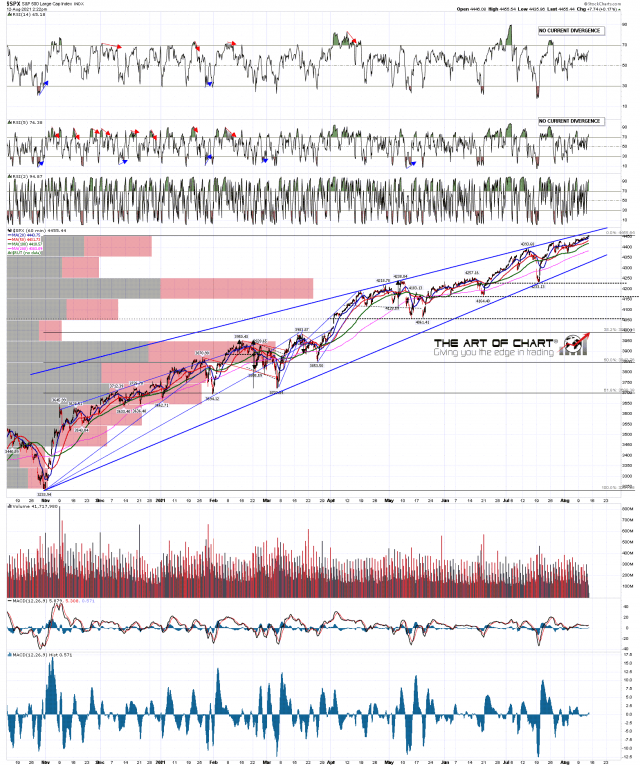

SPX 60min chart:

On the daily chart, subject to the close today, the fixed daily RSI 5 sell signal there may fail, though the one on NDX has now fixed.

SPX Daily chart:

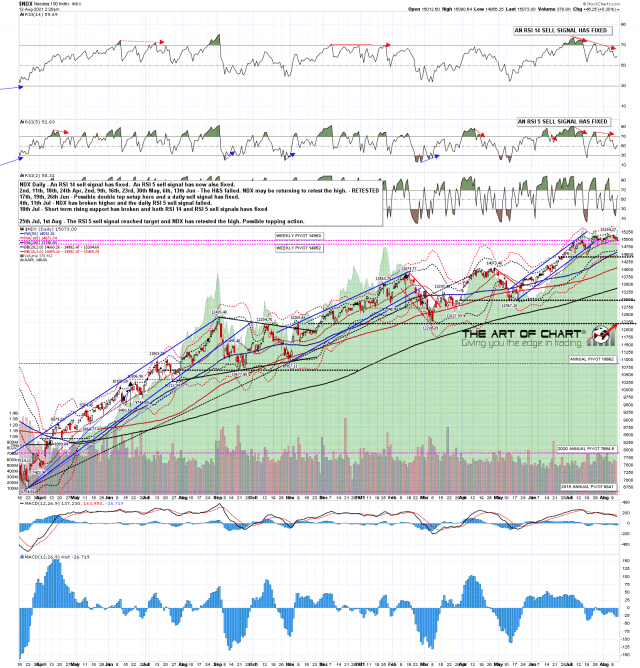

NDX is some distance away from resistance there, now in the 15,350 area. That too does not need to be tested, and if NDX is failing here then there is now a really decent looking nested double top setup formed and a very obvious target for a retracement here at rising support from the November low, now in the 13,950 area.

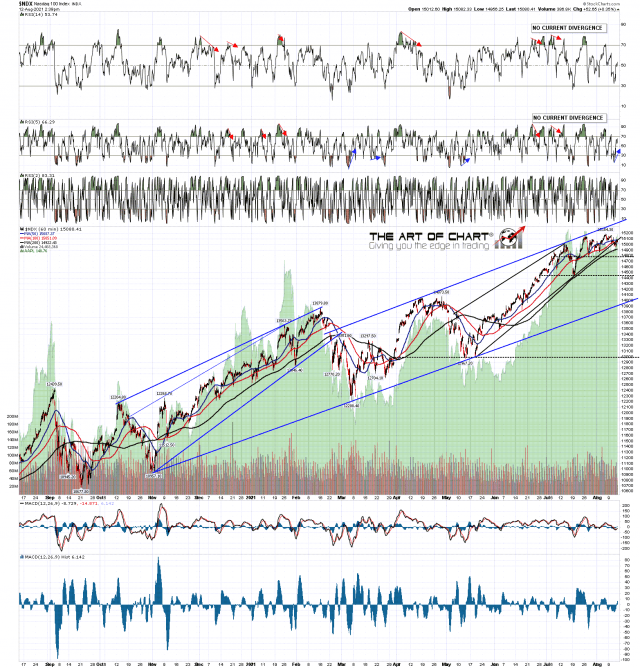

NDX 60min chart:

In the meantime the daily RSI 5 sell signal on NDX that I was looking at as likely a week ago has now fixed and NDX looks ready to roll over at any time. We’ll see how that goes.

NDX daily chart:

SPX and NDX are looking close to a turn here. Do they have to turn? No, they never do, but it is an attractive setup and, if seen, we might see the scenario that I was laying out in my post last Friday play out into October. We’ll see how that goes here.