In my usual self-deprecating style, I pointed out that my scurrying to a 33% cash position and scaling back 50% of my IYR position surely presaged a hard tumble in the market. Well, not quite, but still, the ES and RTY are down double digits and the NQ is down triple digits so……….yer welcome.

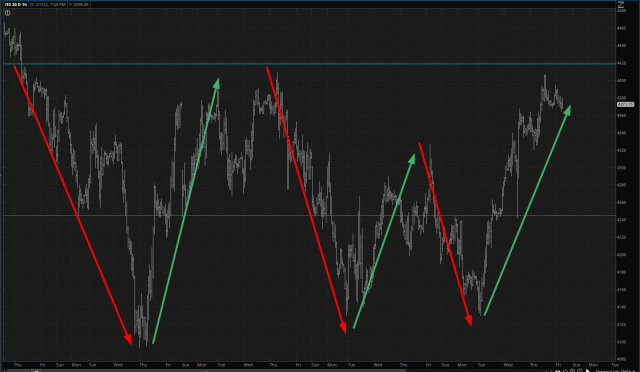

In spite of all my hand-wringing, what’s been going on in recent weeks makes plenty of sense, because we’re trapped in an almost comically-predictable zig-zag pattern. And the emotional part of me gets the better of me, because during the red arrows, I get revved up (but not TNRevved up) about getting super-aggressive, and during the green arrows, I reluctantly remove my dungarees in favor of a tattered ball gown and pumps. It’s actually kinda pathetic when I think about it. But here we have it:

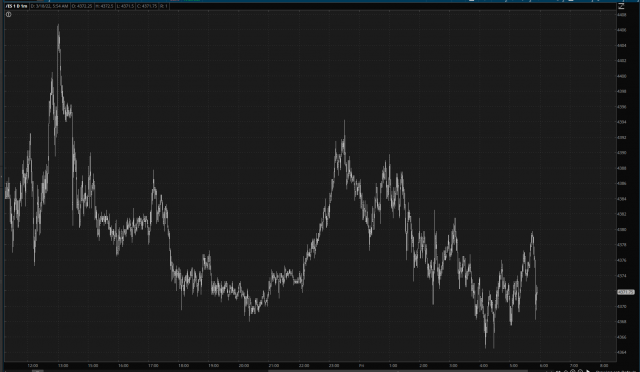

In defense of my effete self, we have indeed experienced by far the worst weekly (and it only took four days!!!) of this entire bear market. You don’t have to squint to see how brutal this week has been for the bearish crowd.

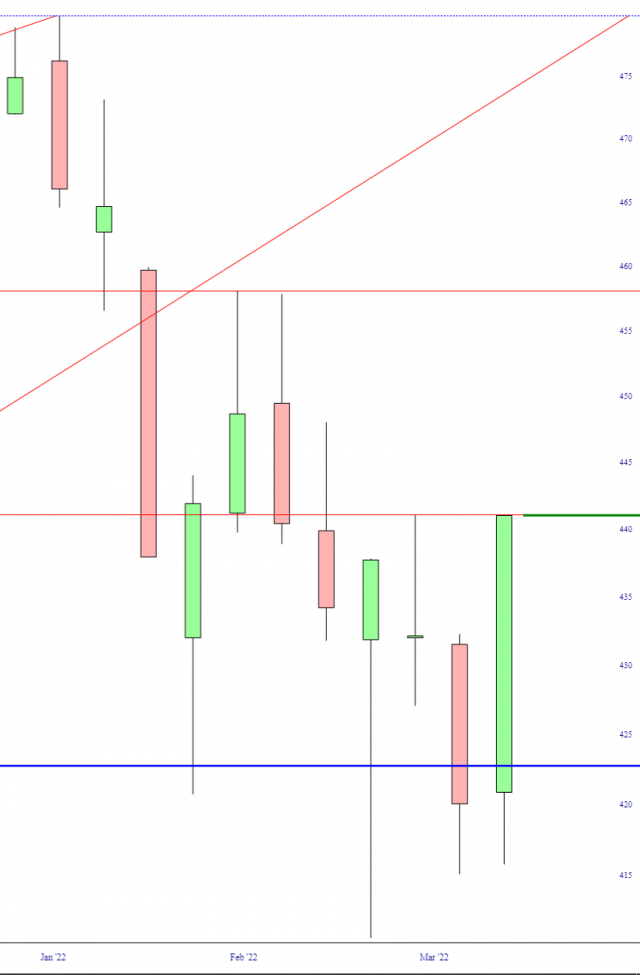

But the cold fact of the matter is that charts like the one below should cause a rational bear to absolutely salivate with anticipation. Indeed, this is PRECISELY the kind of setup any red-blooded (or red-arrowed) bear thinks about: a situation in which:

- The pattern is plainly established;

- The ability to drop hard has been proved;

- Prices have returned to appealing risk/reward levels;

- Complacency has settled in again, thanks to the hearty burst in prices.

So, as we enter the final day of this thus-far horrible week, I’m in 30 positions (two of them ETFs: that is, IYR and EFA) and have an embarrassing amount of cash laying around doing nothing.