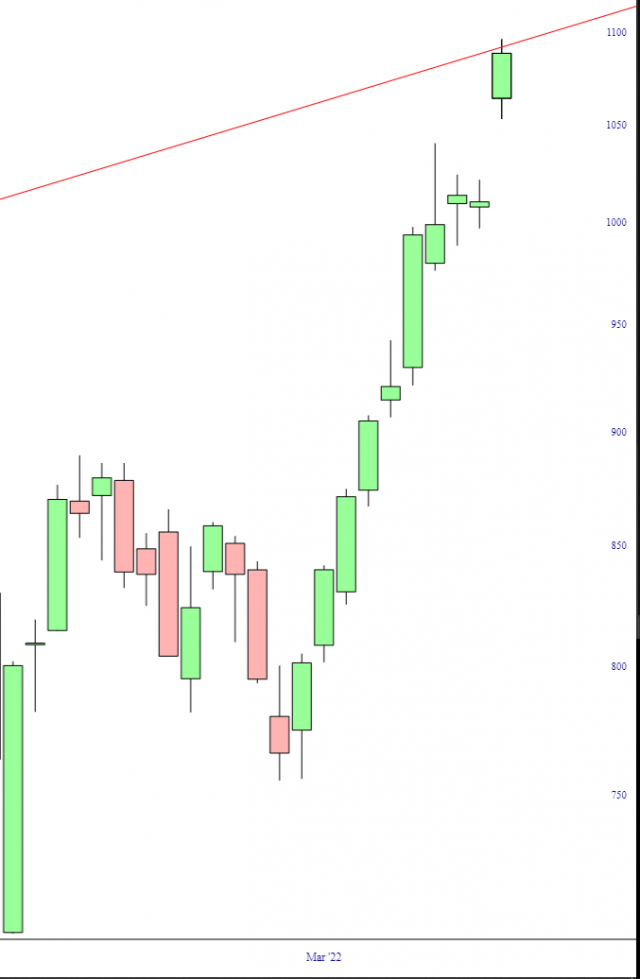

I think my Virtual Trading Equity Curve pretty much tells the story: I peaked on March 14th and am down 70% since then (or about $400 billion). Hey, easy come, easy go. At least it’s fake! Let’s just say my real portfolio isn’t quite as aggressive.

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

I think my Virtual Trading Equity Curve pretty much tells the story: I peaked on March 14th and am down 70% since then (or about $400 billion). Hey, easy come, easy go. At least it’s fake! Let’s just say my real portfolio isn’t quite as aggressive.

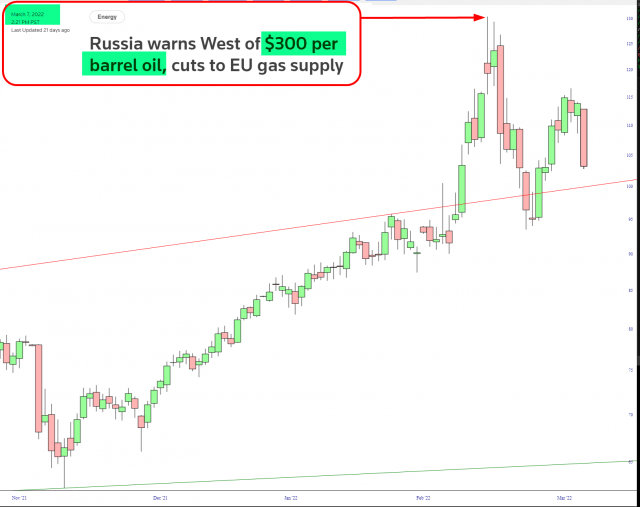

The moment, and I mean the moment, there was chatter about $300 oil, you knew it was all over.

My apologies for the long wait between posts. I went out with some friends for the first time in two years on the first weekend in March and caught COVID, which has taken a while to clear. That wasn’t too bad and I’m clear now though I’m still feeling low on energy. Hopefully that will pass soon too.

I did post one of my premarket videos at theartofchart.net on my personal twitter on 16th March looking at the very large amount of bullish pressure underneath the market and wondering whether we would see a strong rally and we have since seen that strong rally, which has taken SPX back to main resistance at the weekly middle band. So what now?

(more…)If you ask most people about the sell-off earlier this year, they would blame the Ukraine invasion. The funny thing is that the invasion marked the BOTTOM, almost to the millisecond. February 24th!

Take Tesla (please!) Since February 24th, it has climbed 57%. Fifty. Seven. Percent. That’s the kind of return one would hope for over a five year time span, not five weeks. But there we have it.