I’ve had a heavy, though very profitable, week and I’m flagging and working slowly this morning. The setup on SPX here is also simple enough to sum up in a couple of lines so today I’m going to use today’s futures charts that I post every day for subscribers at theartofchart.net with notes.

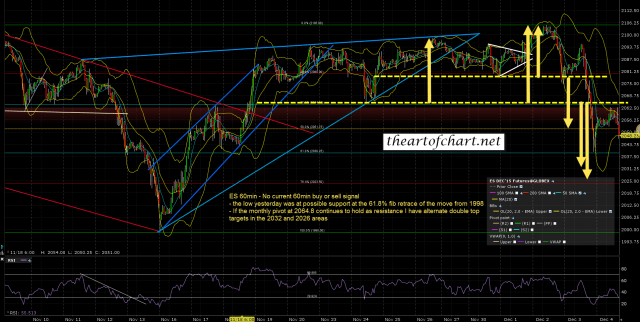

ES has broken back over the daily middle band. Retracement may well be over. ES 60min chart:

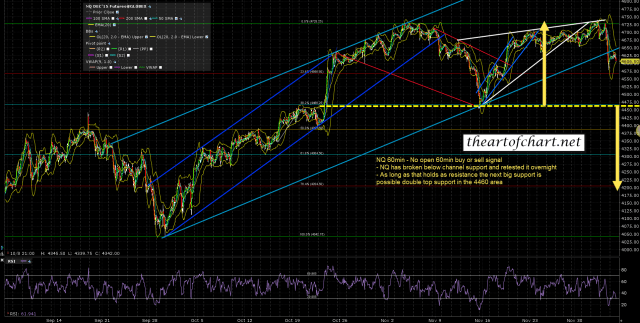

NQ 60min chart:

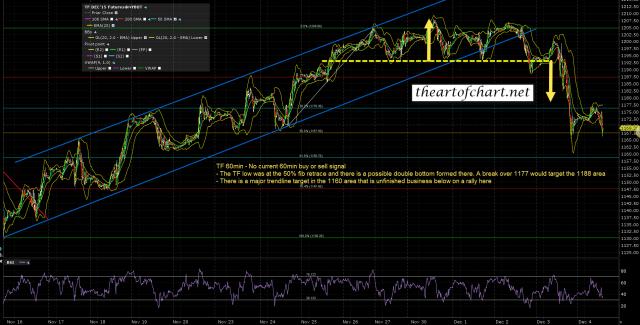

TF has important unfinished business below at a trendline test currently in the 1160 area. I’m expecting that to be tested in the next few days regardless of any rally today. TF 60min chart:

My DX short is one reason that I am having a great week. My main target is a test of rising megaphone support, currently in the 95 area. Big inflection point there which most likely resolves up. DX 60min chart:

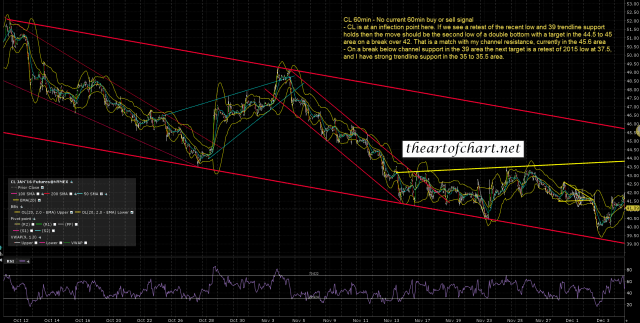

CL at an inflection point here at 39s test. Upside target 45.5 area. A break below 39 opens 37.5 and 35 as targets. CL 60min chart:

My GC long another big performer, albeit a slow starter. This move likely just a rally as long as DX holds the 95 support trendline. GC 60min chart:

If you want to see the current TLT setup I posted that on twitter yesterday so look there (@shjackcharts).

The SPX setup is that there are two key resistance levels today. The first level is the daily middle band in the 2075.5 area and the 5dma at 2077, effectively as single daily closing resistance level. That’s currently breaking up but that break needs to hold into the close today. the second level is the 50 hour MA, currently at 2085. If bulls can convert that to support then we may well be on the way back to that 2116 retest that didn’t quite make target on Wednesday.

Today is a cycle trend day. This means that there are 70% odds that buyers or sellers will dominate the day. If that delivers today then it is very likely that bulls dominate the day at this stage. My working assumption here is trend up day.

As I’ve been saying most days, the bigger picture setup looks very bearish but December seasonality is so strong for bulls that I’m thinking SPX will likely limp through until end end of the month. We may see repeated big swings and may well manage a new all time high in that time. Unless we see a conviction break of 2000 SPX I’m giving bulls the benefit of the doubt, at least to hold the 2000-2100 area.

This is proving to be an unusually interesting December across various markets. Stan and I are doing a free to all Chart chat at the theartofchart.net on Sunday afternoon at 4pm EST and we will be reviewing all of these markets and more there. You can sign up for that here. Unless you hate quality TA or are entirely indifferent to being on the right side of a trend then you should find it well worth the time. Places are limited so if you want to attend I’d advise signing up today.