Well here we are. The rising wedges from the February low on SPX, RUT and NDX have all broken down now, and today is the first trading day of the most historically bearish part of the year running through to the end of October. Most of this week leans bearish historically as well, apart from today, with Dow up 13 of the last 18. With Friday closing on multiple short term buy signals I’m looking for rally today and maybe tomorrow, and for the downtrend to resume after that. Tuesday and Wednesday are the cycle trend days this week and at least one of those should be a trend down.

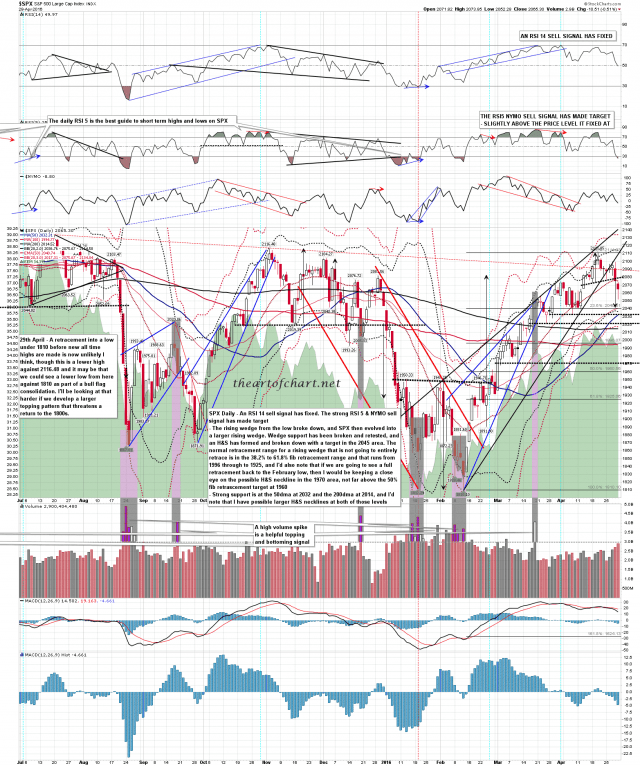

SPX gapped down on Friday though the daily middle band and never filled that gap. Daily middle band support has been broken. The daily RSI5_NYMO sell signal made target, not far from where it fixed, but the daily RSI 14 sell signal that was brewing has now fixed. After a likely rally / consolidation here, SPX should continue down. SPX daily chart:

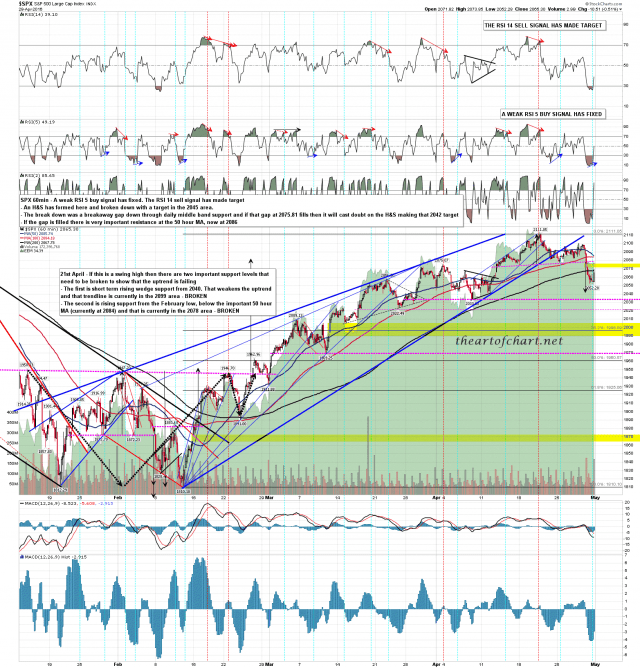

There is a lot of positive divergence across the indices here and I’m expecting at least some upside today. The main thing that I’m watching here is the open gap from 2075.81. If that gap fills then that would open up the 50 hour MA, currently at 2085, and if that was to break that could open up a possible retest of the current swing high. I’m not expecting to see the 50 hour MA broken, but those are the resistance levels to watch today. Bears cannot allow a break back with confidence over the daily middle band at 2076 on a daily close basis today. SPX 60min chart:

There is good reason to expect a green close today but the equity indices look fragile. I wouldn’t get married to either side today, and after this rally / consolidation ends I’m expecting more downside.