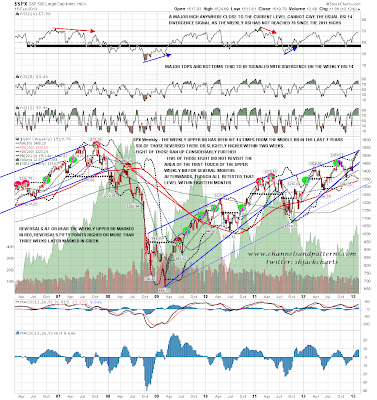

SPX went nowhere on Friday, closing the week some 15 points below the weekly upper bollinger band. This doesn't mean much in terms of retracement, but as this band is still rising at 10 or so points per week, if SPX continues to hug the upper band then that gives potential upside of 25 points from Friday's close into strong resistance. That's well worth bearing in mind:

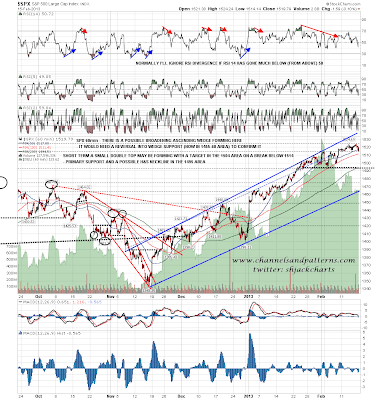

On the SPX 60min chart a small candidate double-top has formed with a target in the 1504 area on a clear break below 1514. Short term support is at 1514/5 and primary support (and a possible H&S neckline) is at 1495/6:

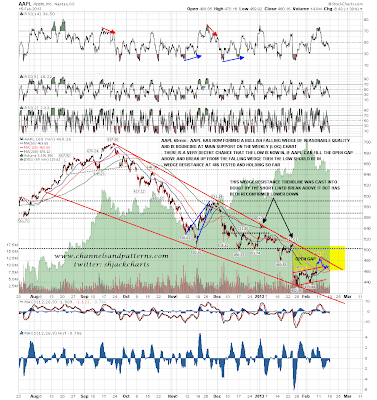

AAPL continues to retrace from falling wedge resistance and we could see a test of the lows. Overall I'm still leaning bullish on AAPL unless we see the current lows broken and compared to most of the rest of the market I think AAPL looks like a bargain here on a forward P/E of 9 and with a dividend at 2.3%:

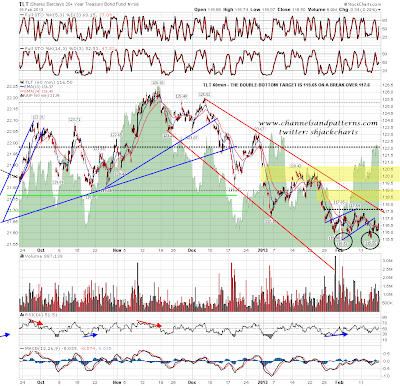

Will we see some retracement here on equities? Well the pattern setup looks promising, though as we've seen in recent weeks, bear setups often form and fail in a very strong uptrend. With the daily RSI showing negative divergence from overbought though, this is the bears' best shot so far and one way or another we should see a decent retracement soon. TLT is supportive of retracement on equities here, with a very nice looking double-bottom forming there with a target in the 119.65 area on a break above 117.6:

I won't show the EURUSD chart today as not much has changed since Friday morning, but CL retraced close to 95 area support and the opposing patterns there of a possible bearish double-top and possible bullish rectangle still both look good. Either way I'm looking for a more exact test of 95 and we'll see whether CL can break below to trigger the bear target into 92:

I've been looking in vain in recent months for a confident resumption of the bull markets in gold and silver. After strong declines on Friday silver is once more testing the four year rising support trendline from 2008 in the 29.5 area. A break below would give a first target at strong support just above 26.15, but a break below this very strong support trendline would suggest that silver may well break below 26 to retest the very strong support level in the 19.5 area:

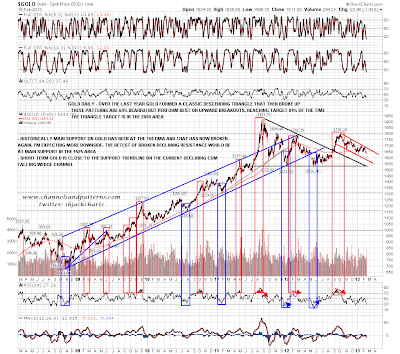

Gold is close to a test of declining channel cum falling wedge resistance in the 1585 area. A break below would strongly suggest a test of primary support in the 1525-35 area:

If this market was not strongly trending upwards I would be confidently expecting retracement this week, with a very possible H&S forming at the candidate 1495/6 area neckline. As it is the setup is there and if current highs can hold we may well see that happen. The first step however is a break below current support at 1510/1 ES and 1514/5 SPX. Until we see that this nice looking retracement setup may well just dry up and blow away like the others that we've seen in recent weeks. If we do see that break I'd be looking for a move to test the SPX daily lower bollinger band (now at 1486) but there is obviously support on the way at the daily middle bollinger band in the 1506 area.