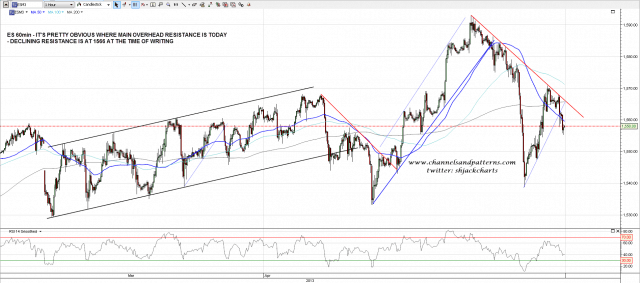

There’s little doubt in my mind that this move up from November has topped or is topping out, but the exact form that top will take isn’t yet clear. We would normally see an H&S or double-top form on SPX at this sort of high and to form a double-top would obviously require a retest of the highs. Whether we see that or not is currently also not yet clear, but the declining resistance trendline that would need to be broken to open the path to that retest is very clear, and here it is on the ES 60min chart:

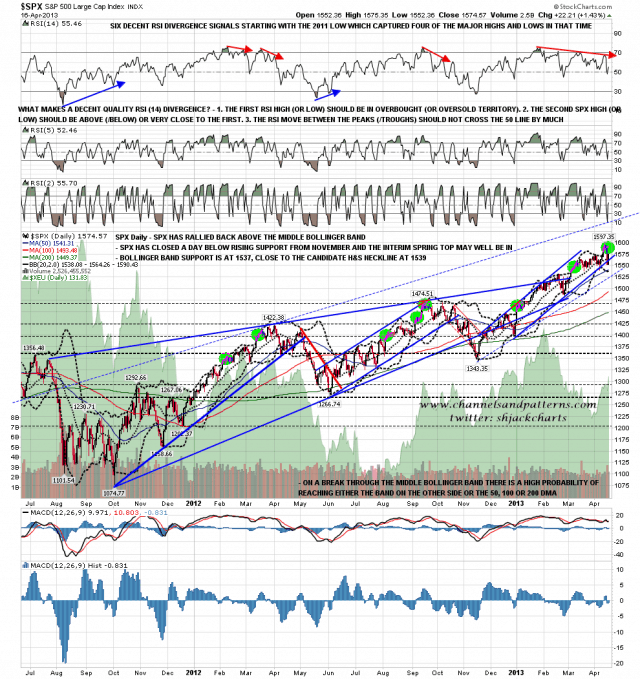

SPX closed back above the middle bollinger band yesterday. The lower bollinger band at 1538 is an attractive target is we see a further decline today. That is in the same area as the possible H&S neckline at 1539, so if we see that area hit that will be a strong contender for a short term low:

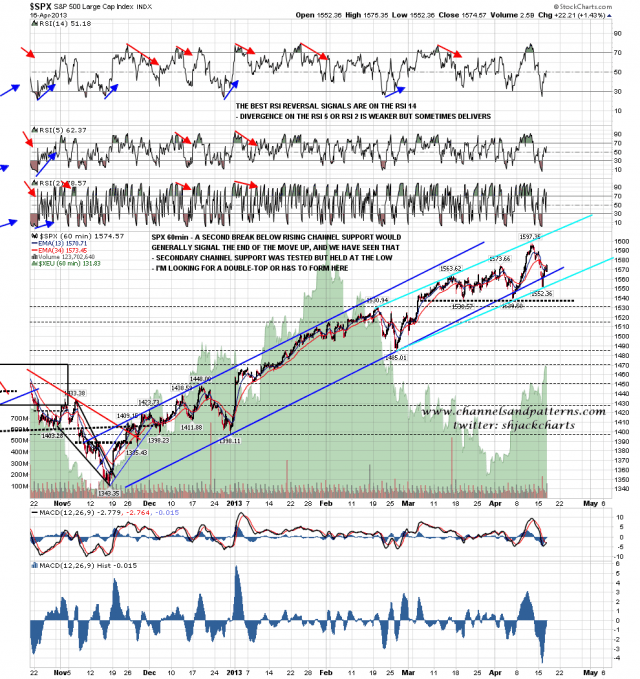

On the SPX 60min the obvious candidates for a topping pattern are the H&S neckline around 1539 or a retest of the highs for a double-top. Secondary channel support is in the 1554 area:

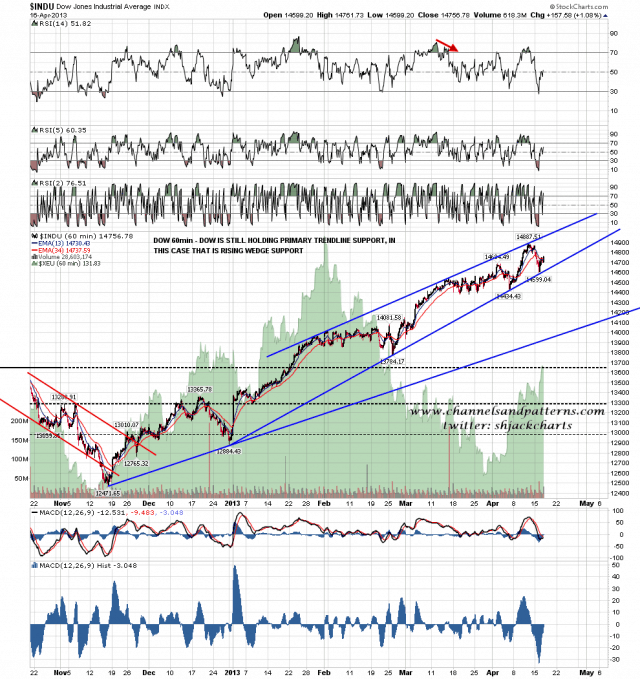

I’ve been browsing through the other equity indices this morning looking for setups. The Dow is clearly the strongest, with primary trendline support there still unbroken, though that is the support trendline for a nicely formed bearish rising wedge:

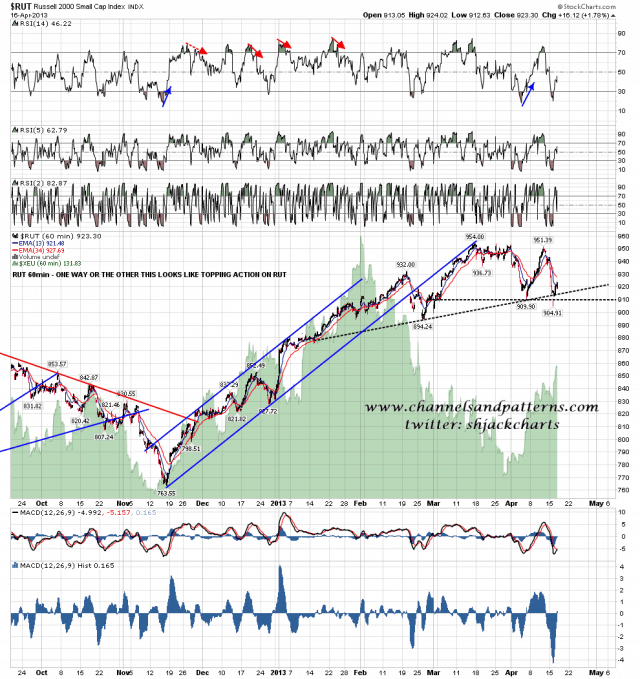

On RUT The rising channel broke seven weeks ago and the uptrend peaked a month ago. I’ve drawn in both an H&S and a double-top on this chart, both of which have pinocchioed but not yet broken down. The peaks are close enough together that I would see this as a double-top:

By the time EURUSD broke the declining channel yesterday it was obvious that was going to happen, but I’m still considering what this means for USD. I’ll consider further there but short term it looks as though broken channel resistance will be retested:

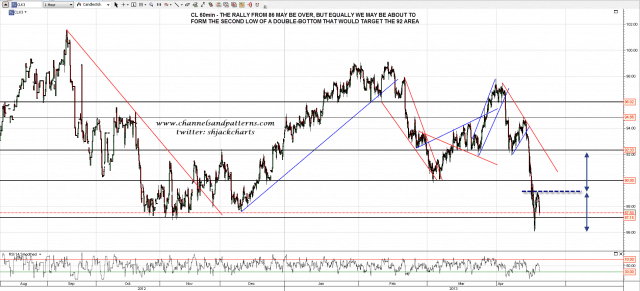

Oil spiked to the 89 area yesterday and has pulled back hard. We could be looking at a resumption of the downtrend here but I’m leaning towards a test of 86 to establish a second bottom of a double-bottom that would target the 92 area on a conviction break over 89:

ES is the main story today I think. If we see declining resistance broken there then we may well see a retest of the highs and, most likely, a strong reversal there. If declining resistance is not broken the obvious downside target is the 1534/5 ES area to hit the 1539 SPX area neckline on SPX.