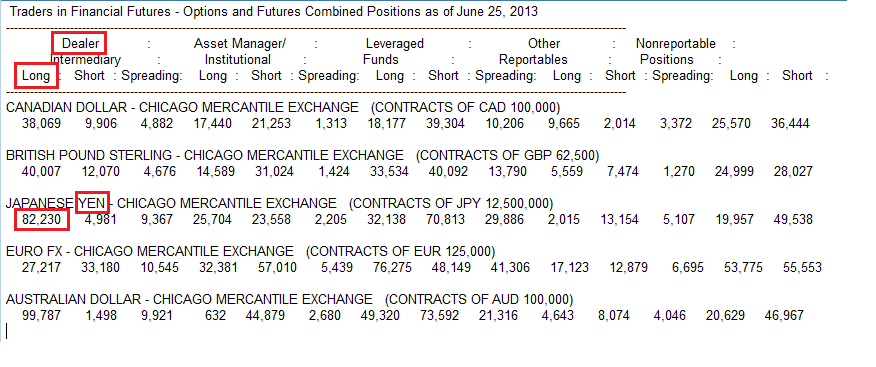

In my last post, I saw possible chart-based turning points for the dollar and its component currencies, but bemoaned the lack of commercial positions data (except for the Yen) to support such an event. And as usual, the data overruled the charts and the dollar continued to work its way up and take the Euro, Pound and Yen down with it.

Ironically, where the commercial positions data did show a large long Yen position, the Yen did not go down to the extremes of the Euro and Pound. The lesson learned is the supporting data can turn a pure guess at a chart formation into a high probability trade or the heeding the lack of supporting data can avoid a costly mistake of taking a low probability trade. Now the question is where do the high probability trade opportunities exist this week due to significant commercial positions and supporting charts?

Copper

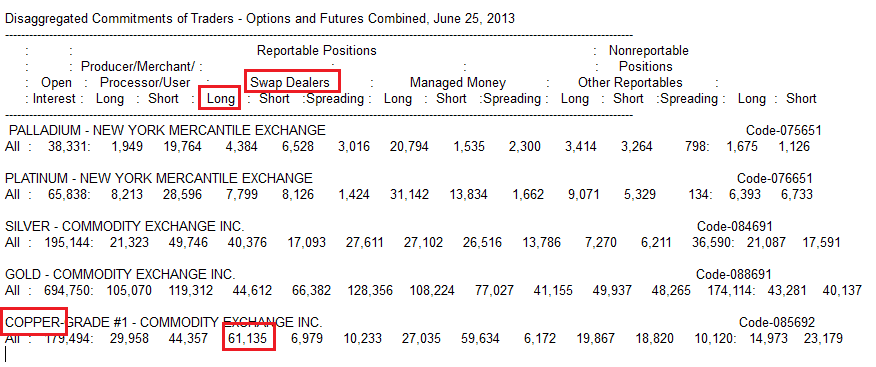

As the commercial positions for metals show copper has the best sponsorship by the commercials for a move up.

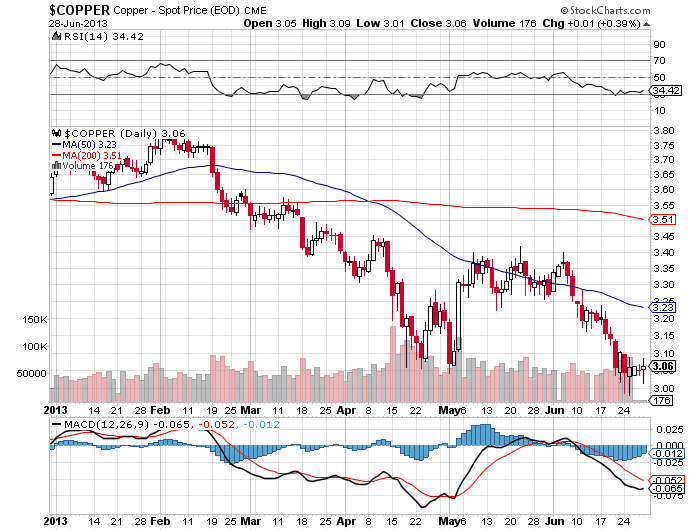

Despite the drubbing the currencies, gold, silver and commodities took last week, copper held up fairly well. The chart still supports a positive divergence in the MACD.

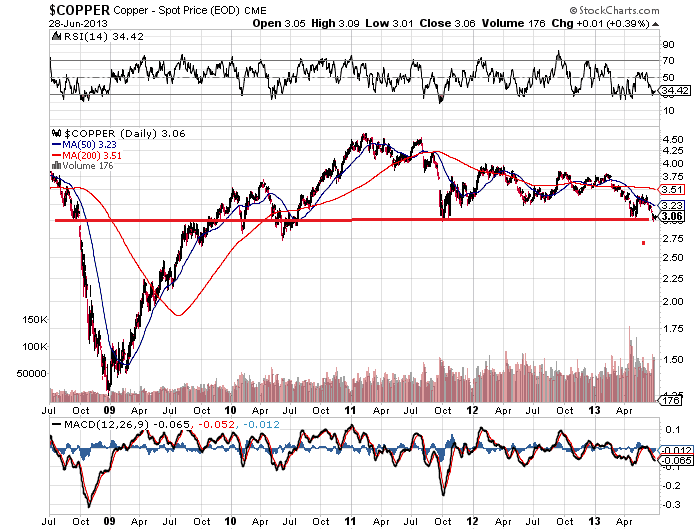

Note the multi-year support line in the 5 year chart.

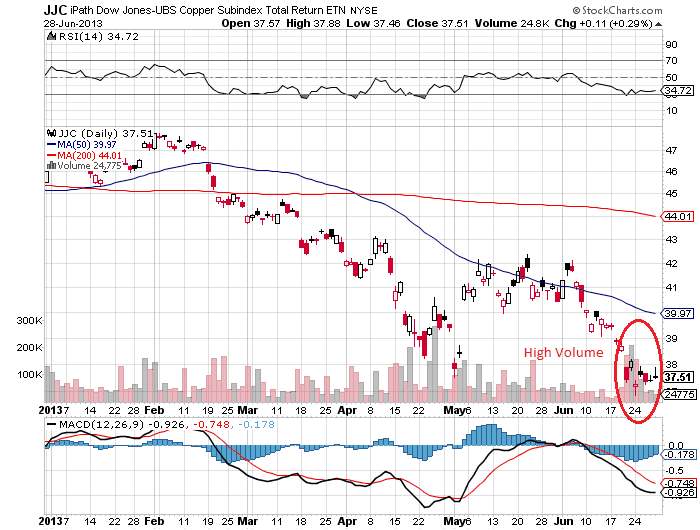

And the copper ETN JJC shows significant volume at the lows.

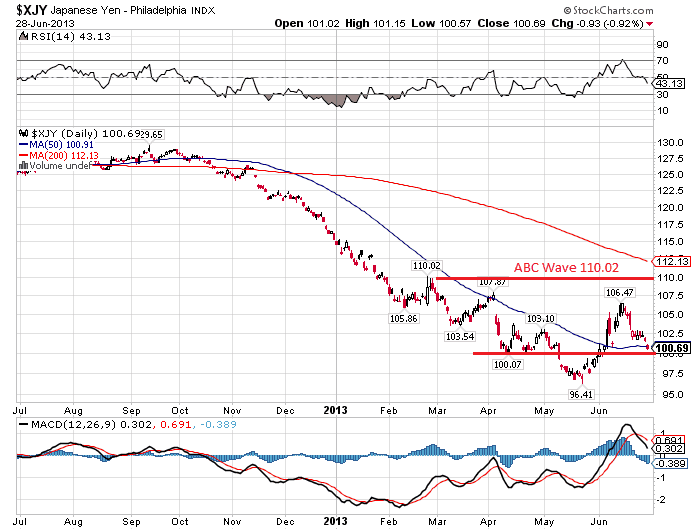

The Yen

Note of the currencies, the Yen still shows a significant long position by the commercials.

The chart shows the Yen finally fell to support, whereas the Pound and the Euro fell through them. If the Yen is not finished in its up move, an ABC wave may unfold taking the Yen to 110.02.

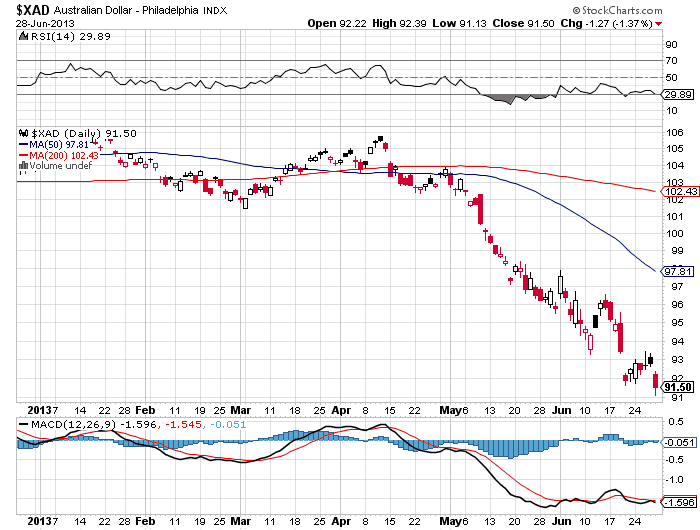

The Aussie Dollar

The currency commercials also show the commercials long the Aussie Dollar, but the chart does not show a bottom yet. A trade in the making, but it needs more time to show a reversal pattern.

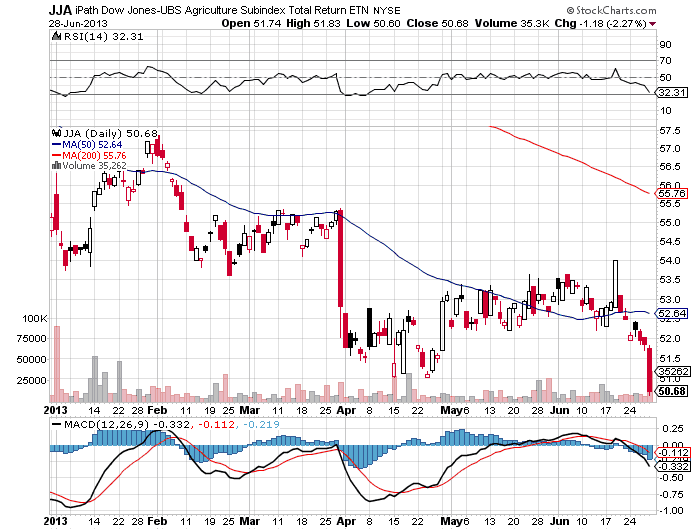

The Softs – Specifically Agriculture

Take a look at the commercial longs on a lot of the agricultural commodities. It is almost throw a dart time.

However, the agricultural ETN JJA just took a big hit Friday. It is nearing oversold with a positive divergence on the MACD. By the way, another agricultural ETN DBA does not show such a positive picture, therefore its component structure may not hold as many of the commercials shown above and should not be traded for this trade.

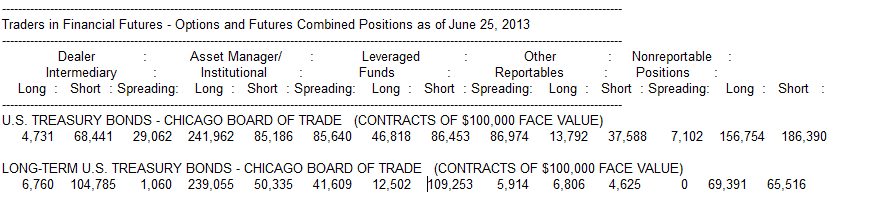

Bonds

The bond commercials still show no sign of covering their large short positions, so perhaps the much talked about target of 100 on TLT will come to pass. How and when it gets there is a trading problem to be addressed.

In summary, outsized commercial positions abound with charts showing the momentum having shifted or about to shift in the commercials’ favor. These conditions often make for high probability trades with excellent returns.