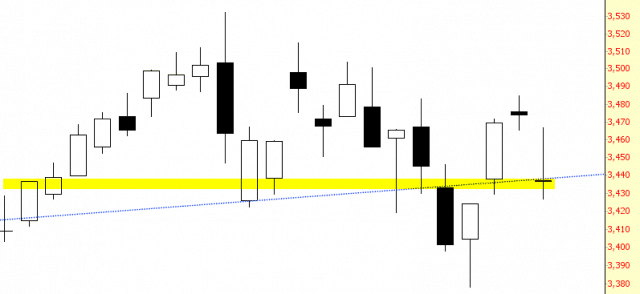

The market has pretty much gone nowhere for weeks. Below is the NASDAQ Composite, and the value is essentially where it was just over a month ago.

What we need is a definitive break (to the downside, if that’s quite all right). I still have 1575 as my approximate S&P 500 target. To date, there hasn’t been any single event to help drive such a drop. The market is just an annoying, back-and-forth, pushmi-pullyu creature that can’t seem to generate any meaningful, sustained downside (unlike, say, our friends across the Pacific Ocean).

One little bit of encouragement for bears is found in the semiconductor index, $SOX, which has a failed bullish breakout.

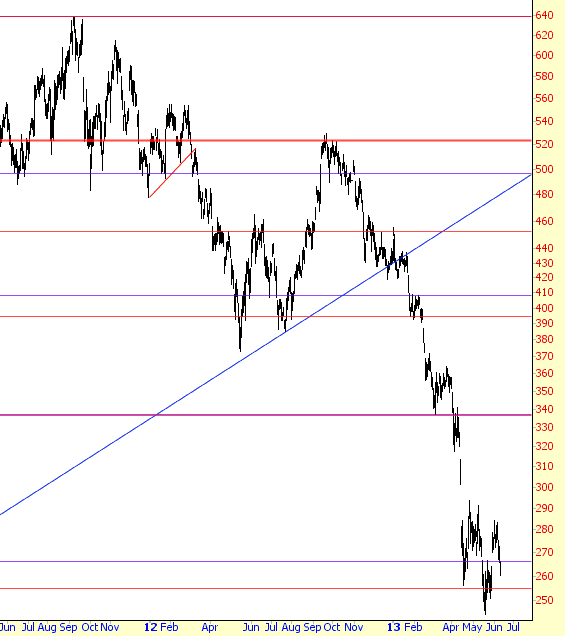

I still get tempted to buy into the miners, but I keep telling myself that precious metals haven’t bottomed yet. I actually bought calls yesterday in GDX, but I sold them (at a $0.00 gain/loss – a “scratch” as some folks say), and thank goodness, because it tumbled hard again today.

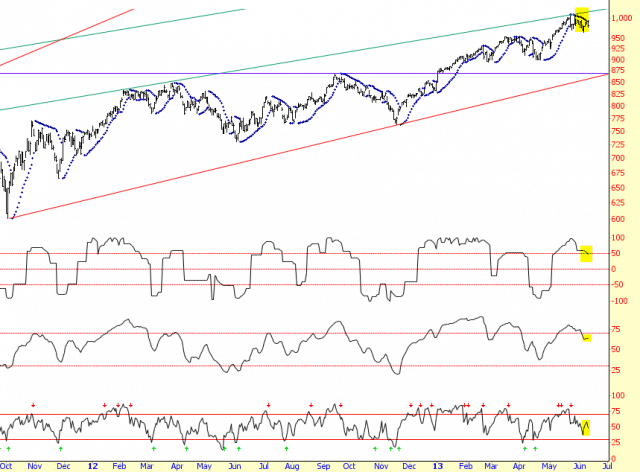

The Russell 2000 also is pretty encouraging. I don’t make much use of indicators, but out of curiousity, I fired up my “Power Quartet”, and all four line up nicely for continued weakness.

I am, at the moment, 70% committed (30% cash), spread out among 90 – yep, 90 – different little short positions. I’ll continue to tighen the stops as necessary and add to my positions as warranted.

I’ve got to work on my book some, so I’ll wish you a good evening and pledge to see you in the morning.