Another dull day on ES yesterday as ES filled the gap and then just chopped around for the rest of the day. Things became more interesting overnight however when ES established a declining channel at the overnight high. As long as that holds today, and ES can get below significant support at the 50 hour MA in the 1686.50 area, then we might finally see the move to test strong support in the 1672/3 ES area (1676 on SPX). ES 60min chart:

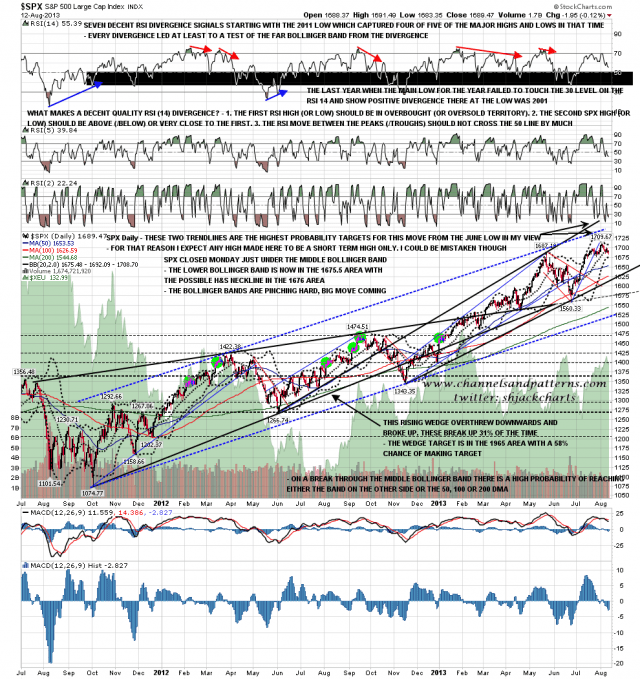

On the SPX daily chart the close yesterday was just under the middle bollinger band and lower bollinger band support today is in the 1675.5 area, very close to the possible H&S neckline at 1676 SPX. SPX daily chart:

On other markets ZB reversed back down as expected and the 60min RSI is back below 30. If we are to see a big rally on bonds over the next few months, and I’m still thinking that scenario looks pretty good, then I’m expecting to see ZB put in a higher low on this leg of this very slow reversal. ZB 60min chart:

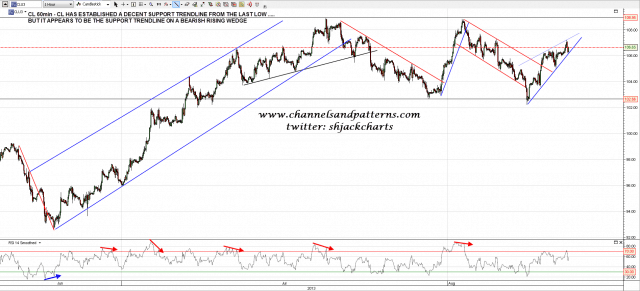

CL has now established a decent support trendline from the last low, but at the moment that appears to be the support trendline for a bearish rising wedge. I’m watching that upper trendline with interest as we may well see a decent shorting opportunity on CL soon. CL 60min chart:

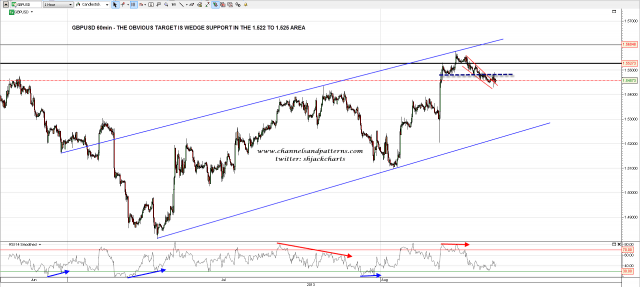

On GBPUSD 60min the short term downtrend has been continuing at a very slow pace. The lower wedge trendline target is now in the 1.522 area with the H&S target in the 1.539 area. GBPUSD 60min chart:

While the declining channel on ES lasts I’m leaning bearish. If it breaks up then I’m be leaning bullish in the expectation that we’ll most likely see a test of the highs. If that happens then the SPX daily upper bollinger band is in the 1709 area (1705-6 ES).