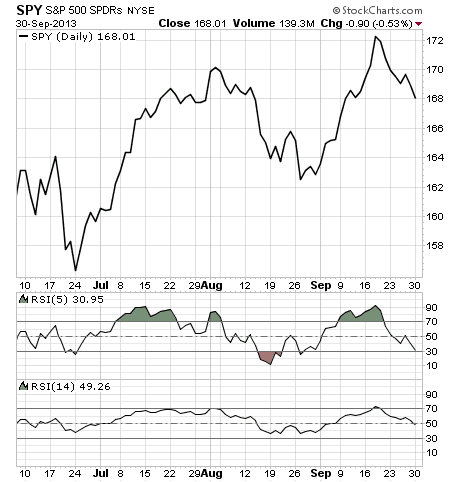

We’ve seen quite the reprieve in the S&P 500 (SPY) from the closing high set back on September 19th.

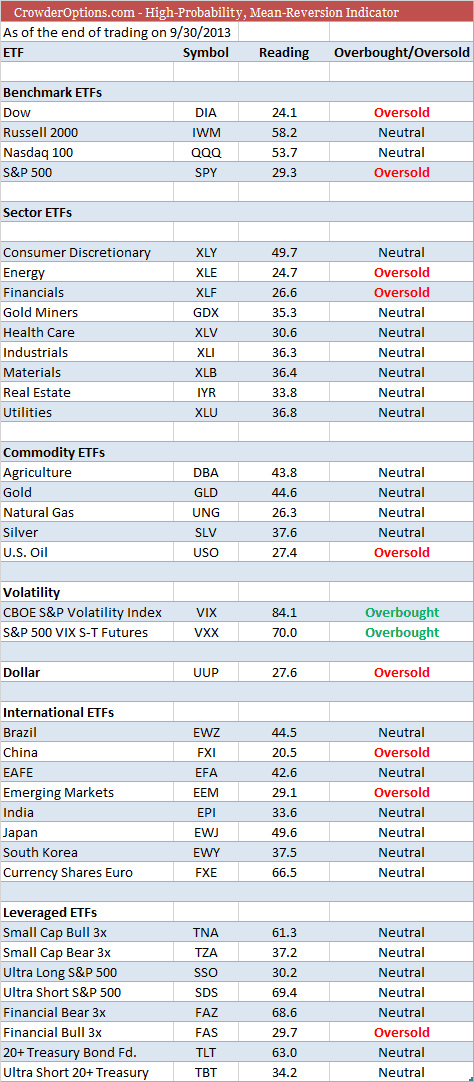

And as you can see (and confirmed in the High-Probability table below) this has pushed the ETF into a short-term oversold state. The question is how do we approach the situation? The answer…spreads mixed in with some short-term directional trades.

Knowing that I am predominantly a high-probability, spread trader I only care about the next 30 -50 days. The premium left in SPY (due to its relatively low implied volatility) for the October expiration is probably limited, so I would probably look towards November as it has over 40 days left until expiration. That should create adequate premium that will also allow us to create a higher margin of error on the trade.

With the pop in volatility (as seen through the VIX) over the past few days, now might be the ideal time to consider a trade. I, for one, made a few trades for subscribers today and plan on adding a position or two in the next few days if price action allows. With that being said, bull put spreads or iron condors look like the vehicle of choice given the increase in IV and the short-term oversold readings in SPY. Some, like myself, prefer iron condors, but I also don’t have a problem legging into an iron condor if the timing is right.

I’m also following XLE, XLF and FXI.

The China 25 index fund (FXI) has some room to go on the downside, but over the short-term we could see a decent pop which might make for a good entry for selling a few bear call spreads and admittedly buying a small number of puts.

Subscribers: please check your emails for the latest trade alert.

If you are a believer in a statistical approach towards investing please do not hesitate to try my options strategies. I use simple mean-reversion coupled with probabilities for each and every trade. Give it a try, it’s free for 30 days.

If you haven’t, join my Twitter feed or Facebook.

Kindest,

Andy