I’m having a very disrupted week this week as my wife has a big deadline and I’m covering. Normal service will resume next week, but I will be absent from my desk a lot over the remainder of the week.

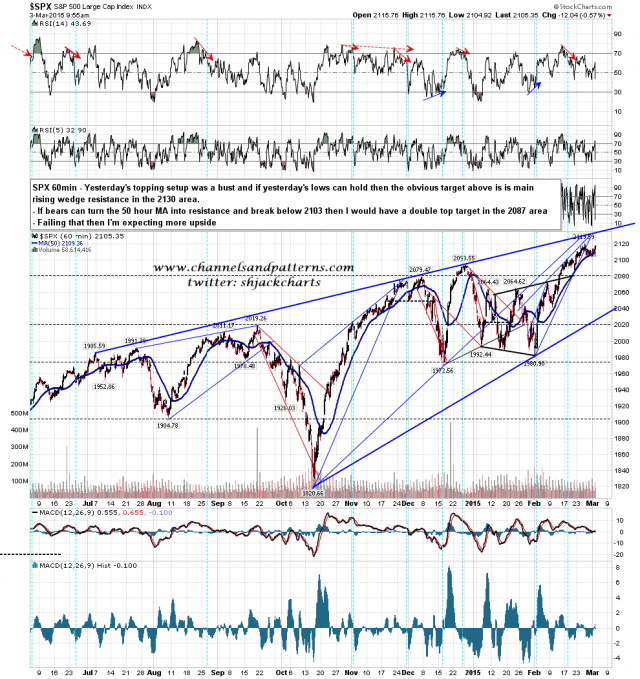

The nice bear setup yesterday morning fell apart quickly and, if there is no significant support break here, then SPX is still heading up with an obvious target at wedge resistance in the 2130 area. If bears can break below yesterday’s low at 2103.75 and sustain trade below it then I would now have a target in the 2087 area, but I’ll be waiting to see that happen before thinking that the bears might get a serious shot today. SPX 60min chart:

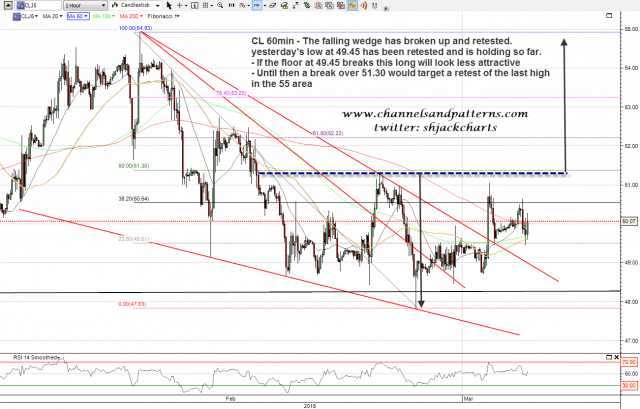

CL has been kicking around in a smallish range for the last couple of days but what has happened in that time is that the falling wedge has broken up and retested, and a possible floor has been established at 49.45. If that floor breaks the CL long will look less attractive but until then a break over 51.30 would target a retest of the last larger range high in the 55 area. CL 60min chart:

As I write this SPX is close to a test of yesterday’s low at 2103.75. If the bears can break that low and hold below it then the double top target would be in the 2087 area. If that support holds then I’d be looking for a retest of the current all-time high at 2119.59, very possibly today.