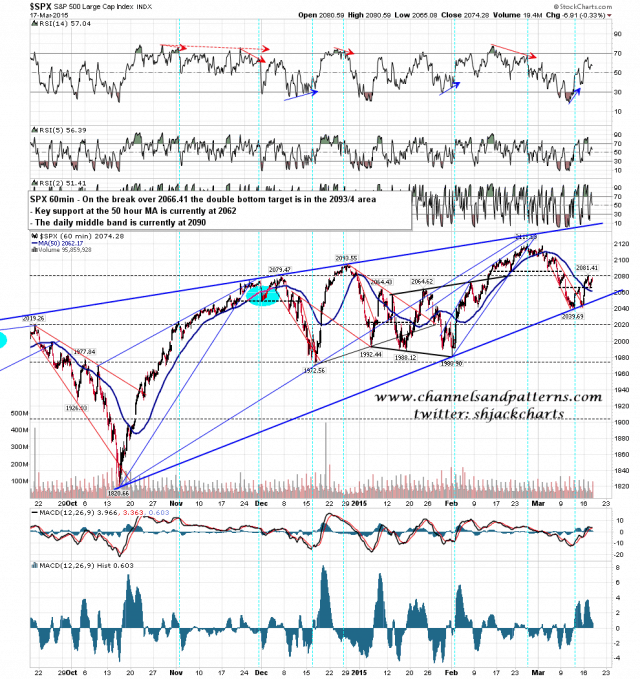

The low yesterday was in the 2064 – 66.5 range that I gave in the morning, and as long as that holds this morning the bulls should test the daily middle band at 2090. The 5 DMA and 50 hour MA are at 2063 and 2062 respectively this morning and those are levels that the bulls really need to hold. On a break under 2060 I will be looking for a test of the 2039.69 low and we might well see a break lower into the 2020s. SPX 60min chart:

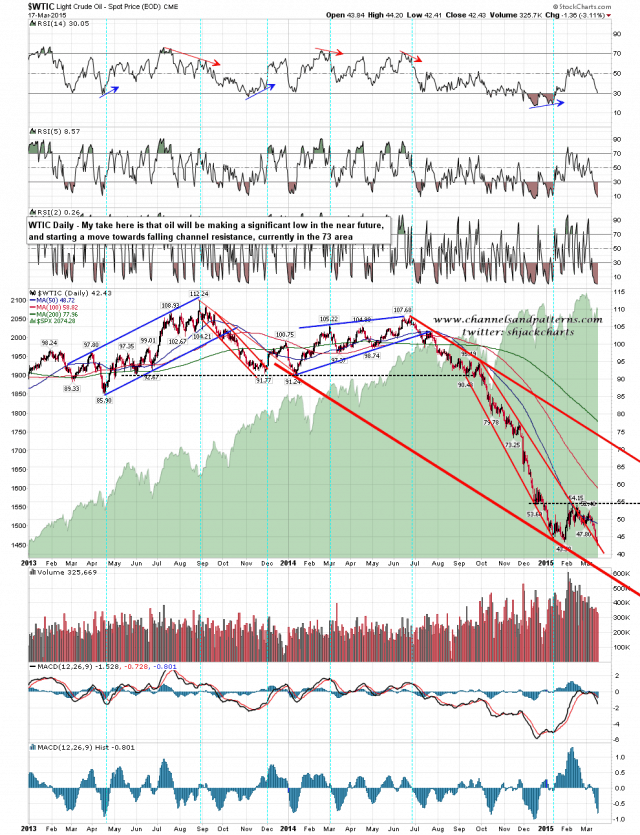

Oil is in a bottoming process here in my view, and could reverse back up at any time towards falling channel resistance, currently in the 73 area and dropping at about $4 per month. There is still room in the channel down to the 37/8 area so we may well still see oil go lower before this significant low is made. WTIC daily chart:

FOMC day today and the bonds charts are suggesting that interest rates will start rising soon, though I’m a bit doubtful that the Fed will announce much today. I was saying on Monday though that I was doubtful that a retracement low had been made and I’m still doubtful. I’ve now run the 5 DMA stats back to the start of 2007 and I still haven’t found an instance where a break back below the 5 DMA like the one we saw on Friday was followed by new highs before lower lows. That’s not to say though that this can’t rally further first to fail at the daily middle band.