Wednesdays before expiration (especially on FOMC days) are special days.

Volume is split between 2 contracts. We have stops getting killed on both sides of indecision, and then a lot of chop, chop, slam…. chop, chop, slam…. It reminds me of the old Duck, Duck, Goose game. Only this time, retail stops are left holding the bag and can’t find a chair or get a break.

The witching hour appears to be the hour going into oil pit close.

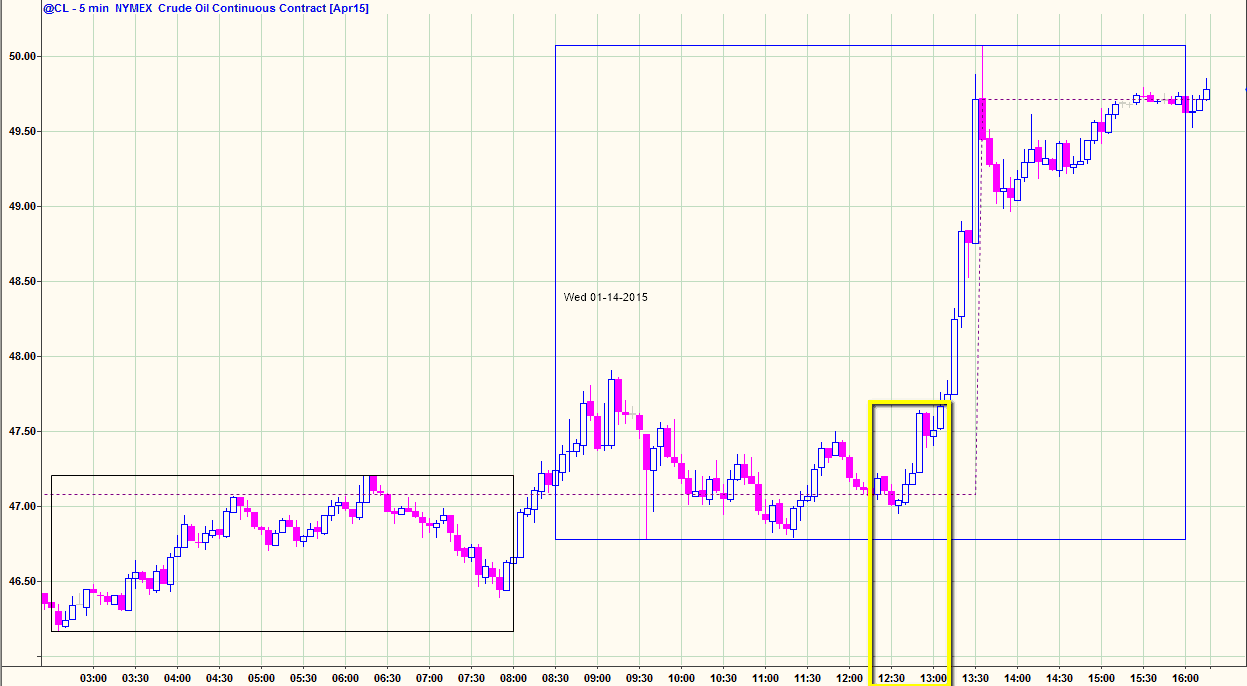

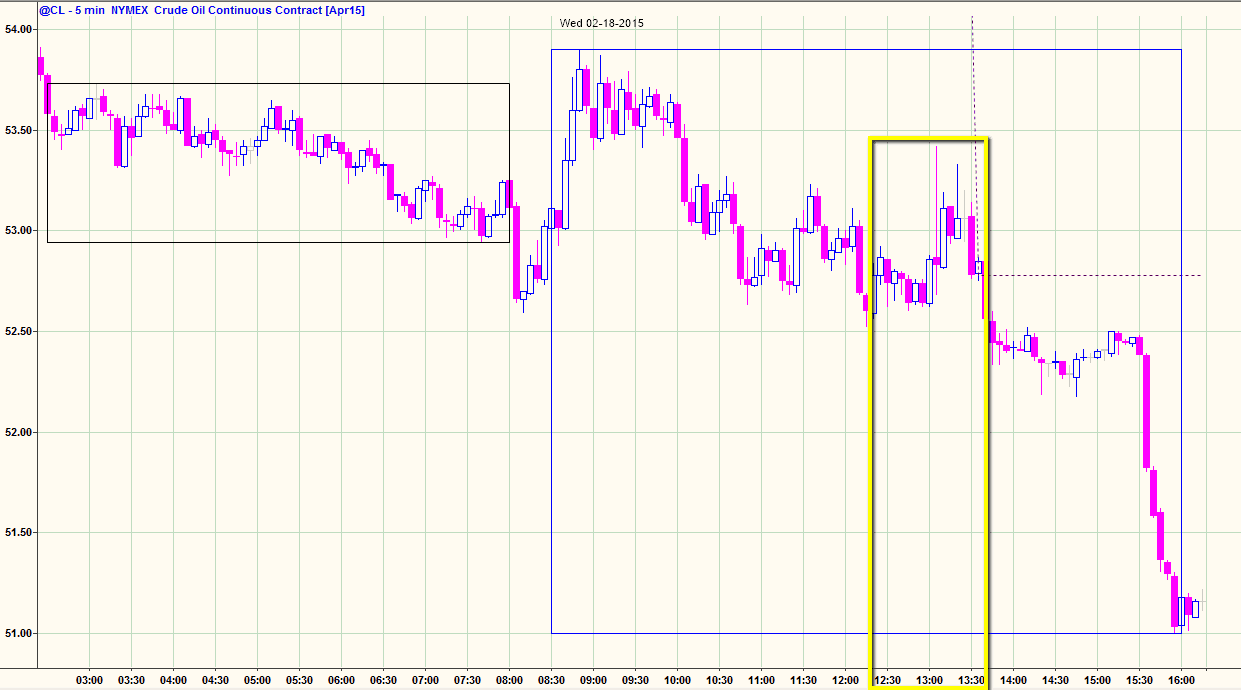

Here’s how the prior 2 Wednesdays before expiration looked:

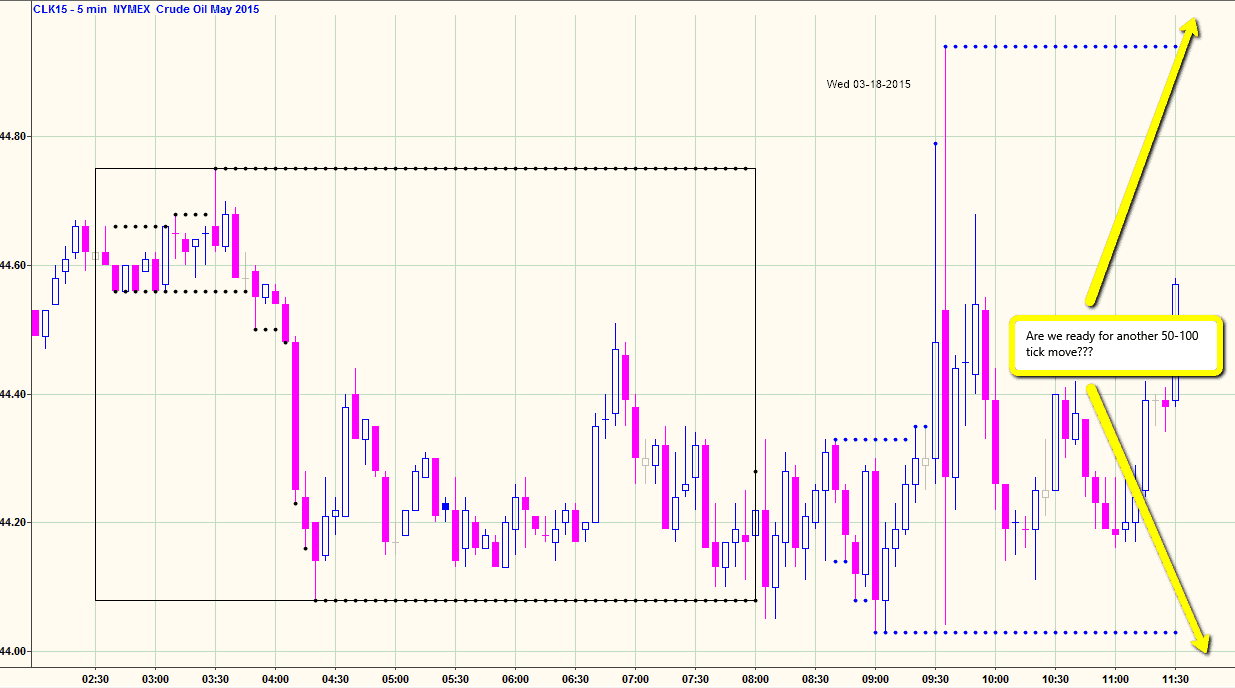

Which way will they rip it going into today’s oil pit close???

Record API and EIA builds… grease should be bullish no???