Yesterday was a fairly classic inside day, with SPX holding the 2110 bull/bear line that I gave in the morning and making a model 50% fib retracement of the move up from Tuesday’s low. So far, so bullish. As long as yesterday’s low holds I’m therefore leaning bullish into a retest of the highs.

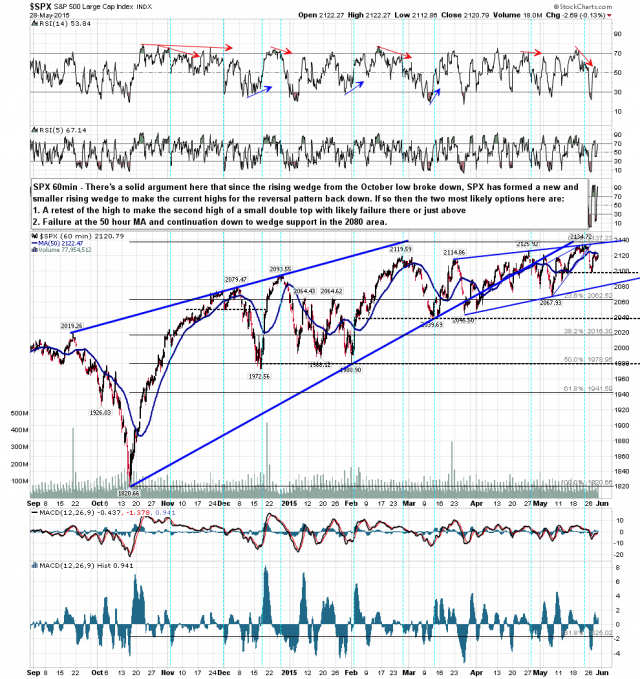

That said there is a significant issue that bulls need to sort out without much delay, and that is the failure so far to recapture and sustain trade over the key 50 hour MA, now at 2123. Both Wednesday and Thursday have failed there and if we see another fail this morning then we might well see a reversal down to the support trendline on the rising wedge from 2145 marked on the chart below. That would be in the 2080 area at the moment.

You can also see looking at the shorter term wedge that the obvious targets within it are the highs retest and the 2138 area. Anything would require a break over wedge resistance. SPX 60min chart:

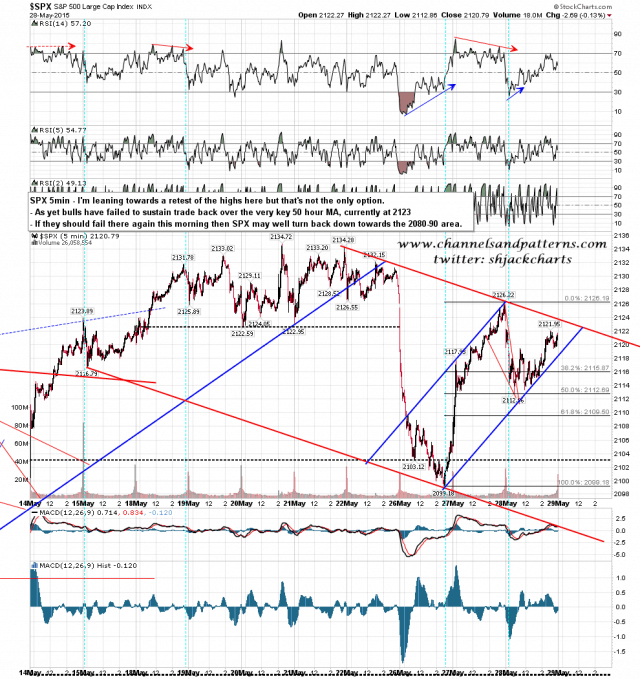

Looking at the 5min chart bulls don’t really want to lose short term rising channel support at 2118, and need to take out falling channel resistance at 2124 as a matter of urgency. If bulls can do that then a retest of the highs should open up. If not the bulls could have a very bad day today. SPX 5min chart:

What are the odds of a bearish resolution today? Well better than they would be on most days. The last trading day of the month has closed red for the last six months, with the following closes: -5, -22, -26, -5, -18, -21

The last trading day for the previous six months were 50% green but I should mention that the mean decline was still -2 and that only one of these last trading days in the last year has closed better than five handles in the green. The results for the previous six months were as follows: +3, -0.5, -40, +5, -5, +24,

Overall the takeaway is that average (mean) decline over the last year of last trading days of the month was -8, with three out of four closing red, with almost half closing 18 handles or more down, and with the last one to close green in October 2014. The bulls are on must perform today and these stats aren’t particularly encouraging for them. We’ll see how they get on.