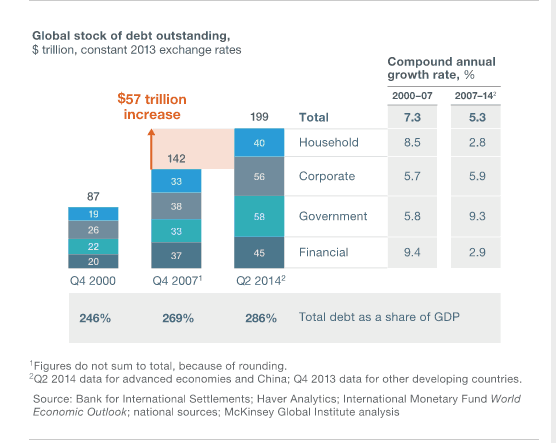

I put this post together as a curiosity. Per international data, the world has now created 4 times as much debt than the combined reserves and M0, M1, and M2 in the world. Out of these reserve and M numbers only $5 Trillion is circulating outside of the banking system. There is 171,000 tons of gold or 5.5 billion ounces, or approx $6 trillion of value, in the world. Total assets are valued at $241 Trillion. The elites have taken us to the wall.

Exeter would be proud and alarmed at the same time.

To my simplistic eye, with debt exceeding reserves by this amount and with worldwide GDP growth essentially stopped, the world will either try to increase reserves (monetize) in earnest or will eradicate bad debt. The trouble with monetizing to bring balance is that the money flows to things that people desperately need but increasingly cannot afford; food, energy, housing, and healthcare. The trouble with debt relief is which billionaire’s ox gets gored, and once we go down that path, can we really stop it.

So that leaves us with gold. If the powers that be do not wish upon a Sisyphus moment, they better start to allow gold to take its rightful place at its natural price (40x higher) to absorb all of this debt. What are your thoughts?

I’ll leave you with a picture from the latest Central Bank meeting. Enjoy.