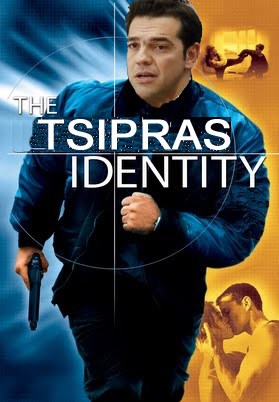

After the recent “mental waterboarding” (as some media called it), Greek Prime Minister Alexis Tsipras is now on the run, in search of his forgotten identity (the one where he had promised to terminate austerity and reject Greece’s creditors proposals):

In the meanwhile, the E-mini S&P500 (ES) has reached interesting OVERBOUGHT levels. If the Greek Parliament rejects the deal signed by Jason Tsipras, oops sorry, Alexis Tsipras, the market may tank again from here, this is why it’s important to see what our SHORT model (below) is saying.

In the meanwhile, the E-mini S&P500 (ES) has reached interesting OVERBOUGHT levels. If the Greek Parliament rejects the deal signed by Jason Tsipras, oops sorry, Alexis Tsipras, the market may tank again from here, this is why it’s important to see what our SHORT model (below) is saying.

The PRICE EXTENSION ANALYSIS model below shows how far a price retracement (uptrend) can go on each time period, based on the statistical analysis of all the historical retracement patterns that share similarities with the current retracement pattern.

The DAILY time period will encounter very strong resistance at the 2089 level (highlighted above): 82.97% of the events recorded in history are scenarios where the market does not go higher than this level during this type of retracement pattern. This level has been reached and breached yesterday, however since the next resistance is much further away (2119.75), for now we keep our focus on this area: even if the market goes a bit higher than this, you can go SHORT at Close, using the CCOC 4-days-up-in-a-row OVERBOUGHT pattern together with the PRICE model here.

The WEEKLY time period will encounter good resistance at the 2094.75 level (highlighted above, best match for the DAILY level): 59.05% of the events recorded in history are scenarios where the market does not go higher than this level during this type of retracement pattern.

The MONTHLY time period will encounter strong resistance at the 2093.75 level (highlighted above, best match for the DAILY/WEEKLY levels): 70.00% of the events recorded in history are scenarios where the market does not go higher than this level during this type of retracement pattern.

The big gauge on the right hand side of the table above shows that 70.67% of the DAILY+WEEKLY+MONTHLY (combined) cases recorded in history are scenarios where the market does not go higher than these levels during this type of retracement pattern. This setup is telling us that the market cannot rise much, long-term, so there will be another pullback. If the market was at a major bottom, and we were already LONG, maybe we could try to hold longer, but after 6 years of uninterrupted Bull Market, with the market at all time highs, probably it’s not a good strategy.

The previous highs above ~2100 can certainly be reached again but we would not hope to see the market much higher than that for now, somewhere around ~2118 is (highly) probably where the market will stop rising and perform a MONTHLY pullback (i.e. at least one month down).

>> Click here if you want to receive this E-mini S&P500 Analysis every day in your inbox.