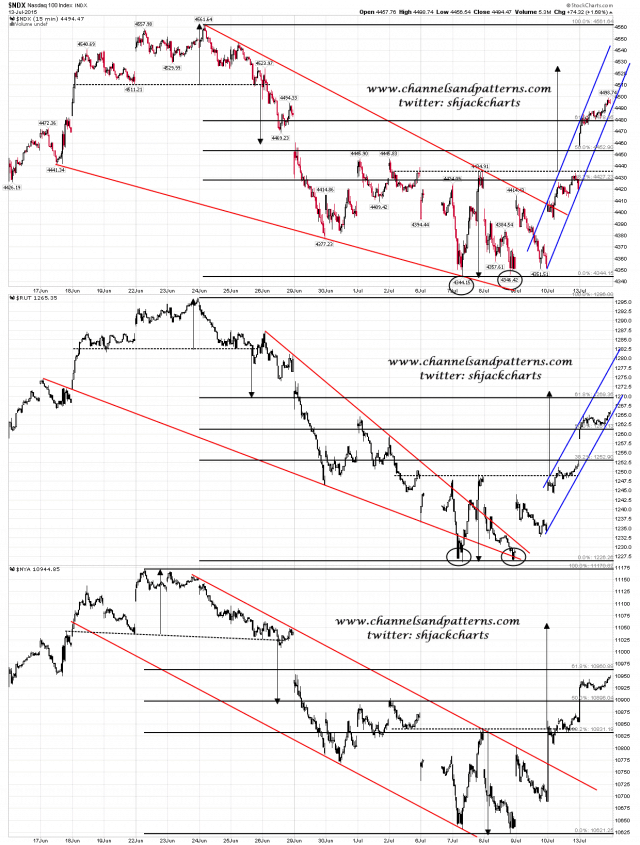

Today I’ve done an optic run of the 15min charts of the main US indices to get an idea of how the next few days are likely to develop. I’ve discarded the smaller SPX double bottom that I’ve been showing as a possibility, and the bottom line is that of the six double bottoms on these six indices, not one has yet made target. Given that SPX, Dow and NDX have already broken the 61.8% fib retracements the obvious conclusion is that the falling wedges that broke up on five of the six indices below are full reversal falling wedges, with targets at lower lows from the previous highs or tests of those highs.

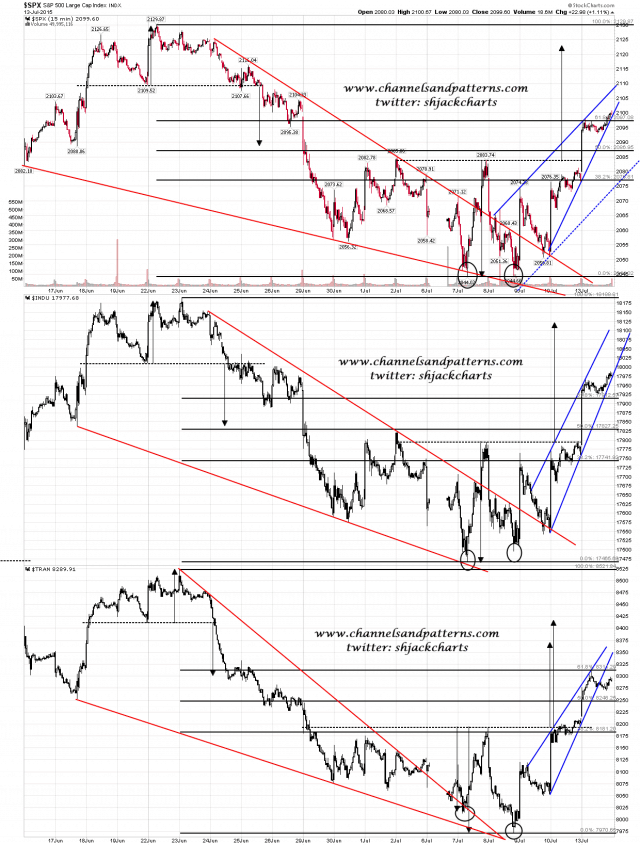

The SPX double bottom target is 2123 is a good fit with that scenario. Neither of the daily RSI5_NYMO or 60min buy signals are close to making target yet, so that backs up a scenario where the short term high is not imminent. Scan 3x 15min SPX INDU TRAN charts:

Scan 3x 15min NDX RUT NYA charts:

The 50 DMA held the SPX high yesterday and it may well be that we are going to fail into a retracement before going higher. I have support for that retracement at the daily middle band, currently at 2088, and very strong support further down at the 50 hour MA and 5 DMA, both currently at 2071. I’ve drawn in a possible channel support trendline on the SPX chart.