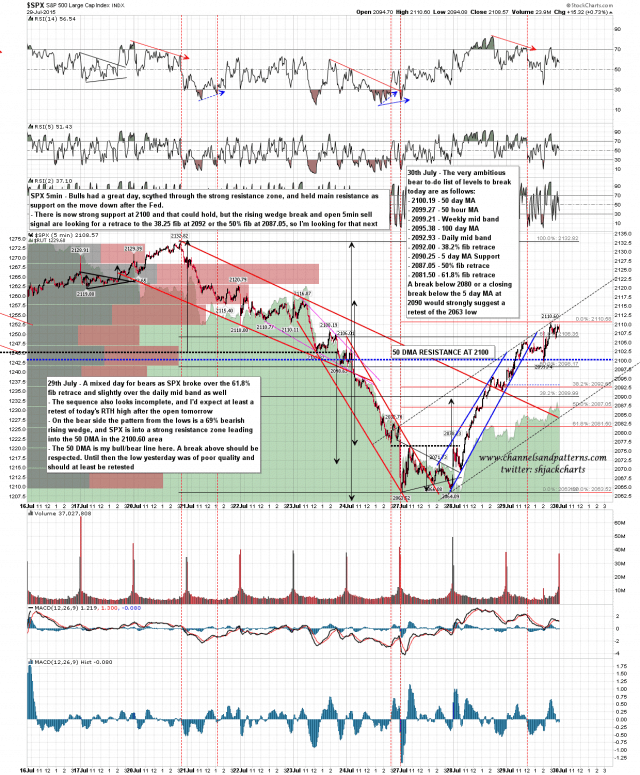

Another very strong day from the bulls yesterday, and both of the breaks above the daily mid band and the 5 DMA were strongly confirmed on SPX. That doesn’t kill off any bear case altogether here, but it means that rather than trying to prevent a break up, bears would now have to break back down. My lean is bullish and I’m not really expecting bears to break back down, but I am expecting to see some retracement today, and I’ve put the key levels on the chart below to show what bears would need to do. SPX 5min chart:

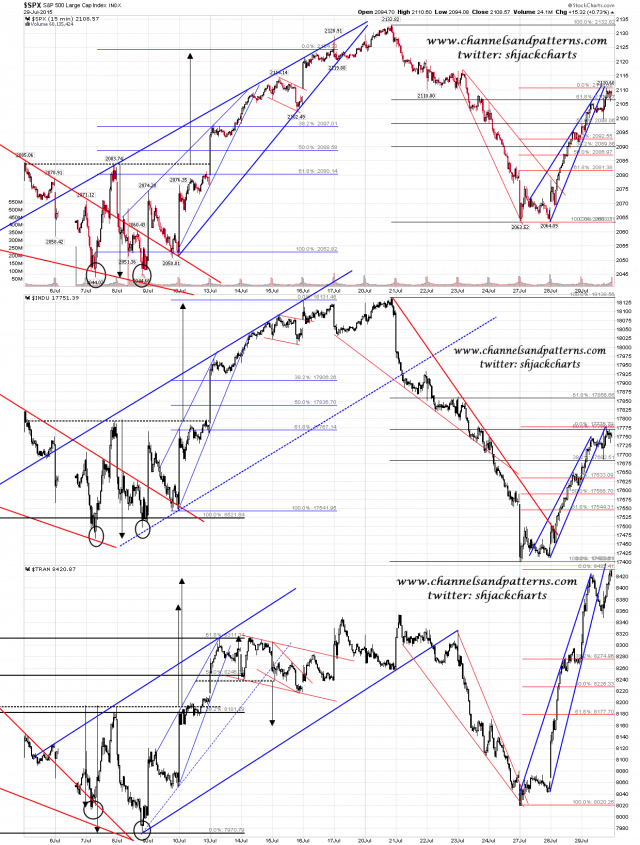

Looking at my optic run US index charts, there are an impressive six out of six rising wedges from the lows, all of which have broken wedge support. There may be more to do on these in terms of forming short term topping patterns, but I would expect retracements very shortly, with minimum targets at the 38.2% fib retracements. We’ll see how that goes today. Scan 3x 15min SPX INDU TRAN charts:

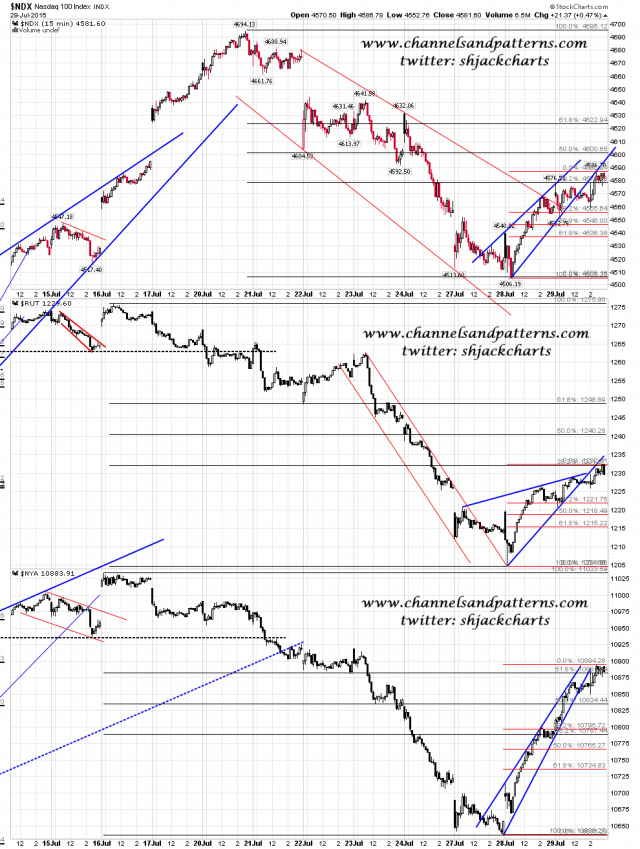

If I was to see anything to encourage the bears on these charts I would note that apart from TRAN, which tends to plough a lonely furrow in any case, the largest moves were on SPX and NYA, both retracing slightly over 61.8% of the move down into Monday. Dow only managed 50% and NDX and RUT only 38.2%. No bullish breaks on Dow, NDX and RUT as yet, though SPX and NYA are the deepest and broadest indices in terms of sector spread. Scan 3x 15min NDX RUT NYA charts:

Bears get a shot at trying to reverse this back down today, though that looks hard and I’m doubtful about them managing that. We should see a decent retracement regardless today though and if bears can’t break this back down, this should be a decent dip to buy.