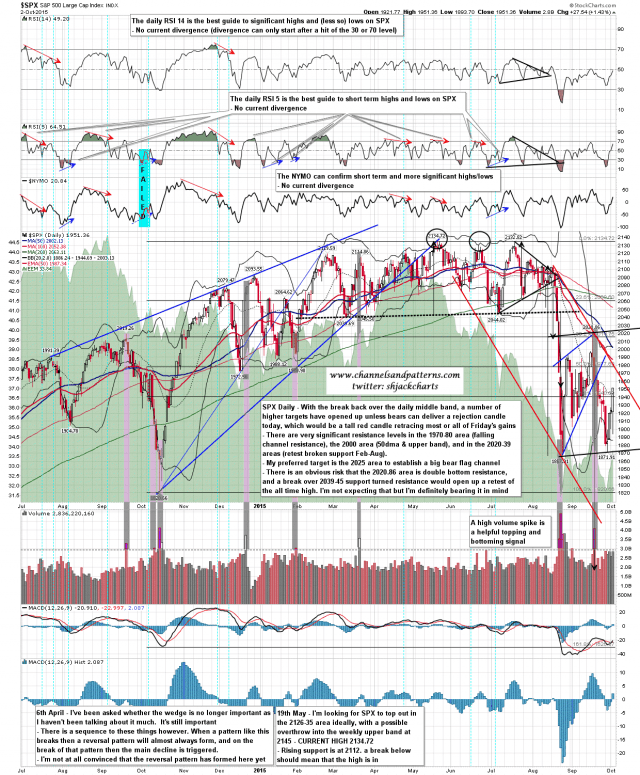

Bears needed a close under the 5dma on Friday, and for a while it looked as though they could deliver that. Bulls took back control though and rallied almost sixty handles to close back over the daily middle band. That was a very significant show of strength, and unless bears can deliver a rejection candle today, which would be a tall red candle reversing most or all of Friday’s gains, we should see more upside. I’m not expecting to see a rejection candle today though.

So what are the upside targets here? Well there is some resistance in the 1970-80 area, including the 38.2% fib retrace at 1970 and falling channel resistance at 1978. There is a second resistance area at 2000, with the 50dma at 2000, the 50% fib retrace at 2001, and the upper band currently at 2005.

My preferred target though is close to the 61.8% fib retrace at 2032, as that would be a decent match with the obvious pattern setup on SPX here, which is that this is either a bear flag or double bottom forming. There is an obvious double bottom setup here with a retest of the all time high on a break over the FOMC high at 2020. With the second low of the possible double bottom slightly higher than the first, we would often see double bottom resistance broken slightly to establish a bear flag channel. then fail. Ideally that high would be in the 2025 area and would set up the next leg down.

Is there a chance that the double bottom setup is actually a double bottom setting up a retest of the all time high? Very much so, though I’d be surprised. If that happens we will know when SPX breaks back through broken Feb to Aug support at 2039-45, and then the 200dma, currently at 2063 and falling. SPX daily chart:

Falling channel resistance at 1978 has been tested since I capped the chart below. That is an obvious level to see a decent retracement if we are going to see one today. SPX 60min chart:

What are the odds that the main low is in? Low in my view, but always a possibility. Even a retest of the all time high at this stage would most likely be making the second high of a double top. Stan & I did a free Chart Chat webinar yesterday, and if you want to see the recording you can find that here.