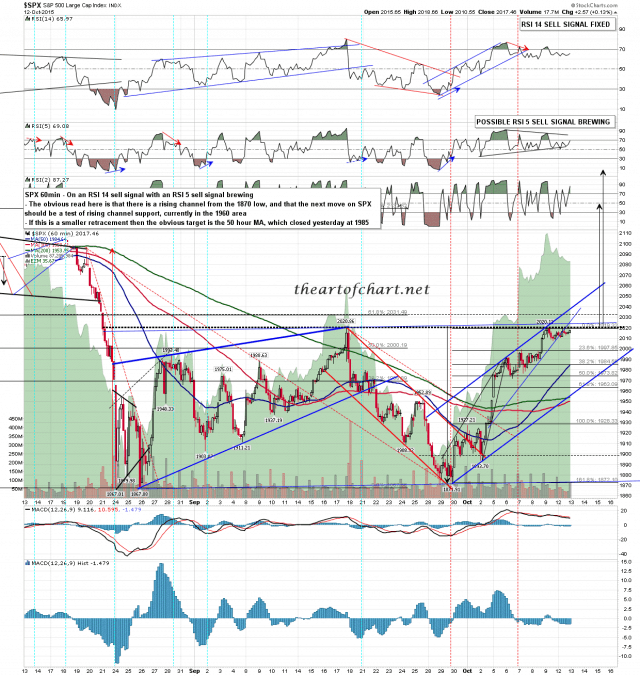

Yesterday’s intraday low was broken at the open so the retrace of the thrust up from the triangle should have started now. The ideal target is 1995 and as that’s a match with the weekly pivot on ES I’d expect that to be hit. There is also important support getting close on the 60min chart at the 50 hour MA. That closed yesterday at 1985 and is now at 1987. By the time 1995 is tested it may well be close to that level. SPX currently has open 60min and 15min RSI 14 sell signals so while it’s possible that SPX might continue to trade sideways today, there is a lot of pressure to retrace here. SPX 60min chart:

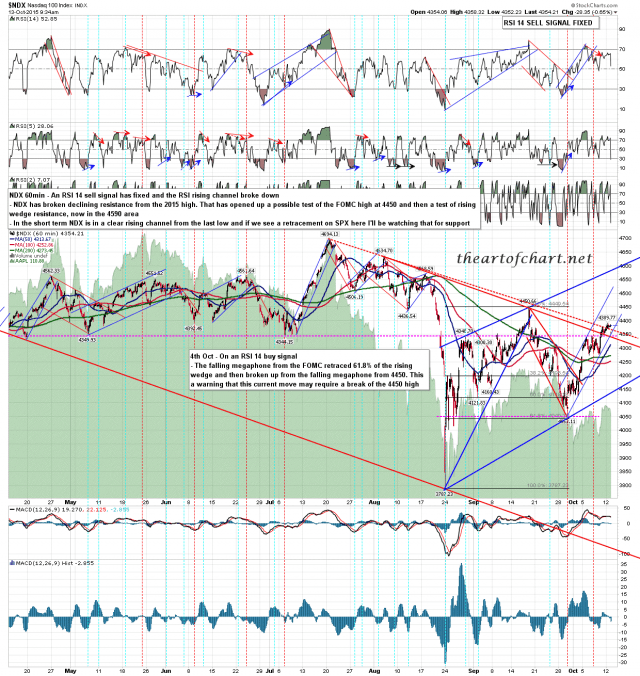

NDX broke declining resistance yesterday which opens up some possible higher targets. NDX also has open 60min and 15min sell signals. NDX is in a perfect rising channel over the last few days, so I’m watching to see whether that channel support holds today. NDX 60min chart:

If we do finally see this retracement to 1995, Stan has today as a possible V day, so it may well bounce straight back up from that test. There is a very decent chance that SPX would then be making the second high of a double top or head on an H&S then, before a hard fail in the next few days.