After the close yesterday I had a very careful look at the declining resistance trendline from 2132 using very thin trendlines. The high yesterday tested that trendline twice, and the obvious rally target has therefore been hit. Looking at NDX and RUT there are quality trendline highs on all three indices, with a daily RSI 5 sell signal now fixed on RUT, and close to an RSI5_NYMO sell signal on SPX. If this has just been a rally, which seems very likely, the top should now be in. Even in the event that this hasn’t been a rally the short term high should now be in, though in the latter case the resistance trendlines established yesterday would obviously be less strong.

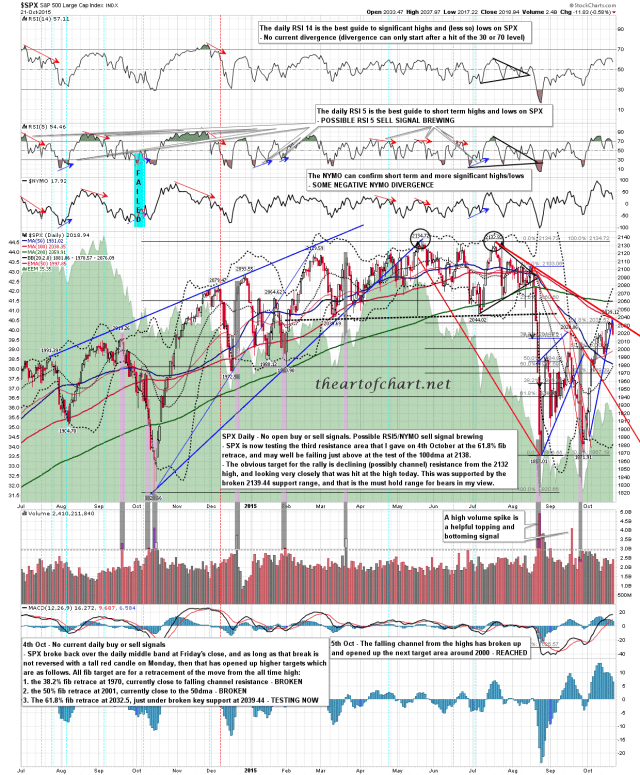

SPX has tested declining resistance from 2132 and reversed there so far. There is no clear overall pattern on SPX but that trendline is one half of the overall pattern that should become apparent later. SPX daily chart:

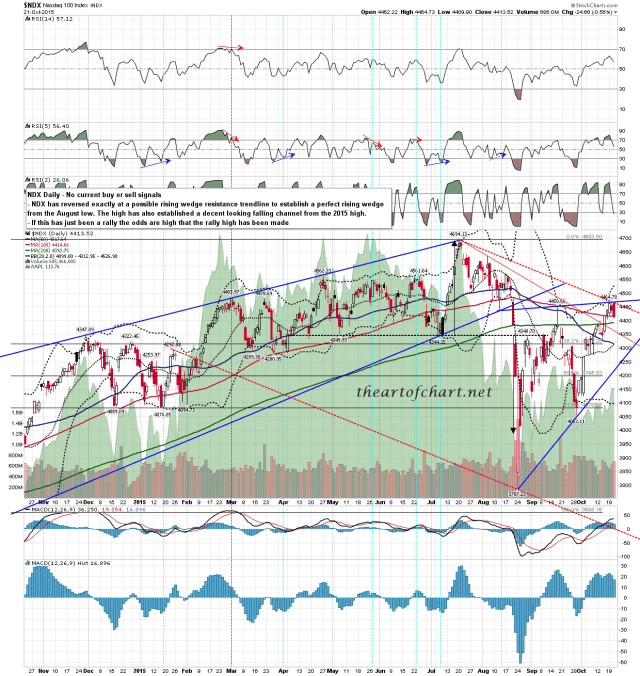

NDX has established a decent falling channel from the high, and a perfect, if unusual looking, rising wedge from the August low. The obvious next target within the wedge is wedge support, currently in the 4240 area. NDX daily chart:

RUT has established a falling channel from the highs, and has a very nice nested double top setup that has started to break down. RUT daily chart:

Today is the cycle trend day this week. That doesn’t mean that we will get a trend day but it does mean that there are 70% odds of today being dominated by either buyers or sellers. Often this would be a trend day but often not. Bears want an AM high that fails into a move down to the obvious SPX first targets at 2000 and the possible H&S neckline at 1990. Bulls want to trend up today and beat the highs this week, killing off the trendline setups on the three indices and opening up higher targets.

There was short term positive divergence at the close yesterday which has translated into this bounce overnight. The key/bull bear area is in the 2030 area and a sustained break above would be bad for the bear case. Bears would ideally like to test 2030 and fail there. I’m definitely favoring the bears on this setup but Draghi has been blathering about increased european QE and possibly negative interest rates coming this morning, and that has pushed ES to the key resistance area before the open. We’ll see if the bears can hold it.