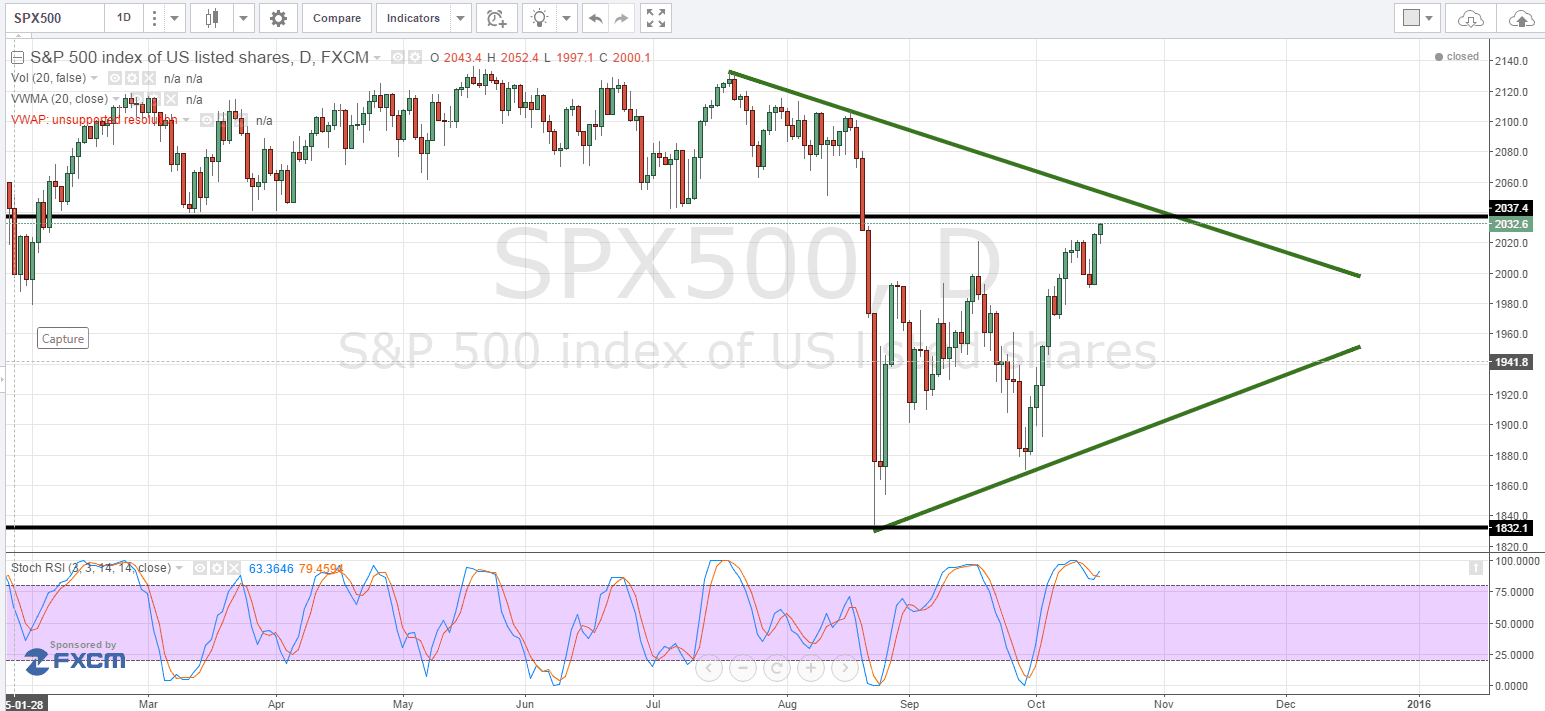

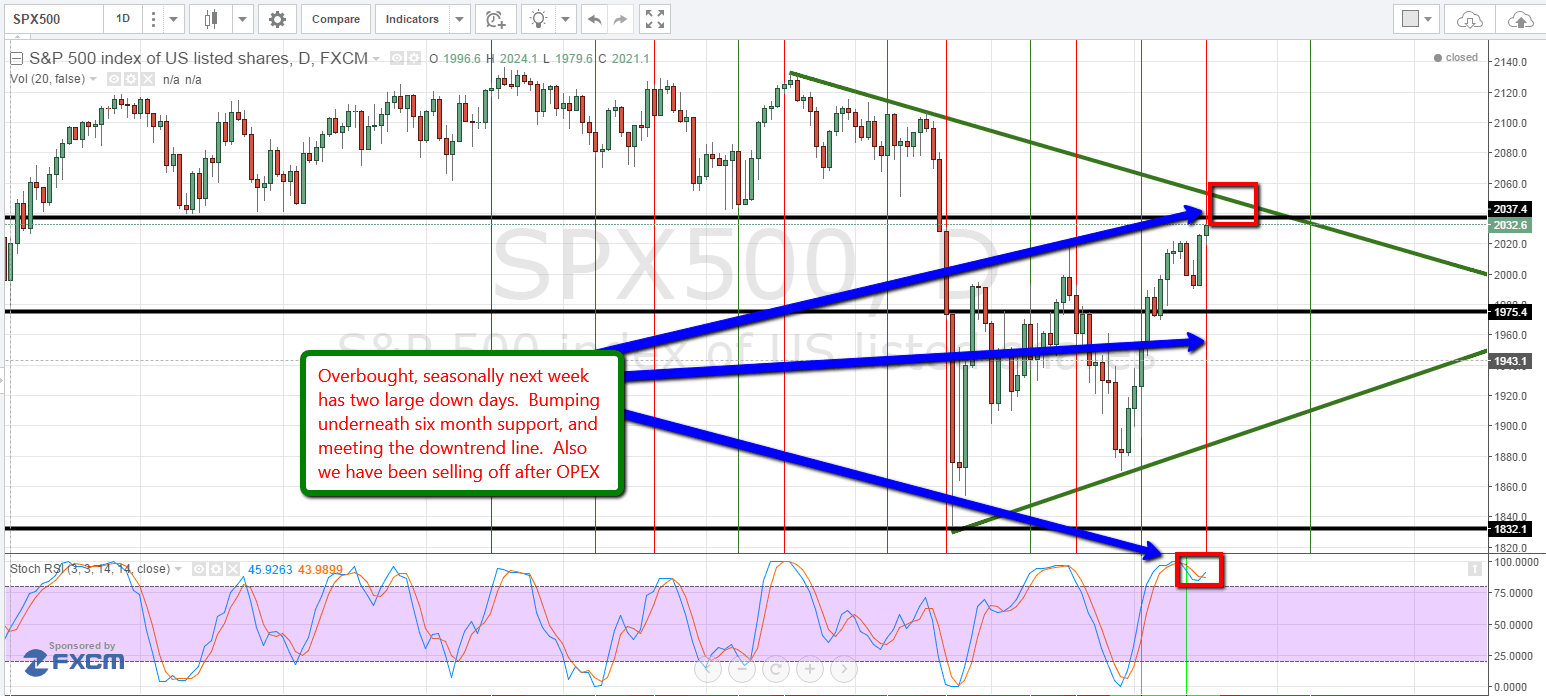

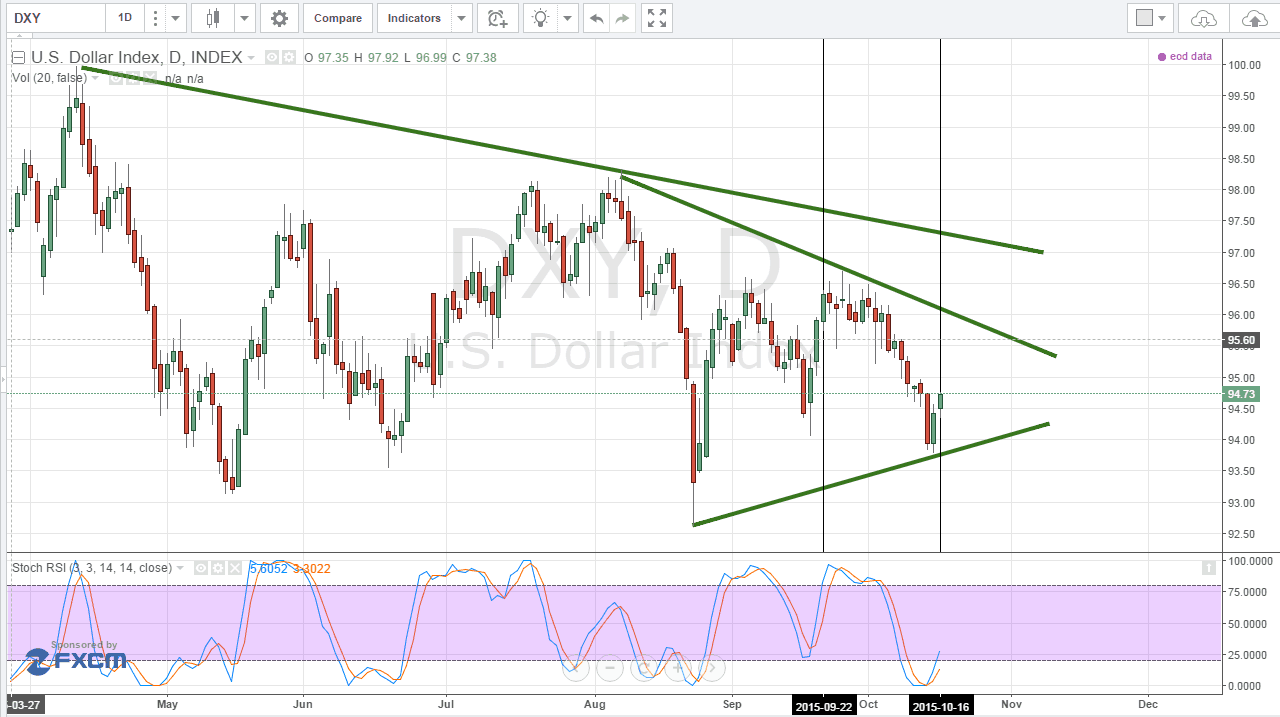

Ever since the Fed quit QE, the market has been oscillating based on OPEX. Many sites have been remarking on this as of late (so probably will not work this month) but technical patterns, seasonal s, and trend-lines suggest we take the trade short. Also, it looks likely that the market has readjusted back to levels prior to the we are going to raise rates meeting. Now what, back into the old rectangle, or as I think we are now in this new lower rectangle.

I am short ES and Biotech, but there are many ways to play this whether you are a conservative or aggressive trader.

Short ES at the R1 tomorrow if we get there, or wait for Stoch/RSI drops below 80.

Buy November Week one puts, or spreads (consider buying the 80 delta, and selling the 40)

Inversely, sell a credit spread same strike, same deltas (selling 80, buying 40)

Buy TVIX

Buy BIS

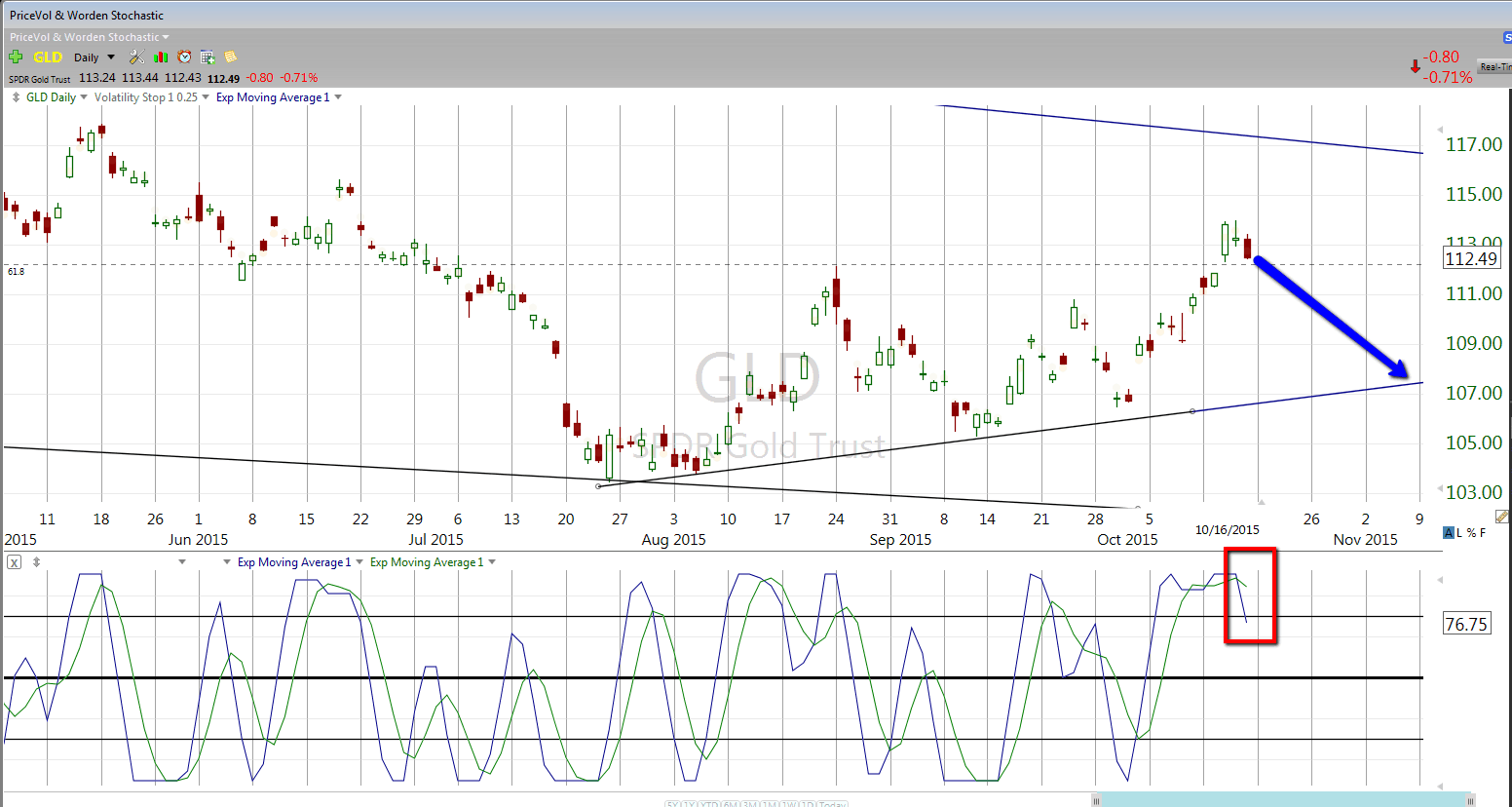

Sell gold

Sell oil

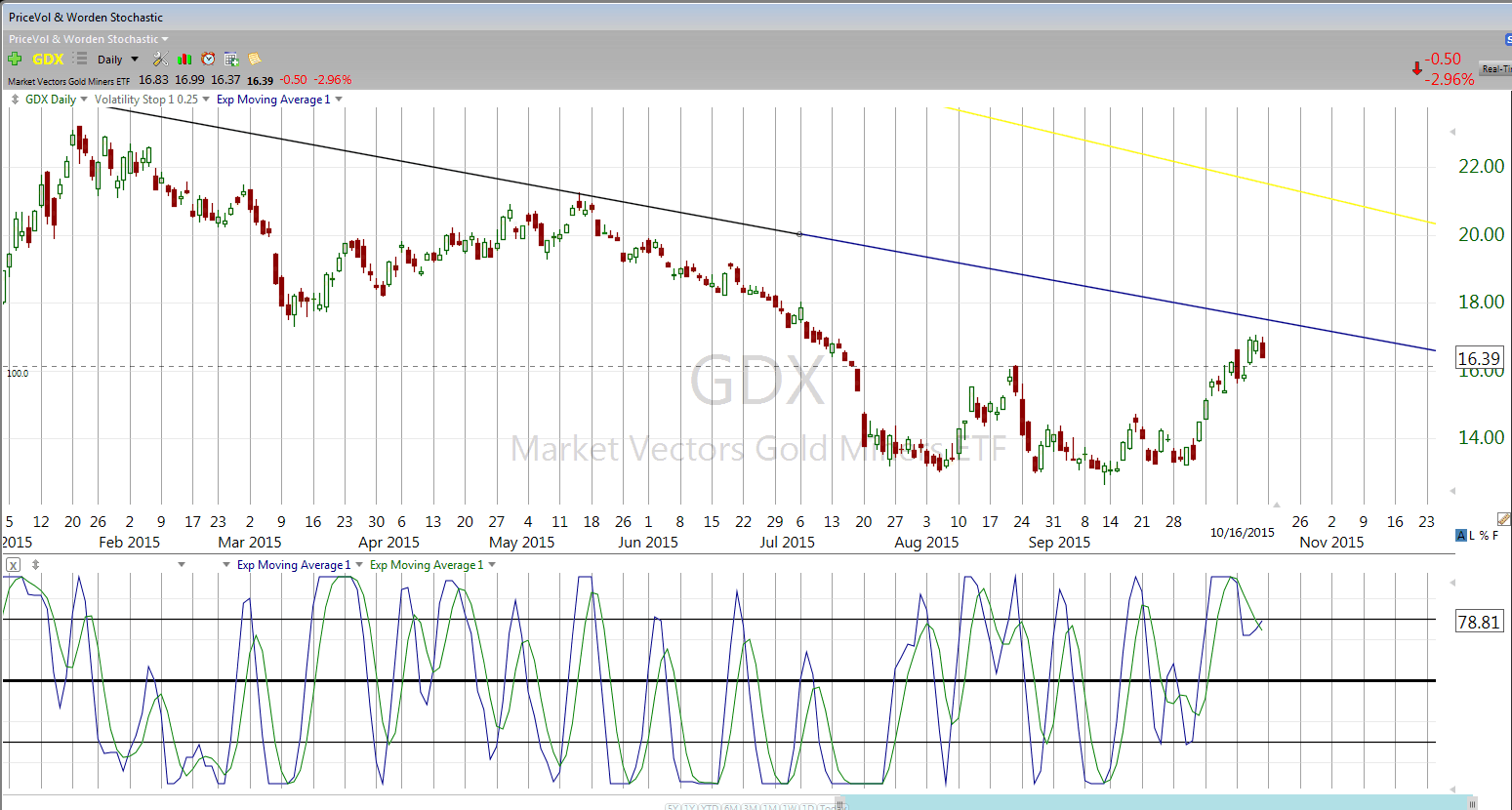

Sell miners

You get my point. Here are my charts

www.bobsstocksignals.com