It may sound counter-intuitive, but the United States needs a recession. I don’t say that to wish ill will on our nation. I say it for our good. Recessions are the market’s form of cleansing the excesses, and generating new innovations that only pressure can bring. Just as nature protects against major forest fires by having smaller fires from time to time, our economy needs to retreat from time to time to cleanse itself.

Obviously, the Federal Reserve over the seven years has been doing everything in its power to prevent even the smallest retreat in economic activity through an unprecedented expansion of the monetary supply. Distortion is not creation, and printing money does nothing to expand genuine economic activity. On the contrary it leads to mal-investment and greed, two things our nation and economy needs to be cleansed of.

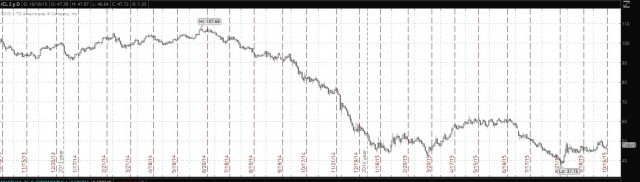

This can best be seen in the energy sector. Contrary to what the public may believe, the world has been drowning in oil for the past few years. The oil market has been badly over-supplied in recent years, as more oil has been coming out of the ground than the world can use or even store.

Under normal market circumstances, companies would have been scaling back production over the past few years. However that was not the case, as corporations were emboldened by artificially low interest rates to borrow at near zero percent to finance not only continued production expansion of high cost projects, but also funding their own stock buybacks to boost their stock prices. As a result, quick price declines are possible as market forces are subverted to the point where they finally break.

Over the past year we have seen oil prices rapidly drop from near $110/barrel to $40/barrel. The lesson here being that manipulation of market forces cannot last forever, and only serve to make the eventual move to true equilibrium more dramatic when it is finally initiated.

So what about true innovation that leads to real economic prosperity and growth? I found a surprising example this week, at a retailer that historically has repulsed me. Walmart. I will confess, I am not a Walmart shopper, and have never been. The couple times in my life that I have shopped at the retailer, the entire experience has disgusted me. However, this week the chain launched a new grocery pickup service at a few of their stores around the Nashville area. Simply order your groceries online, select a pickup time, and then drive to the store and you groceries will be loaded into your car upon arrival. I was intrigued. As a middle aged male, I hate shopping. Over the past couple years I have moved to get most of what I need delivered through Amazon and their free two shipping with their Prime membership. Clearly Walmart has eyes on competing directly with Amazon.

As you can see from the chart above, Walmart has struggled as of late with a sharp decline in their stock price over the past year. Their struggles as of late led to this innovation, as the company looks for new ways to grow market share. Where can they look to grow market share? With precisely the middle and upper-middle class population, like myself, that have previously been disgusted with their shopping experience. This new innovation bypasses in-store shopping entirely, saves time, and cuts the 2 day wait time with Amazon down to same day pickup anytime the customer desires. Progress. Innovation. It comes most of the time only when pressure is applied.

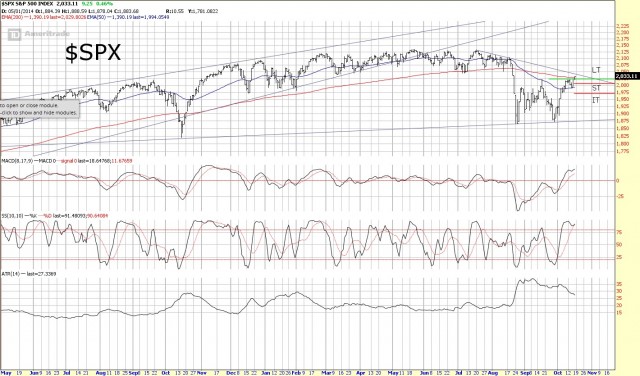

On to the charts… $SPX shown below is currently challenging its long term reversal level, the 200 day moving average, as well as its downtrend line off the July high. The August decline led to a long term sell reversal in the index, and I continue to work off the assumption that the top in SPX is in for the bull market of 2009-2015. This month’s rally in stocks has led to short term and intermediate term buys in $SPX, but the index would need to close the month above 2023 to move back to a long term buy. If that were to occur, I would expect new highs to come later this year. But, that is not my expectation. Let’s take a look at some reasons.

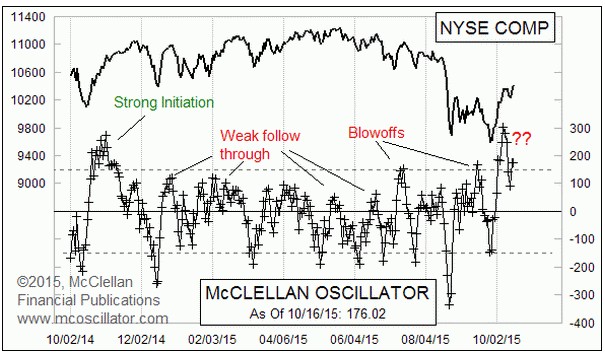

Tom McClellan continues continues to expect market weakness into April of next year. His interpretation of the recent large spike in the oscillator that bears his name is bearish, not bullish. He states:

“Now we are in a downtrend, and the countertrend rallies have been able to take the Oscillator up to a level which would otherwise be an indication of strong new upward initiation. But the lack of follow through reveals those high readings to be markers of blowoff tops instead of strong new initiation. The latest Oscillator peak rose all the way up to +303, and we thus far are not seeing follow-through.

If the Oscillator continues falling and goes back down through the zero line without building any complexity up above zero, then that will be a “tell” that the recent bounce has been just a countertrend rally, and is not the start of a new uptrend. That is the outcome which I expect to see, and so the Oscillator serves as a great tool for confirmation of expectations.”

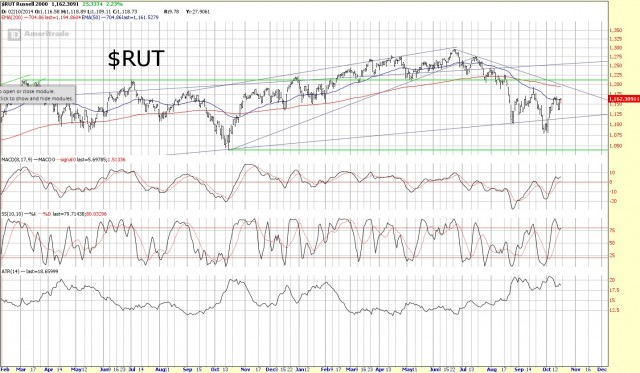

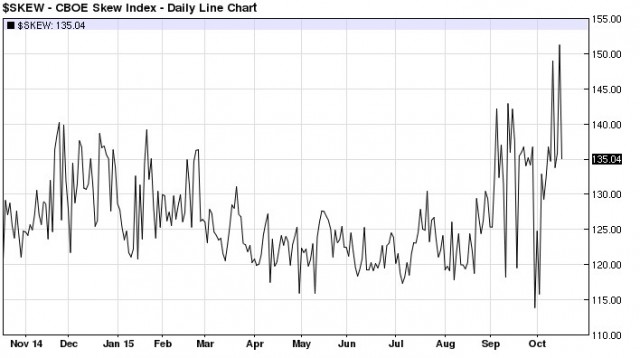

Other areas to look for bearish confirmation that I am following are $RUT and the SKEW index. The Russell continues to lag $SPX. It has not broken its September or October highs, continuing to negatively diverge, showing a lack of liquidity in markets.

Finally the SKEW index, which tracks traders expectation of outsized negative returns in the next 30 days, hit never before seen highs last week. This is foretelling the possibility of 2 or 3 standard deviation declines going into November option expiration. In the words of the Rev over the past year…. SKEW don’t lie bro!