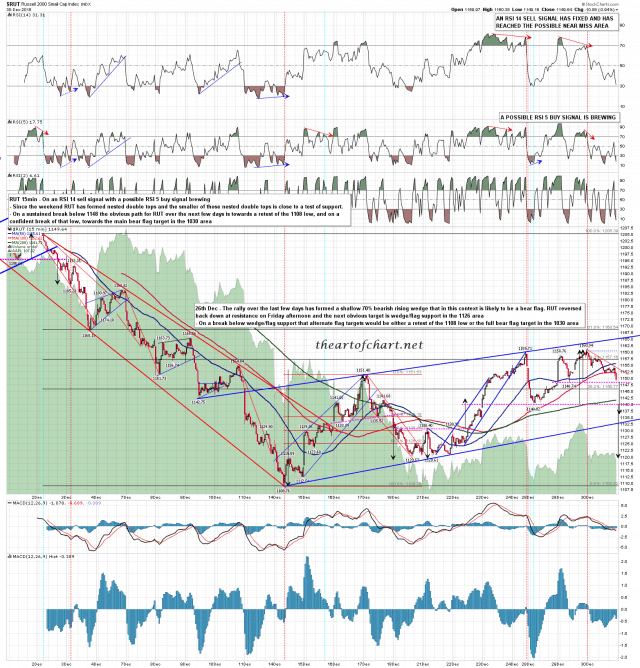

At the start of the week I posted the very bearish looking sequence of RUT charts, suggesting strongly that downside was likely to dominate the next couple of weeks, and after all the bullish excitement on Monday afternoon and Tuesday, all that has changed on RUT is that there are now nested double tops in place to clarify how RUT is going to make it to those downside targets. With the support breaks yesterday and gap down this morning it seems that Santa is leaving the building or has already left, and that being the case I’m not expecting the highs this week to be challenged before at least the second half of January. Here is the RUT 15min chart from yesterday’s close to show the setup here. RUT 15min chart:

I’m posting my ES, NQ and TF 60min bonus charts that I did for theartofchart.net subscribers this morning as my other charts today. This is part promotional but mainly because I was up late and still feeling a bit under the weather. I’m very happy that tomorrow is a holiday. ES Mar 60min chart:

NQ Mar 60min chart:

TF Mar 60min chart:

What’s the takeaway here? The Santa rally is very likely over, and the setup here is strongly suggesting that the first week of January may well be a rerun of the very bearish first week of January 2015. I’m cautious about holding shorts over the weekend but until further notice I’m treating any decent bounces as sell opportunities.

The big number today is the closing print on SPX in 2014 at 2058.90. I understand that there has never yet been a year with a five in it that has closed red on SPX so there may be some pressure to try and maintain this again this year. I’m putting the odds of a close under that number today at 70/30 in favor of the bears on this opening setup.

Lastly a reminder that Stan and I are doing a free to all Chart Chat webinar on Sunday at theartofchart.net, and that if you enjoy top quality TA, or are at all interested in the 2016 price prospects for equities, bonds, forex, precious metals, commodities etc etc, then you should consider attending. You can sign up for that here. Spaces are limited so don’t wait too long to register if you are planning to attend.

A very Happy New Year to everyone and my next regular post will be on Monday morning. 🙂