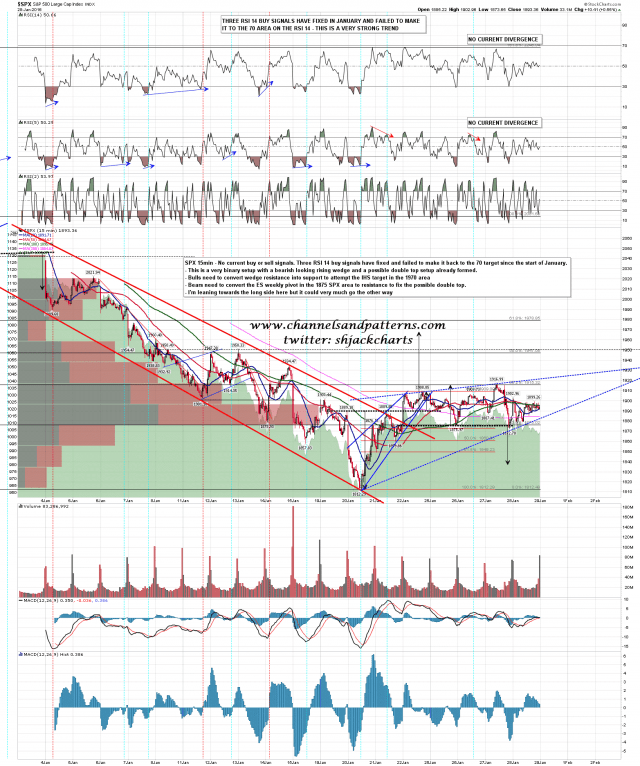

SPX has been compressing for a few days now and we are going to see a move very shortly. I’m leaning long for that move but it’s possible both that any new high will be marginal, on the possible rising wedge option, or we may go straight down through support, on the double top option. Only if bulls can convert possible wedge resistance into support does the IHS target open up as a target, and even then there is significant resistance both at the daily middle band in the 1930 area, and possible channel resistance in the 1940 area. SPX 15min chart:

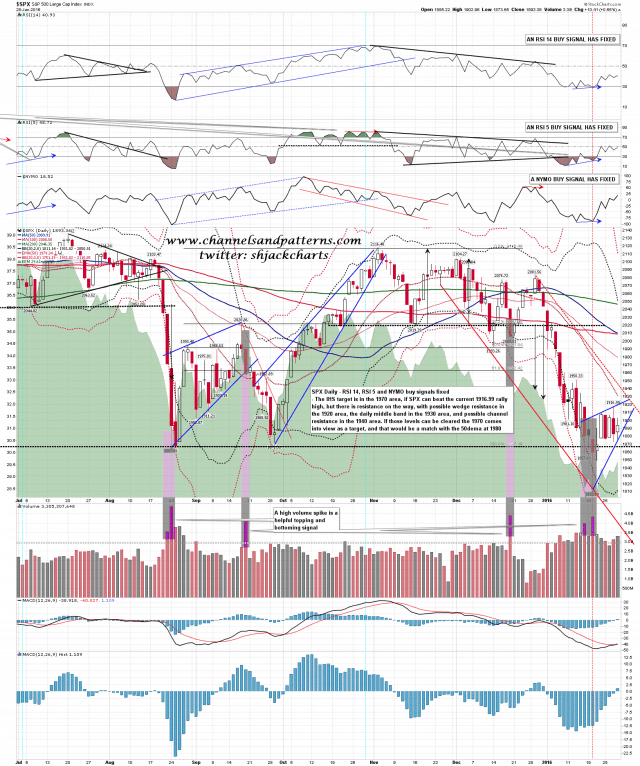

What the bulls have on their side is the very bullish daily signals setup, but this doesn’t preclude a possible retest of the lows of course. SPX daily chart:

Today is a cycle trend day, which doesn’t mean that we’ll see a full trend day, but does give 70% odds that today will be dominated by either buyers or sellers. Today is the last day of January and the stats lean bullish. Even more so on Monday. We’ll see if the bulls can run with that.

My January barometer setup requires a close under 1990 today to repeat last year’s strong lean towards a flat year at best. No doubt the bears were up all night worried about losing that level today. Support is in the 1875 area and resistance is in the 1915-25 area. We’ll see who wins the day, but it’s seems almost certain that bears have already won the month, and therefore most likely also the year.