I have promised my wife that I will fight against my strong natural english tendency to understatement this year, and will at least mention particularly sweet calls that I make when they make target. This is therefore a good time to look back at my first post after Xmas on Monday 28th December where I gave 70% odds that RUT was about to decline 10% into the 1030 area. RUT tagged 1031 yesterday, slightly less than ten trading days after that post, and I’m considering that target made, though I’m not expecting that low to hold long. You can see that post here.

Also worth a mention is my call in the same post that the odds were 50% that SPX would close the year red for the first time ever in a year ending in a 5. Obviously that delivered too, though I’d note that the stat I’d read that SPX had not closed red in a year ending in a 5 since 1875 would have been more impressive if SPX hadn’t been launched 48 years later in 1923. Nonetheless that was still an unbroken string of nine examples that has now been broken. Not the only big stat that was run over last year of course 🙂

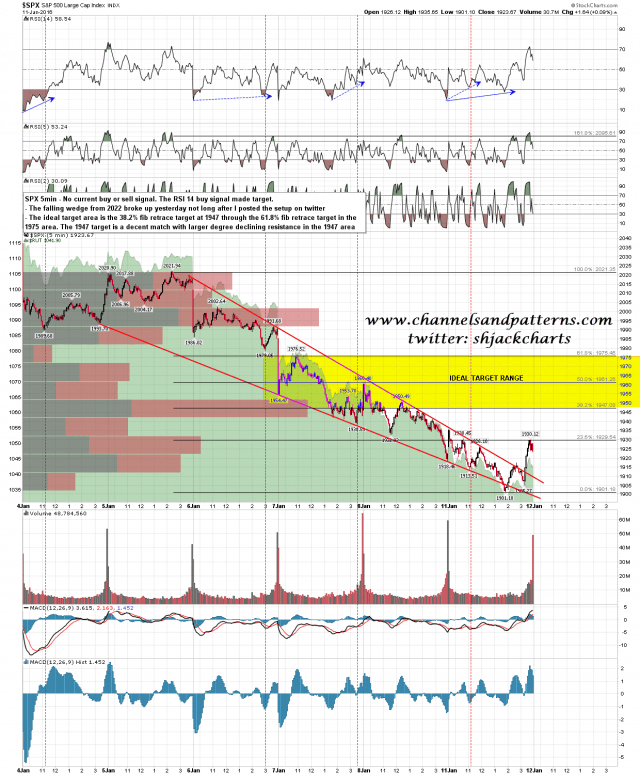

Moving on to today, I posted an earlier version of the chart below on twitter yesterday before the falling wedge from 2022 broke up, and gave the ideal fib target range as 1947, 1961 and 1975. SPX 5min chart:

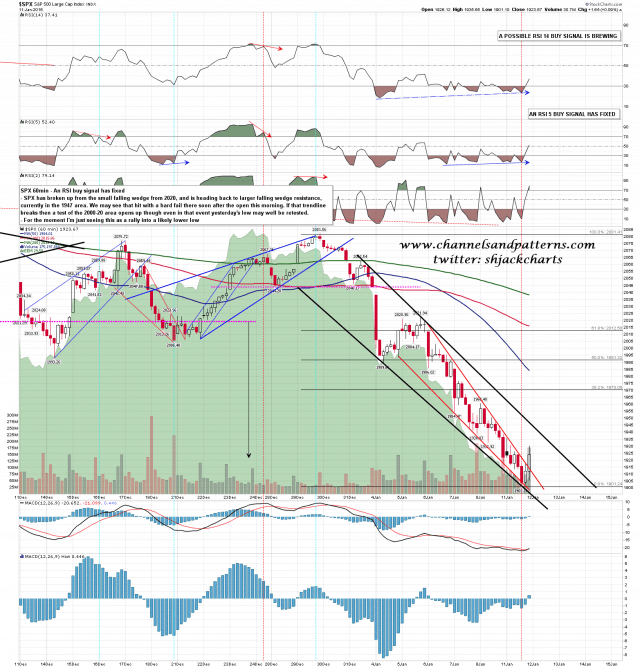

I’d note that the resistance trendline on the larger degree falling wedge from 2062 closed in the 1947 area yesterday and that if we are to see a reversal into new lows then that trendline is the obvious target, and would most likely be hit this morning. SPX 60min chart:

Where are we within this leg of the downtrend? Well I think this is likely to be the last significant rally before the wave low is put in. If we are to see significant new lows then that wedge resistance in the 1947 area at the close yesterday should ideally be tested and hold this morning. A break above would suggest that any subsequent new low would likely be marginal and the second low of a double bottom into the larger rally that Stan and I are looking for shortly.