Early today, I saw a prominent article declaring that the low for 2016 was in, because there have been a couple of recent years in which early February marked the bottom for the year as well. Ummm, OK. This, to me, is about as meaningful as getting excited every October, simply because huge market crashes seem to take place during that month (like in 1929, 1987, 1990, and 2008, just to name a few). It’s dumb.

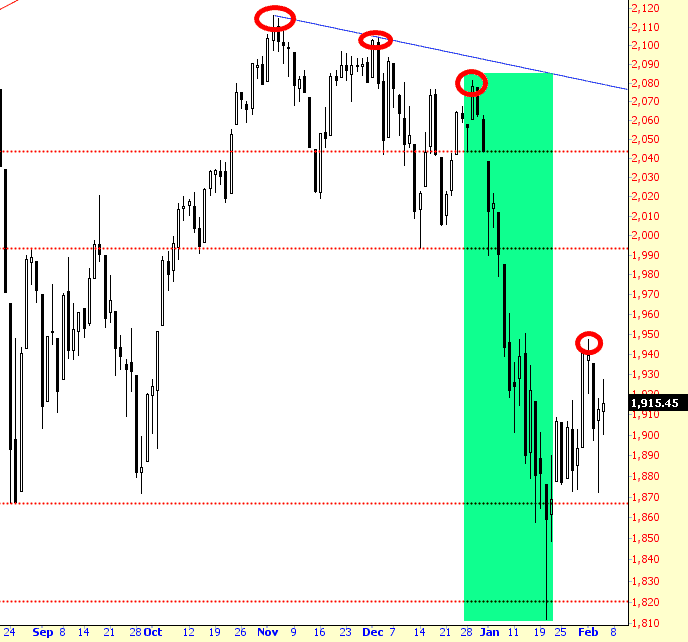

Indeed, if there’s anything I’ve noticed about recent market action, it’s that intermediate highs take place at the very start of each month. It’s actually kind of freaky, and this didn’t dawn on me until I began writing this post. I’ve circled about the 1st of November, December, January, and February below. I’ve also tinted the brief drop which, according to some, is the entirety of the 2016 Bear Market, and it’s all blue skies ahead from here on.