Decent rally on Friday that has failed so far either to make a higher high or to break over the 50 hour MA on SPX, so unless that changes I’d expect the rally to be reversed in the near future, and that may well happen. There is a possible alternate scenario here where SPX might be forming the H&S on a larger and flatter H&S pattern, and if so the ideal high would be a bit higher in the 2075 area. That would be very close to the 61.8% fib retracement of the decline from the highs so far and is obviously still potentially in play. Stan’s bull/bear line is the 2039 ES area (approx 2043/4 SPX) so I’ll be watching that area for possible support this morning.

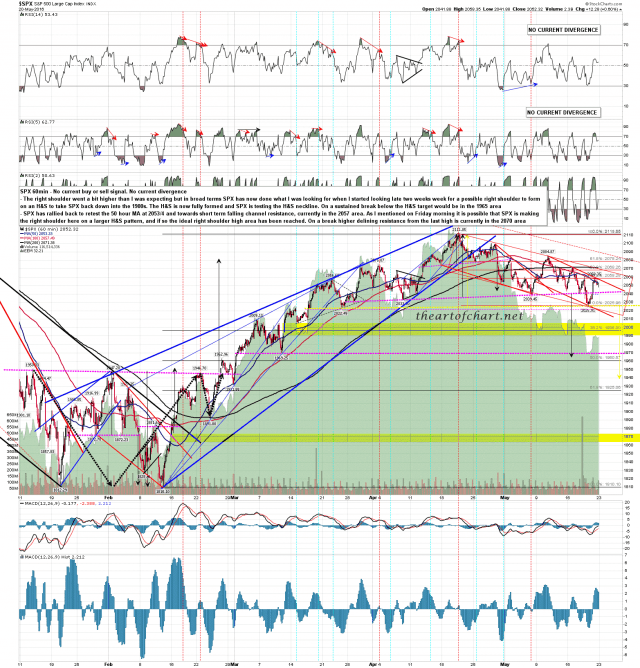

The short term pattern on SPX is a decent falling channel and channel resistance hasn’t been tested yet. A lower high under Friday’s high could deliver that this morning and we may well see that. SPX 60min chart:

This is last night’s chart on ES but since then a possible double top setup has formed that would target the 2031 (~2035 SPX) area on a sustained break below 2043.5 (~2047.5 SPX). ES Jun 60min chart:

The early warning of Friday’s rally was the open 60min buy signals remaining on ES, NQ and TF after Wednesday’s rally. ES has made the near miss target and NQ and TF both made the full target, but after a marginal higher high overnight a 60min sell signal has fixed there. TF Jun 60min chart:

The ES weekly pivot this week is at 2047, so about 2051 SPX. If bulls can hold that as support then this rally may be heading higher. A beak below opens a possible test of Stan’s bull/bear line at 2039 ES (~2043 SPX), and a conviction break below there should mean that the rally from Thursday’s low is retraced in short order, most likely in a decent leg down.