The bulls delivered a strong confirming daily candle and tested the daily upper band on SPX yesterday. The good news for bears is that 60min sell signals have now fixed on ES, NQ and TF, with all of them looking close to starting a decent retracement. The bad news for bears is that if seen at all, the low on that retracement is most likely a strong buy, as the technical picture has now shifted heavily in favor of the bulls. I’ll explain why below.

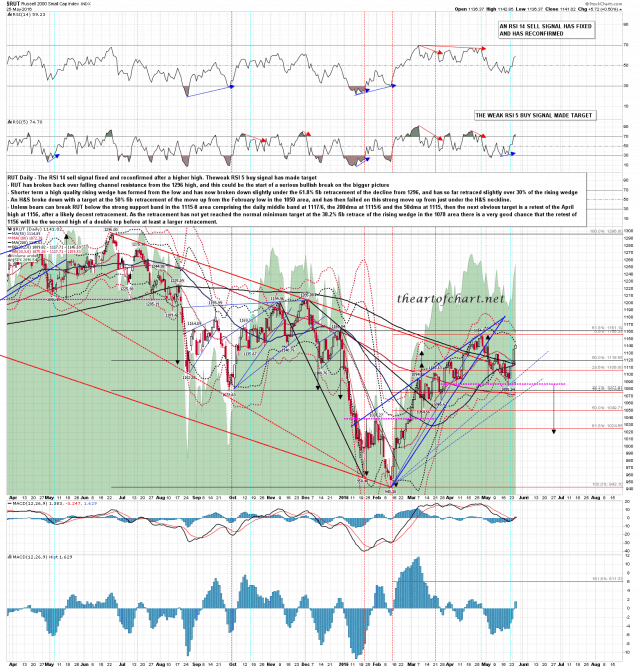

I’ll start with the most bear friendly of the daily charts. On RUT the obvious next target is a retest of the current swing high, though the limited retracement seen so far would suggest that retest should be the second high of a double top before a larger retracement. On the TF chart there is an open IHS target at the retest of the current swing high. RUT daily chart:

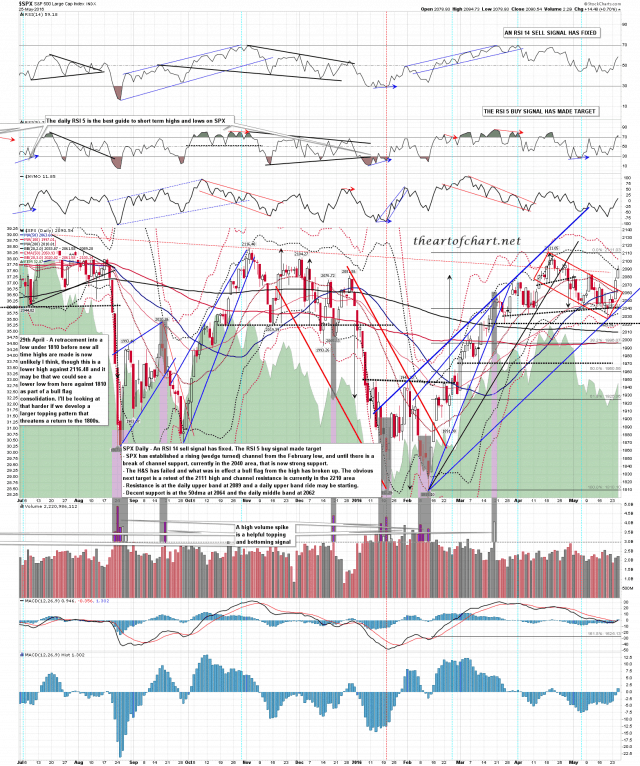

That’s pretty much the end of the good news for the bears. On SPX the rising wedge from the February low has now evolved into a rising channel. That means that until that channel breaks down, with rising channel support currently in the 2040 area, the obvious lean is bullish and this may well be a rising channel to take SPX to a new all time high. I’ve been mentioning regularly over the last few months that I was and am doubtful that the bull market high for the move from the 2009 low had been made, and this may be the channel for that last move up. Hard to say where this move would top out but the compression on SPX is arguing for an extended band ride in either direction, the channel shifts the odds towards an upper band ride while it lasts, and I’d just mention that I have channel resistance currently in the 2220 area. This move could run up a while. SPX daily chart:

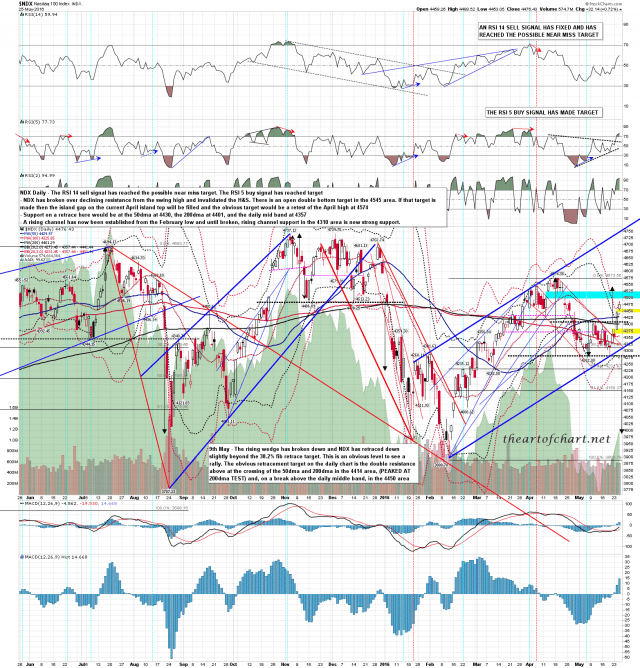

The initial rising wedge on NDX has also evolved into a rising channel, which again favors the bulls here. NDX daily chart:

If this is an impulse wave up then it’s important to remember that short setups can and will fail a lot. Sell signals will also fail regularly. We’re already seeing this to an extent, as the trendline and divergence setup at the close on Tuesday was very bearish, and was then shrugged off on Wednesday morning in a way we really haven’t seen much lately. There is a very solid setup for a decent retracement here, and if seen a very obvious target area in the 2065-70 area. Will we see that retracement? Maybe, and if so it is likely to be a dip to buy. If we are going to see that retracement then the best chance to see it is today, as it is the last cycle trend day this week, and tomorrow and Tuesday are bracketing the holiday weekend, traditionally days of thin pickings for bears. The opening setup looks promising. We’ll see how that goes.