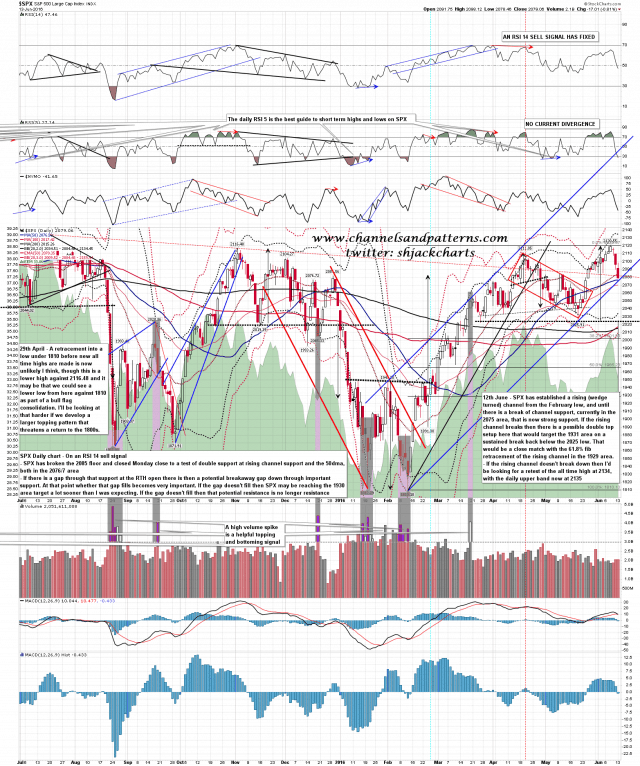

SPX broke support yesterday at the established floor at 2085, supported by the 38.2% fib retrace target and the daily middle band at the same level. SPX closed the day just above the test of double support at main rising channel and 50dma support in the 2076/7 area, and has gapped through that support at the open.

This is a potential breakaway gap through important support and what I’m watching closely here is whether that potential breakaway gap fills. If it does then this is just a break of the channel, which opens up lower targets but no more. If that gap doesn’t fill then it may well not fill until we have reached the obvious targets below, and we may then be reaching the ideal 1930 target area a lot faster than I was expecting. We’ll see how that goes today. If the gap does fill then the daily middle band at 2084/5 is now important daily closing resistance. SPX daily chart:

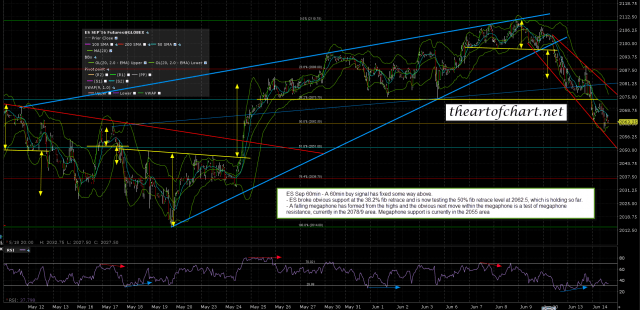

There are a lot of open buy signals here and as long as that breakaway gap fills, I’m expecting a decent rally soon without going too much lower. Stan is looking for some support in the 2050 ES area (~2060 SPX), close to the 61.8% fib retrace target on SPX at 2062. If it goes lower I’d note that the daily lower band is currently in the 2034 SPX area. ES Sep 60min:

The possible breakaway gap has filled while I’ve been writing so that’s no longer indicating a possible and immediate extended decline. I’m looking for a likely rally soon and on a sustained break back over 2085 that may be in progress now. Otherwise I’ll be looking for support in the 2062 SPX area.