Much to everyone’s surprise, including mine, the Brexit campaign won the UK referendum by a healthy margin and it seems the UK is starting down the road to leaving the European Union. There were big reactions overnight on the markets, and much gloom voiced and written about the danger and the instability of the Brexit, but personally I think it’s a good thing, and if you believe that it’s always better to stick with the devil you know, then I’d suggest perusing the writings of the US founding fathers for a series of opposing opinions. Change sometimes works out ok, and it’s worth remembering that the only situation for humans that is ever really stable, is death, which is a high price to pay for certainty. Any good outcome always involves taking a risk. 🙂

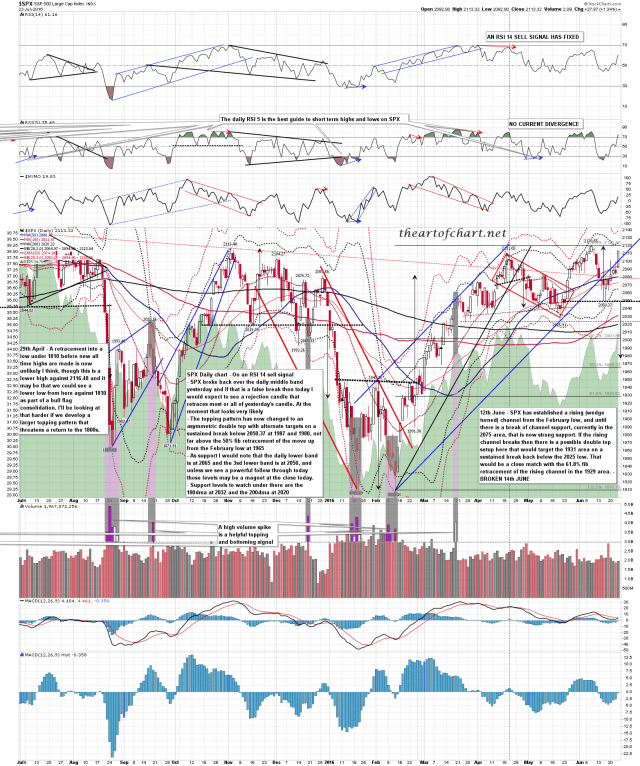

Moving onto the markets SPX broke back over the daily middle band with confidence yesterday and on the day after that happens, if that is a false break, then there will be a rejection candle that will retrace most or all of the breakout candle. Obviously we’ll likely see one of those today. There is now a double top in place that would have alternate targets in either the 1987 or 1980 areas on a sustained break below 2050, which I would note has not been broken yet in RTH. SPX daily chart:

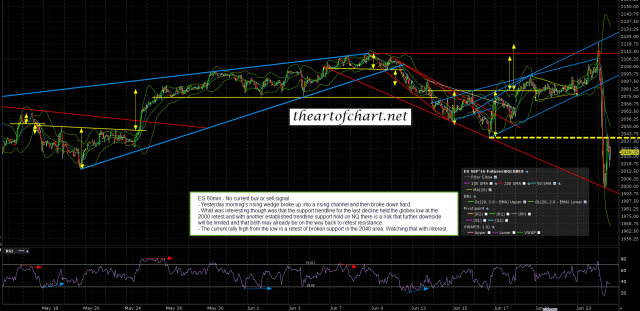

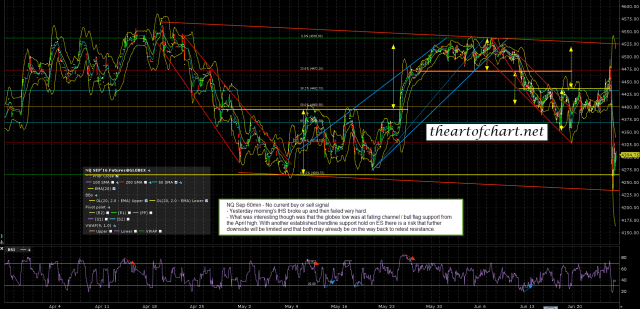

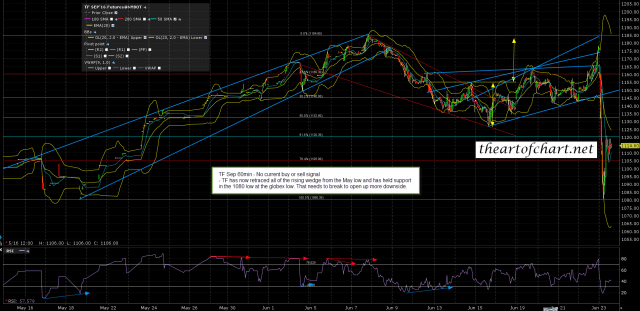

On the futures charts I’m posting all three of this morning’s bonus charts of ES, NQ and TF for subscribers at theartofchart.net, because all three made globex lows at very significant levels that could limit further downside. Coupled with Brexit in my view being a storm in a teacup from a fundamental perspective, that is a serious concern for seeing further downside here, and raises a possibility that the main reaction low has already been made in globex. I’m leaning towards more downside, but watching this carefully.

ES Sep 60min chart:

NQ Sep 60min chart:

TF Sep 60min chart:

Even if the reaction low has already been made in globex I’d be expecting to see at least an attempt at a retest of that today. Today is liable to be whippy and if you struggle in very volatile markets it would probably best to leave this tape until Monday. Everyone have a great weekend 🙂