We had a very big storm blow through the San Francisco Bay Area over the weekend. What would I do during what was called the biggest storm of the decade? Head to the beach with my youngest child, of course!

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Aces and Eights

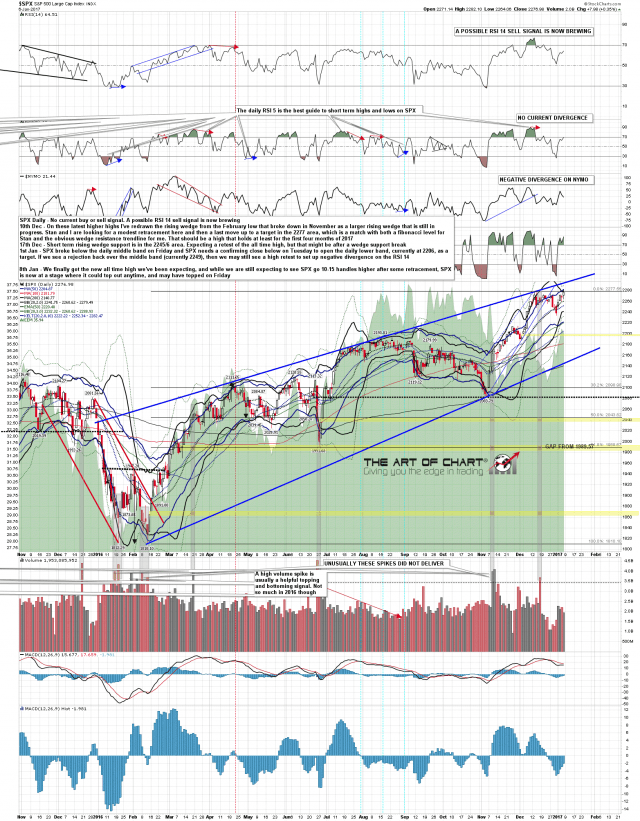

SPX and NDX made new all time highs on Friday, and the minimum requirement that we were looking for in the high that is forming here has been met. There is a setup for sharp retracement from here, though it’s very much still in the inflection point still, and I’ll be showing you on the last chart why I think the setup favors the bulls, though it could very much go either way.

On the SPX chart there is now a daily RSI 14 sell signal brewing, with NYMO divergence and SPX close to rising wedge resistance. SPX daily chart:

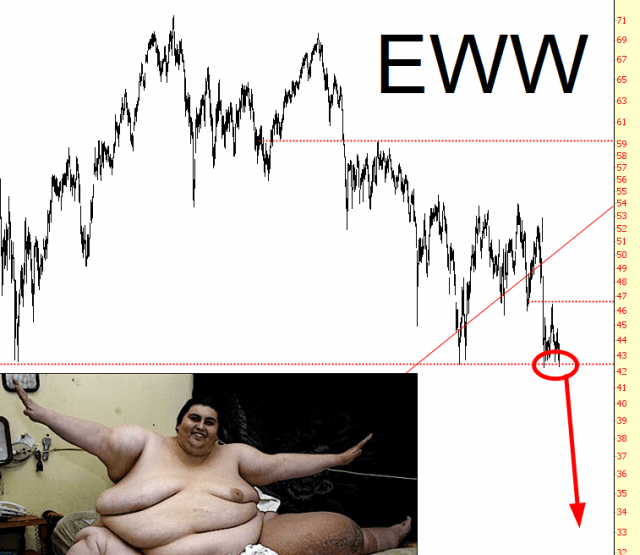

¡Olé!

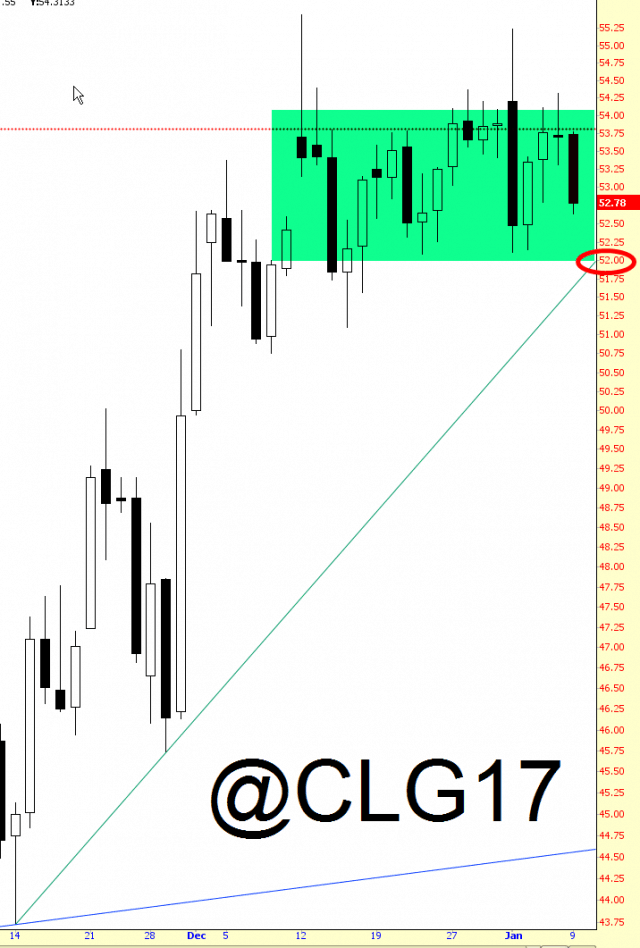

Crude’s Tight Range

There’s not a lot going on this morning, but oil is kind of interesting, down nearly 2.5% as I’m typing this due to concerns that the U.S. producers will be ramping up their output due to stronger prices. For weeks now, oil has been in a very tight range of only about $2. The key, though, is the lower end of that range – about $52 – because, if broken, we could finally see the uptrend snapped and move back into the upper 40s, dragging energy stocks down with it.