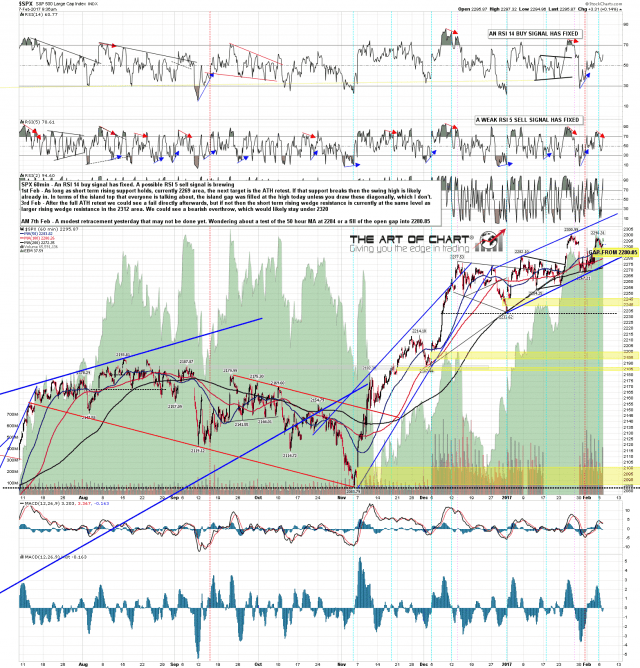

I had fixed 60min sell signals yesterday morning on ES and TF, and a weak RSI 5 sell signal on SPX. The TF signal made target but I’m wondering if SPX and ES will need a bit more retracement today. If so I’ll be watching the 50 hour MA at 2284 and the open gap into 2280.85 for support. On the upside rising wedge resistance is now in the 2312 area. SPX 60min chart:

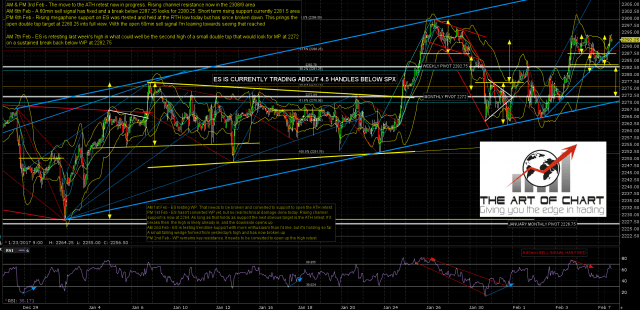

A somewhat bearish looking opening setup on ES here. Important support at the weekly pivot 2282.75. ES Mar 60min chart:

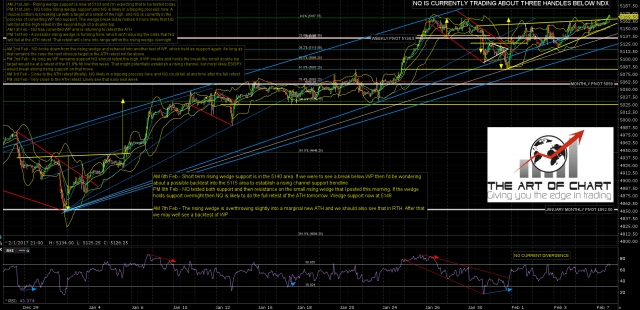

Also somewhat bearish looking on NQ here with the very nicely formed rising wedge that tested support and resistance yesterday now overthrowing into a new ATH. No negative divergence here but unless NQ is expanding into a larger pattern then this looks like a short term high forming. NQ Mar 60min chart:

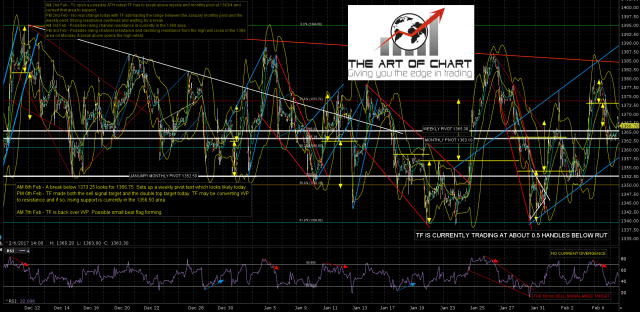

TF has been underperforming on this retracement and I remain sceptical about seeing a full ATH retest on RUT/TF. TF Mar 60min chart:

We are expecting the swing high this week. Ideally that would be made by the close tomorrow and probably hasn’t already been made, though the new ATH on NDX/NQ satisfies one condition for that high obviously.