While I’m with people playing top golf I wanted to write an article on delta.

To recap an option is out of the money when the strike price it diverges the current price. For example for call options if the strike price is below the current price that option is in the money. It will have both extrinsic value and intrinsic value. Remember when we mentioned intrinsic value that means that if the option is exercised at this moment the amount of value between the strike price of a current price represents the intrinsic value. Because options expire in the future they also have an extrinsic value which is governed by four primary factors.

The four Greeks that truly matter are delta, theta, gamma, and vega. The first three are derived from Greek letters by the last one is a common name that has been derived by options traders. These are known as the “greeks”.

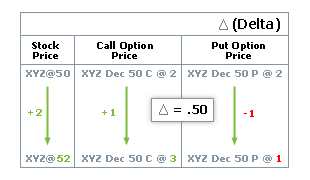

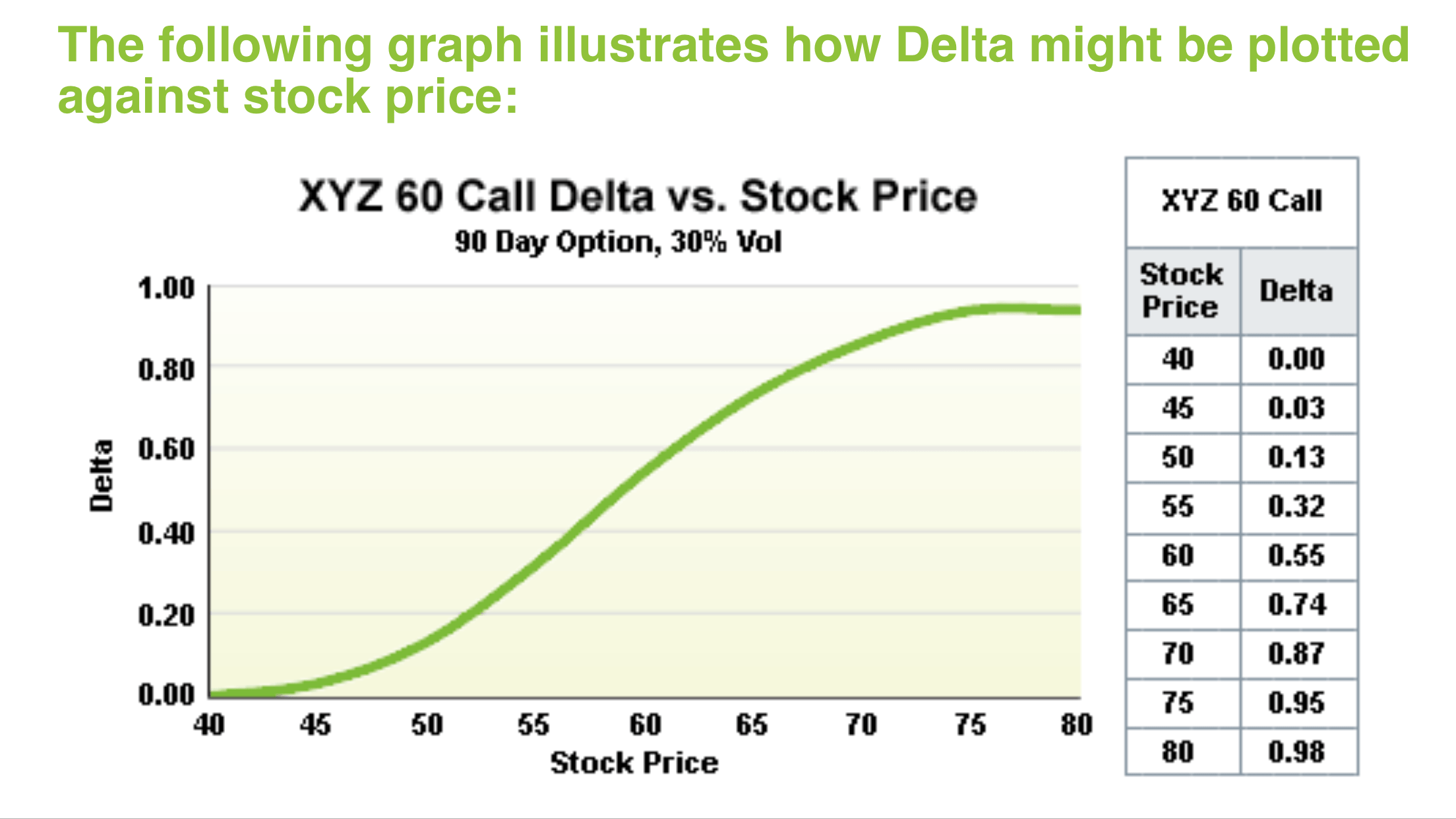

Delta represents the percentage of the underlying that will affect the the option’s price. For example if we have an option that is a 50 delta (50%), directly at the money, meaning the strike price equals the current price, that means that there is 0 intrinsic value and whatever value that option has it is pure extrinsic value. All options with a delta less than 50 behave this way.

The delta of a 50 delta option means that if the stock price goes up by say five dollars the value of that option will go up to 50% or approximately $2.50. On the other hand if the stock drops five dollars, the option will lose value by about $2.50.

What delta also represents are two critically important things. First of all delta also represents a common currency value that links stocks and options together. In other words stocks are options and options are stocks, and they are interchangeable if one wants to use them in this way.

Stocks by definition will have a delta of 100 because for every increase of one dollar in the stock value 100 shares will go up by $100. Standard equity options have a multiplier of 100 , so 1 contract represents 100 shares of stock.

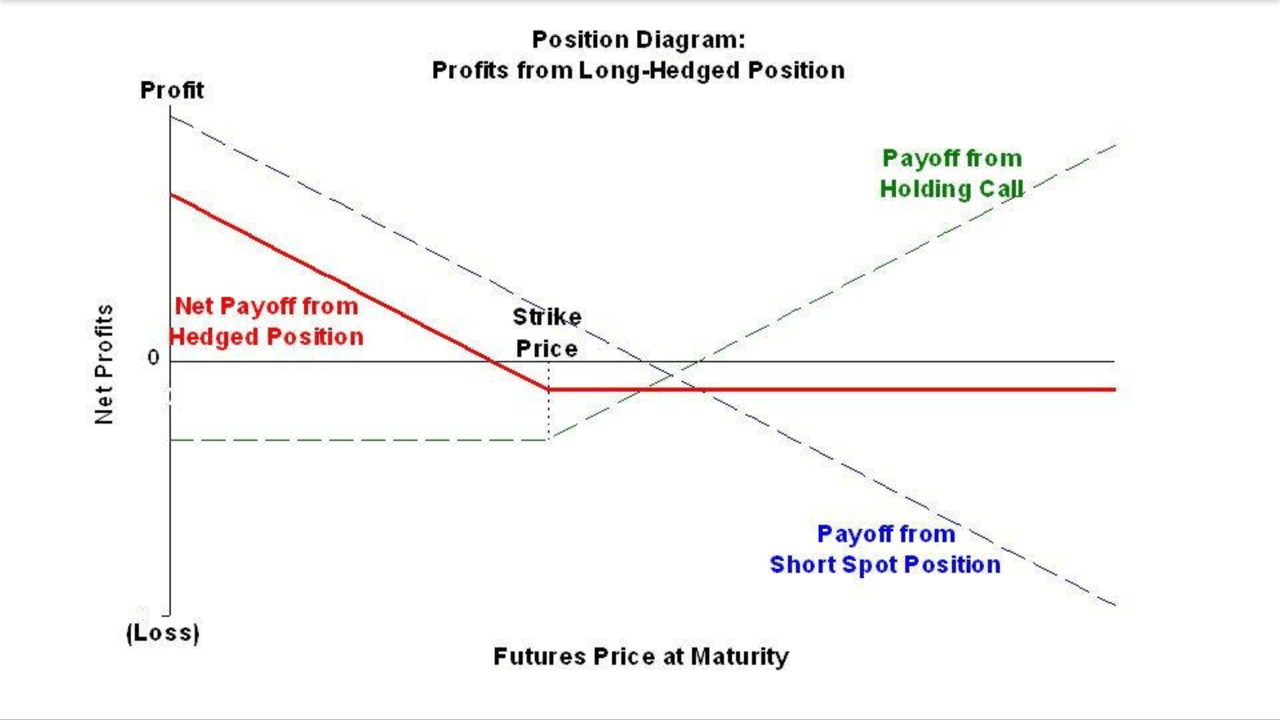

So for example say I wanted to hedge Tim’s recent trade in the NASDAQ. Tim bought a put option. Let’s say that put option was at the money, and we want to hedge this. To hedge we essentially want to reduce the amount of our costs by about 70%. Purchasing one put at 50 delta means that we have shorted about 50 shares of stock. To hedge this we want to buy 35 shares of the NASDAQ, which represent 35 delta. This is useful because for example if we buy or sell options and market closes, we can buy or short stock to hedge, depending on what happens in the after hours market, say, after earnings. In this way we still have a measure of control of our risk even after trading hours.

The below is one reason to hedge.

Again options are stock and stock or options, and that means when Tim shorts the stock he is shorting 100 Delta per 100 shares.

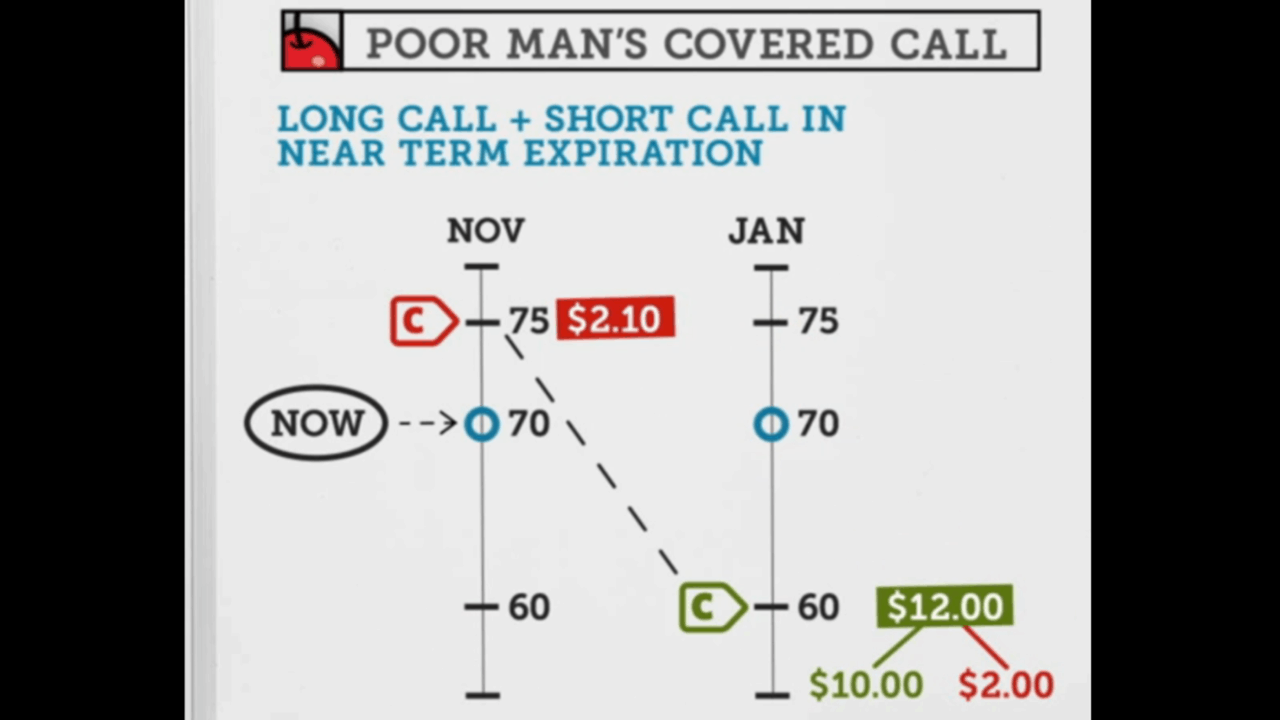

Also let’s go over in the money options. In the money options typically have a very high delta approaching 100. That’s because it’s very unlikely that in the money options will expire worthless. Therefore most of their value is actually intrinsic value, and extrinsic value becomes less relevant. This is useful as you can use longer term (>80 days) in the money options to simulate stock positions for 50-75% less reduction in our buying power. Tim can buy a put 120 days out which will simulate a short position (and can get a bigger position than using reg T margin). He can sell a put _against_ this position, to hedge. (A so called married put postion, the inverse of a covered call).

The below shows how using an option to simulate a long stock position can work with a covered call. This is known as a poor man’s covered call (PMCC).

Out of the money options are also useful. One good way to use out of the money options is to use them as insurance for an at the money credit position. For example if we sell an at the money option but we want to have some protection we could buy for example a 10 delta option for some protection to prevent catastrophic losses. For example if we say want to short a highly volatile biotech stock, we could sell an at the money option but buy a 10 delta option to prevent us from having catastrophic risk. This will also reduce the amount of profit we can have but it is useful to use the out of the money option as cheap insurance. Buying out of the money options by themselves are cheap but usually result in losing money and are not recommended.

Mastering the idea and concept of delta is critical to understanding options trading. There are thousands of different instruments with different strike prices, and literally millions upon millions of possible combinations. The way to make sense of all of these and to communicate in a universal way, and to compare indices, equity instruments,and commodities is to use call/put status, delta and the days to expiration to represent the characteristics of an option.

In the coming articles I will discuss theta which is time decay, gamma which is the rate of change of delta based on the rate of change of the underlying position, and vega which represents volatility or the part of the option price which is based purely on supply and demand.