It can be a little disconcerting being up at 5 in the morning, pitch-black sky outside, and know that I need to write something……….anything………about a market which is doing absolutely zilch. And yet that’s the task ahead.

As I expected, the “Super Thursday” this week, with – according to ZeroHedge – seven gigantic, market-moving events, turned out to be a big, fat nothingburger. As I am typing this, the ES is up a tenth of a percent, the NQ is up, but even less than that. and I’m not so sure traders won’t be gathered around their screens on Saturday staring at quotes, since it won’t seem much different than any other day this week.

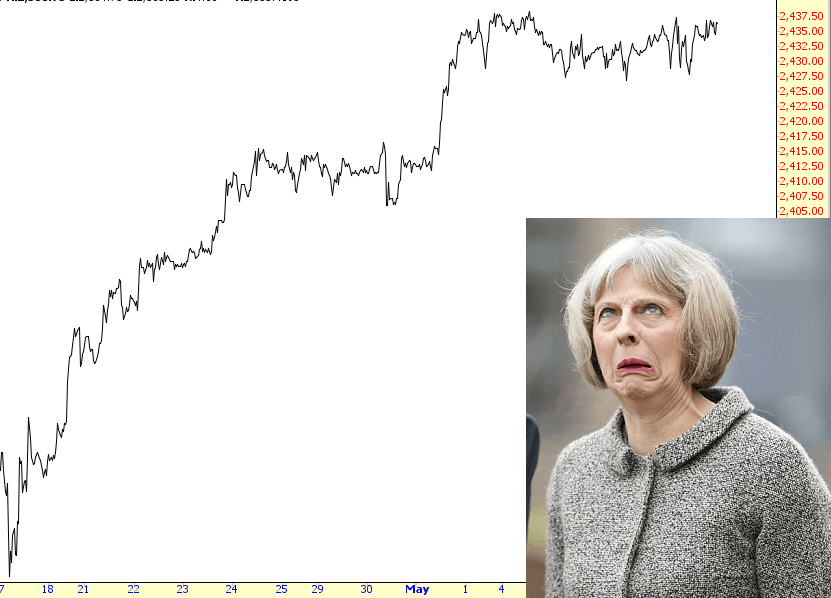

If you look at the ES over the past month, it is either steadily ascending or, from time to time, makes a bit of a jolt higher. Zzzzzzzzzz………….

For myself, I remain steadfastly short, with a concentration in energy and retail sectors, and, as I’ve mentioned a couple of times, I’m long a slug of QQQ July $143 puts. My ETF-only portfolio consists of a mere two positions – SDS (the ultrashort on the S&P) and ERY (the triple-short energy). In spite of the market puking to highs every single day (with the notably exception of Saturday and Sunday, which are strictly bear-territory), my ETF portfolio is nearly a lifetime high.

I’ll also mention that I’ve got a new “best of Slope” post in the wings that I’ll post on Saturday morning and probably leave up for the day. I think you’ll like it quite a bit.