I hope everyone had a great holiday, and so far this week the tape has been pretty tedious. However I bring glad tidings, as the pattern setup here says that is likely to be changing in the near future. I’ve included my full premarket video today just to show that even with interesting things likely to start happening on equity indices, there are still more interesting things happening on many other markets this week.

The equity indices section is at the start of the video, followed by quick looks at DX, CL, NG, HG, GC, ZB, KC, SB, CC, ZW, EURUSD, GBPUSD, JPYUSD, CADUSD, AUDUSD and NZDUSD. Enjoy! Intraday Video – Update on ES, NQ and TF:

On the ES chart the boring chop of the last few days has resolved into a clear triangle. This leans bullish and on a break up over triangle resistance at 2693/4 ES should then at minimum retest the all time high. ES Mar 60min chart:

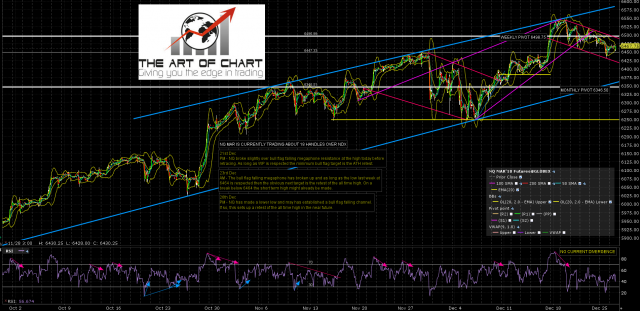

On the NQ chart the less boring decline over the last few days has resolved into a clear bull flag channel, and on a break and conversion of weekly pivot just under 6500 NQ should then at minimum retest the all time high. NQ Mar 60min chart:

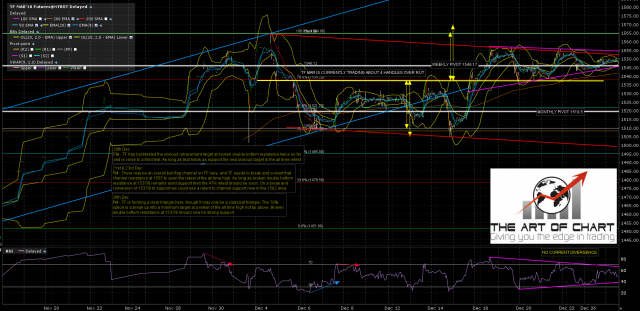

On the TF chart the boring chop of the last few days has resolved into a clear triangle. This leans bullish and on a break up over triangle resistance at 1555 TF should then at minimum retest the all time high. There is still an open double bottom target at the same retest. TF Mar 60min chart:

These three retests may reject into three small double tops so I’ll be watching them carefully.