As I make my way to Copenhagen, I wanted to offer up a post with enough charts to allay my blogger’s guilty for a good long while, because Wednesday is going to be largely “shot” for me. I’ve got a ton of short positions, but I decided to hone in on my favorite sector now, which is retail. Here are y sixteen live short positions, courtesy of SlopeCharts:

Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

The Slope of Music

Well, my friends, I’m heading off on an international journey. I will be, Dick Cheney style, in an “undisclosed location”, but generally speaking in and around Austria through Monday. Slope lives on, of course, and I’ll continue to tend the site during my travels, although during radically different hours. I suspect over 90% of you wouldn’t have noticed any difference, since I try so hard to keep things flowing on the site, but I just thought I’d mention it, particularly since some of you have an acutely good feel for the pulse of this place. Good luck to us all!

Regarding President Oprah

A Slope classic:

Smelly FRT

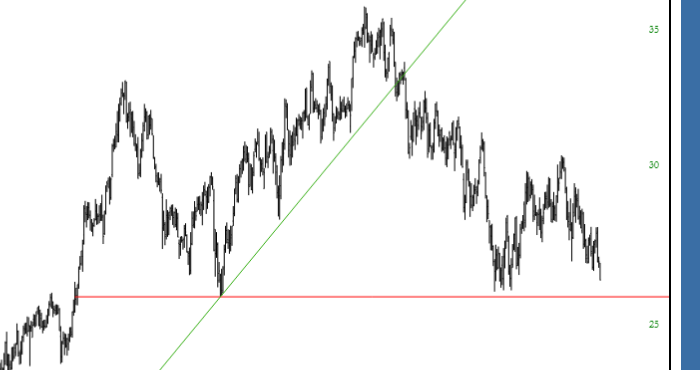

In spite of this stupid market soaring to lifetime highs every day, I’m doing all right. I’m up 1% now in my all-short portfolio, and one of my winners is Arcadia Realty (symbol AKR):

A Polite Cough

I’ve been ill or recovering much of the new year so far, as has Stan, and much of the western world as far as I can tell, and I’ve managed to keep up with my main work at theartofchart.net but this is an unusually late first post for the year.

That’s not the polite cough that I’m referring to in the title though. SPX and ES have been on both daily RSI 14 and RSI 5 sell signals since the end of 2017 and a polite cough to the upside would at this stage be all that is required to kill the underlying RSI divergences and fail those signals. We may well see that happen today, though there is at least some reason to think that bears might be able to pull off a last minute decline to save them from that failure today.

I look at that in my premarket video this morning, though with the observation that it’s not a trade I’m taking. I’ve included the whole video today so if you’re interested you can see which other trades I do think are interesting, notably CL and KC today, and managing existing trades in ZB and NG. The part on equity indices is covered in the first five minutes. Premarket Video – Update on ES, NQ and TF: (more…)