A couple of announcements today. We did our monthly public Chart Chat on Sunday and if you missed that you can see the recording on our May Free Webinars page. We are doing a free webinar on Thursday after the close looking at our new directional Paragon Options service trading options on futures, and if you’d like to attend you can register for that on the same page. We finished our first Academy Trader Boot Camp course last Friday and the feedback was very positive. If you’d like to see some of that then scroll down to the bottom of our Testimonials page to find those. We’re planning to do these regularly and the next one starts next week so if you’d like a very reasonably priced and high quality four week course on TA, risk management and trading methods, you can register for that here.

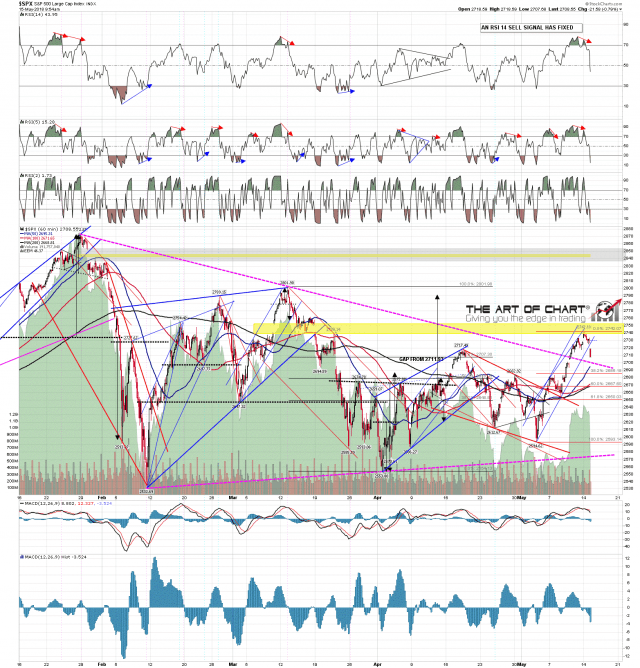

On SPX the retracement we have been expecting is in progress and, since I recorded the premarket video below, is now testing the first main target area at the ES weekly pivot at 2704/5. There is decent support here, but I was noting on the video that there are some decent looking hourly RSI 14 sell signals that have fixed on SPX, NDX and RUT that are suggesting a break lower, and as of now, none of those sell signals are close to even the possible near miss (RSI) targets. Partial Premarket Video from theartofchart.net – Update on ES, NQ and TF:

If SPX does go lower here, then the obvious next big target would be the daily middle band, currently in the 2676 area, and a possible match tomorrow for the 38.2% fib retracement of the rising wedge up from the early May low at 2685. That would be an ideal low for this move.

Wherever this low bottoms out, we are thinking that the next move up from this low may spike up to retest the SPX all time high over the next three to four weeks, so we are expecting this to be an important low to find for a very nice long trade. SPX 60min chart: