Slope has a very successful affiliate relationship with the folks behind TradeMachine Pro, and recently their CEO suggested a webinar specifically for Slopers. I’ve published one of their recent trade ideas below, but most importantly, please email me if you’d like to be notified of the online webinar they are going to put together (you don’t have to type any message; just click ‘Send’ since I just need your email address). Anyway, here’s their post:

Recently we wrote on The Exact Bearish Trigger in Nvidia. Today we look at the other side for Amazon.

There is a technical set up such that it triggers bullish times to trade Amazon, even in a bear market, that has shown triple digit returns during the bear market of late 2018, the Great Recession, and the bull market in between those times.

There is such a technical condition, and we will review it, right now.

The Short-term Bullish Option Trade in Amazon

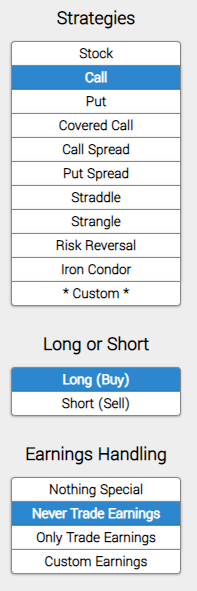

We will examine the outcome of going long an out-of-the-money (40 delta) call, in options that are the closest to 30-days from expiration. But we follow three rules:

Never Trade Earnings

Let’s not worry about stock direction or earnings, let’s try to find a back-test that benefits from volatility. Here it is, first, we enter the long call.

* Use a technical trigger to start the trade, if and only if these specific items are met. As of this writing, 1-4-2019, the conditions are not yet satisfied.

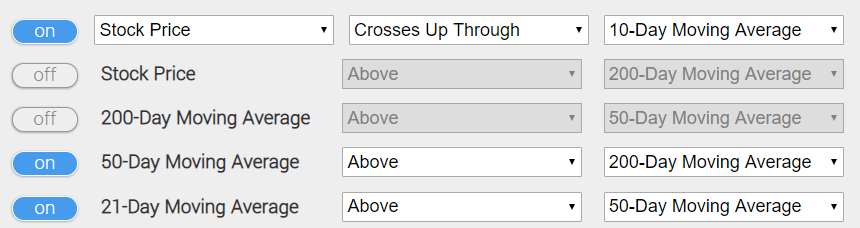

Wait until the day that the stock price crosses above the 10-day moving average and the 50-day moving average (DMA) is above the 200-DMA and the 21-DMA is above the 50-DMA. Those last two requirements are sometimes called “stacked moving averages.” Here is a nice simple image of the technical requirement:

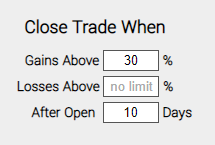

Finally, we set a very specific type of limit:

* Use a 30% limit

* Close the trade after 20 days, if the limit has not been hit.

At the end of each day, the back-tester checks to see if the long call is up 30%. If it is, it closes the position. If after 20-days the limit has not been hit, the call is closed so not to suffer total time decay.

RESULTS

Here are the results over the last three-years in Amazon:

| AMZN: Long 40 Delta call | |

| % Wins: | 69.6% |

| Wins: 16 | Losses: 7 |

| % Return: | 612% |

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy had an overall return of 612%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 22.1%.

Checking the Moving Average

You can check moving averages for AMZN on the Pivot Points tab on www.CMLviz.com.

Back-testing More Time Periods in Amazon

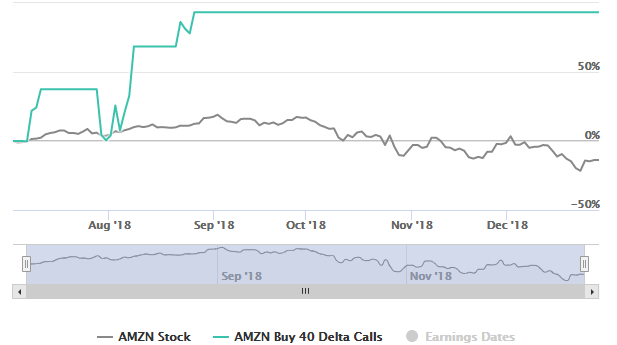

Now we can look at two bear markets. First, We check the six-months from 2018-07-01 through 2019-12-31. AMZN stock was down 12.5% during that time period.

| AMZN: Long 40 Delta call | |

| % Wins: | 75% |

| Wins: 3 | Losses: 1 |

| % Return: | 93.3% |

In a period where AMZN stock saw a negative 12.5% return, this bullish trigger saw a 93.3% positive return. Here is a chart of the option strategy (in blue) and the stock price (in gray):

Notice how the trigger is ‘silent’ for a period of time, and active when appropriate. That’s exactly the goal.

And finally we can look at the period from 2007-09-30 through 2009-04-01, which was the worst part of the Great Recession and AMZN stock was down 21.4%.

| AMZN: Long 40 Delta call | |

| % Wins: | 67% |

| Wins: 2 | Losses: 1 |

| % Return: | 81.1% |

Tap Here to See the Back-test

In a period where AMZN stock was down 21.4%, this bullish trigger saw a 81.1% positive return.

Trade Machine gives you the capacity to trade beyond luck, with stock or options, with and without technical triggers. Use science and empirical results. Click here to see it for yourself