SPX went up through both of the annual pivot and 50dma resistance levels and has come close to a test of declining resistance from the all time highs, now in the 2690 area. I was talking earlier this month about the vital importance of monthly closing resistance at the monthly middle band, now at 2664. In the event that there is a clear close in January back above it, then the odds would strongly favor a retest of the all time high before there was anything more than a marginal lower low on SPX. The last time there was a significant monthly closing break back over the middle band in a possible bear market without such an ATH retest coming next was over 60 years ago.

(more…)Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

China Rejoinder (by Binkius Hippo)

Hi, Tim: You recently posted an email, “A Response to China Deal” and the article is so misleading and paints such a false narrative that I have to wonder if it’s a Communist Party cyber-ops fake news attempt to obfuscate the truth. If you could post my rebuttal, I would appreciate it.

Let me start with this introductory pre-amble. The single largest problem with business in China is not the negotiations, not the contracts, nor the law. Very simply, what matters in the end is if the terms of the agreement are Verifiable and Enforceable. It doesn’t matter what you agree to, what you sign, or what the law is in China. What matters is if the deal you have made is Verifiable and Enforceable. If you can’t get this, all you got are seashells.

(more…)What’s the Magic?

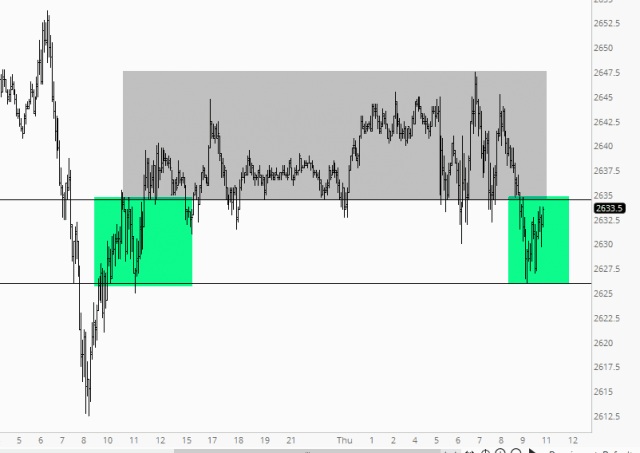

Good God, this is getting boring. Between lines of cocaine, Kudlow is slamming the BUY button on his desk any time the ES gets near 2626. Indeed, that was the PRECISE low in today’s trading, then, surprise surprise, we shoot higher. We seem to be trapped between 2626 and the Fibonacci retracement of 2635. I was hoping earnings season would get things rocking, but we still seem to be totally without direction.

Hilarious

Crazy Eyes EXPOSED

Get out your Coke and popcorn. This is going to be a spectacular fraud case.