Slope of Hope Blog Posts

Slope initially began as a blog, so this is where most of the website’s content resides. Here we have tens of thousands of posts dating back over a decade. These are listed in reverse chronological order. Click on any category icon below to see posts tagged with that particular subject, or click on a word in the category cloud on the right side of the screen for more specific choices.

Cannabis & Health Stocks to Watch

Health and cannabis stocks top our list of charts to watch today.Amarin Corporation plc (AMRN) popped $1.12 to $15.03 Wednesday on 13.8 million shares, more than 1 1/2 times its average volume. The move followed a J.P. Morgan Healthcare conference presentation by the company, which markets a purified fish-oil pill. The stock took out the declining tops line and reached resistance at $15.80 before backing off. Next targets are $17 and then $19.

Aphria Inc. (APHA) gained 46 cents to $6.79 on 7.2 million shares Wednesday on no news. The cannabis stock popped across resistance, getting to as high as $6.90, important resistance from its gap down in early December. A move to fill that gap would get the stock to $7.75-$8.00, our next target.

(more…)Laissez Les Bon Temps Rouler

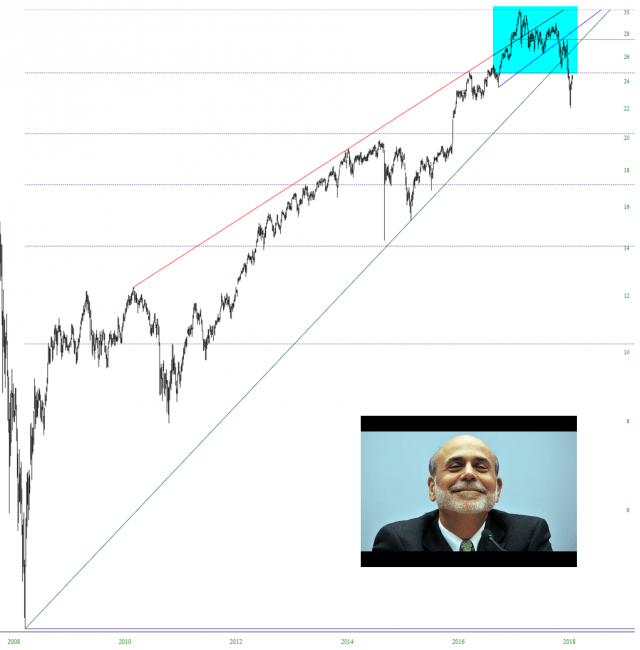

This is yet another “wow!” moment for me. I present to you below the financials ETF, symbol XLF, with a Fibonacci retracement laid on top. I was quite excited to see the result, which is similar to what we’ve seen with the Russell 2000. The retracement is spot-on!

Dirty Sanchez

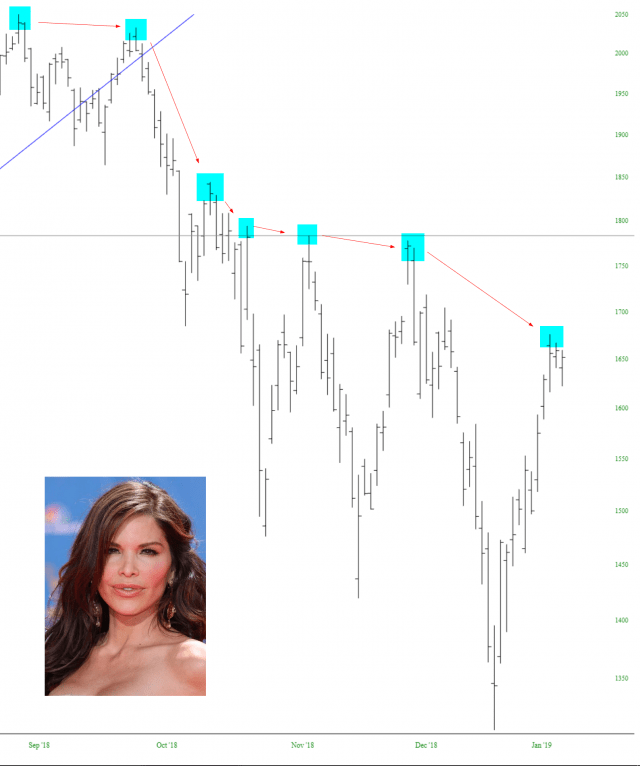

OK, OK, the subject title is dreadful, but it just came to me. The devil made me do it. Anyway, I suspect “Amazon World’s First Trillion Dollar Company” makes for a LOT better of a headline than “Bezos Dumps Family for Mistress“, but times have changed. The chart tells you all you need:

Remarkable Russell

Ever since Jerome Powell demonstrated he has absolutely no backbone, and is far, far more concerned about having his feelings hurt by a mean tweet than he is about the long-term stability of the United States, the equity markets have been on an explosive ascent.

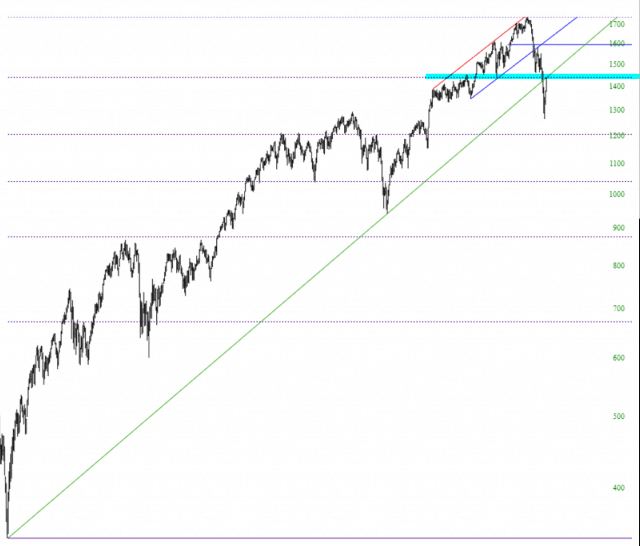

I would like to quietly point out something that 99.9999% of people are unaware of, which is the Fibonacci retracement spanning the entire decade-long bull market of the Russell 2000: