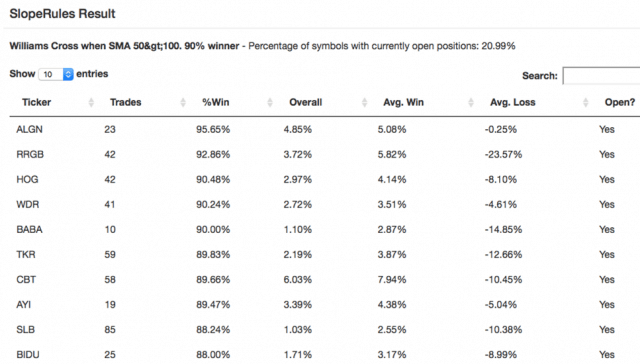

Here are some trade options ideas for the recent SlopeRules Results I posted this weekend.

The Rule is very simple:

When the SMA 50 is greater than 100

and When the Williams %R crosses below -50, enter.

When the Williams %R crosses above -50, exit.

For SPY, there was an 89.7% win rate, with avg rate of 0.33% per trade. Currently 21% of SPY stocks fit these conditions.

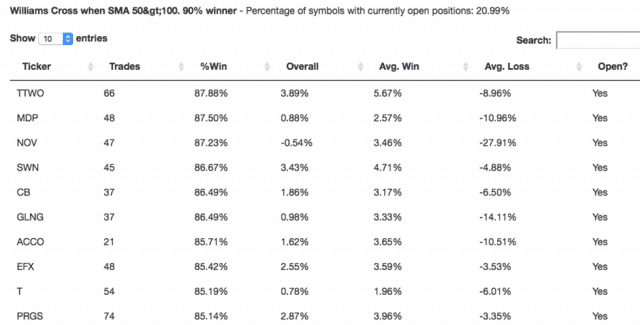

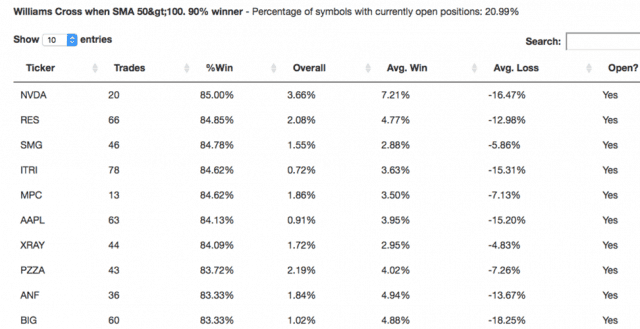

Here are the first 30 actionable trades based on this, ranked on highest percent win rate (already shared on Social Trade).

These include highly liquid underlyings.

Let’s go over 8 option trades that may be promising in light of the above.

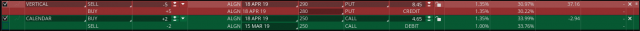

First, let’s look at the highest winner, ALGN [Align Technology]. There is relatively low volatility here now. First, I put on a calendar trade (15 MAR/18 APR) $250 call strike, and also put on a vertical in 18 APR selling the 290-280 put credit spread (bullish). If the stock goes down a little, stays the same or goes up, one would make money. BPR is about $1750.

Here is the P&L graph

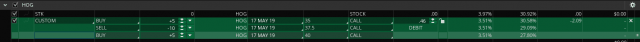

Next look at HOG [Harley Davidson]. Here there is higher volatility so we open a butterfly: in 17 MAY 2018 we buy a CALL with buying 5 contracts of the $35 strike call, selling 10 contracts of the 37.5 call and buying of the $40 strike call. You risk very little (several hundred dollars) to make a $500-$1000 if the stock stays within a fairly narrow range, and on avg it moves 3% or about $1-2 increase.

And the P&L

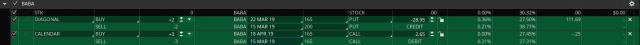

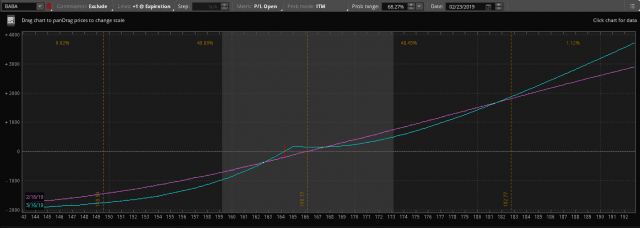

For the third trade, let’s look at the always fashionable BABA [Ali-Baba]. Here we have a low volatility situation, so we’ll put on a calendar AND a diagonal. Start with the $165 strike call calendar selling 3 of the 15 MAR calls and buying 3 of the 18 APR calls. Then add a diagonal, selling 2 MAR 15 $200 puts and buying 2 of the MAR 22 $165 puts.

This way, you benefit again, from rising volatility, time, and a slight decrease, no change and increase in price of the stock, giving you a very high probability trade that had a high probability to begin with. The trade:

And the P&L:

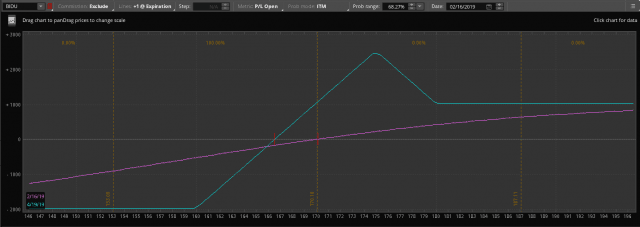

Next we have BIDU, which has high implied volatility. Here we can put on a BROKEN WING butterfly, which will benefit from decreased volatility, time and can profit in all scenarios except for a large decrease in the stock. For 18 APR, Buy 3 of the 180 Put, sell 6 of the 175 put, and buy 3 of the 160 put.

The P&L:

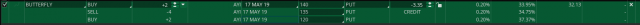

Next we have AYI [Acuity Brands]. Again, we have a higher volatility situation, so we put on a broken wing butterfly. For 17 MAY, buy 2 of the 140 puts, sell 4 of the 135 puts, and buy 2 of the 120 puts.

The P&L:

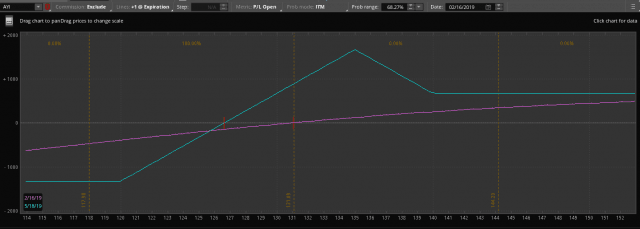

Next let’s look at SLB (Schlumberger). Again, volatility is somewhat high so we put on a broken wing butterfly. For 18 APR, buy 5 of the $50 strike puts, sell 10 of the $47.5 puts and buy 5 of the $40 puts.

Here is the P&L:

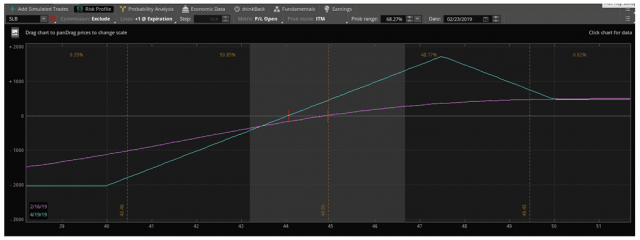

Next let’s look at EFX (Equifax). This too has relatively high volatility, so again we put on a broken wing butterfly. For 29 MAR, buy 3 of the $120 puts, sell 6 of the 114 puts and buy 3 of the $100 puts.

The P&L chart:

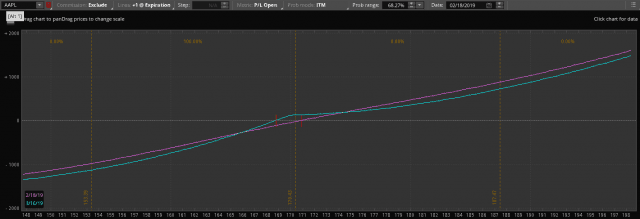

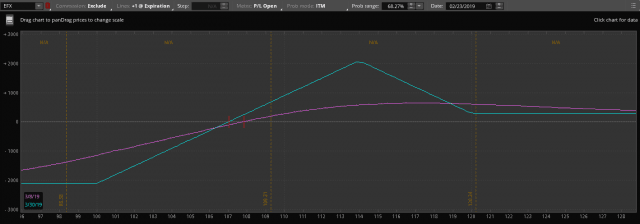

Last let’s look at AAPL (Apple). Here volatility is straight down the middle. So we’ll put on a ratio spread, selling one call, and buying two. We will sell 1 of the 15 MAR 170 calls, and buy 2 of the 21 JUN 170 calls.

Here is the P&L: