Rev can talk about something other than gold? Yes, yes he can… When’s the last time you looked at lumber prices and their implications on interest rates? There’s a correlation? Yes, there is.

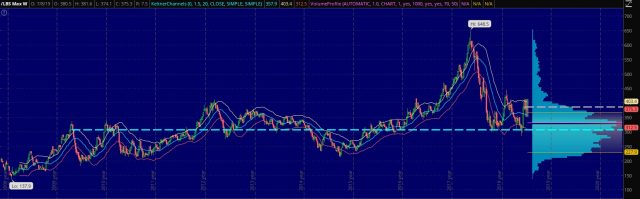

First, let’s take a long term look at lumber prices. Below is a ten year chart of lumber prices. From their early 2009 bottom at 137.9, lumber prices rose steadily, but not dramatically for the next few years. However, after their 2015 bottom, lumber would start a three year rise that would culminate in their 2018 blowoff top at 648.5.

The ensuing waterfall decline in the second half of 2018 saw lumber fall back into nice demand around the 300 level. With the retest of this area in May of this year, it is possible we have seen a low put in for lumber.

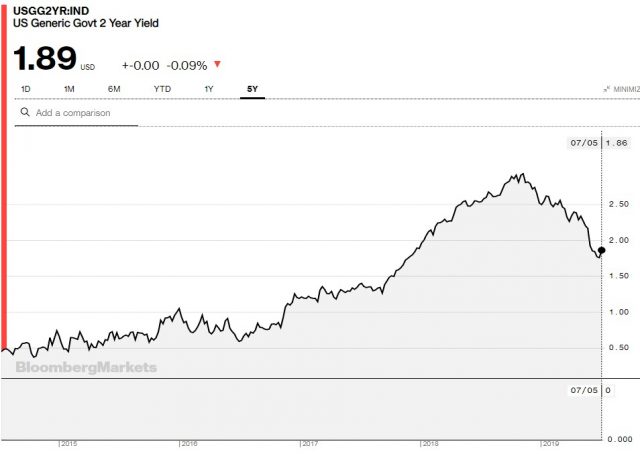

Great Rev, but how can I make money with that knowledge? I’m glad you asked. One of the pieces of analysis that I track from Tom McClellan is his study of how lumber prices set forward 12 months are an excellent indicator for how 2 year Treasury yields will react, and thereby Fed policy. He discusses the relationship in the Dec 2016 interview “Lumber Prices are a great economic indicator“.

Now, let’s see how that correlation lines up with 2 year yields. Looking at the chart below you can see the quick rise in rates between mid-2017 and mid-2018, followed by the fall in rates we’ve been seeing for the past year. Have rates bottomed? Probably not. But, I’d assume they don’t have much farther to fall. If we look back at what lumber has done over the past year, it had farther to fall, but has largely been range bound as it worked to retest it’s bottom.

With all of that said, over the course of the next year I expect interest rates to remain relatively range bound, with a slight bias to the downside. I don’t expect economic armageddon. The Fed however, remains tight at the moment relative to the 2 year. I expect they are on the verge of beginning an easing cycle that will ultimately see them cut rates by 75-100 bps over the course of the next 6-12 months. They aren’t going to zero….yet.