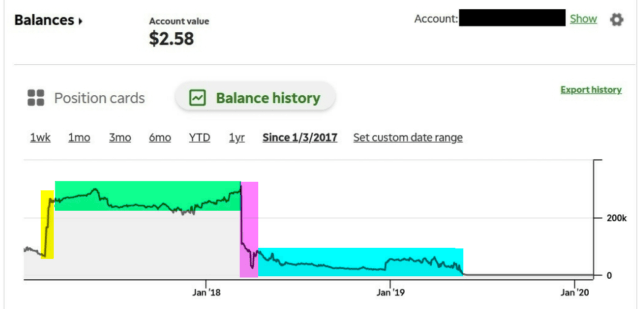

I’d like to use, as a talking point, an equity graph shared this morning on public media with one trader who has had his account blown to smithereens:

As the accountholder explains it (and I’ve tinted the chart to make the narrative easier to follow):

- He started off with 50k, built it up 80k, and then had a big surge (tinted in yellow) with a very lucky options play, pushing it into several hundred thousand dollars;

- He then steadily traded the account throughout 2017 (green tint);

- Only to see it get nearly destroyed within moments when the VIXtermination wipeout happened (magenta tint);

- He tried to piece things together after that, but the last twenty trades were all losers (cyan tint), thus bringing an account worth hundreds of thousands of dollars just a couple of years ago down to a level that could not purchase a latte at Starbucks. But maybe a drip coffee.

(Here are his exact words, although I said the same thing above: ” Well… I started with 50k, slowly built to 80k, got lucky 10xing an options play worth 20k that catapulted me to 250k range. Built that up to 320k with a retarded strategy and then VIX day happened and wiped me down to something like 40k. I completely lost my mind, as you can see a flailing attempt was made immediately after that catastrophe and I got a little back on the bounce. After that I was trading regularly but was flat most of 2019. I then had like 20 straight losers last year and $2.58 is all that remains. I kept hope until the last trade expired worthless.”)

As he went on to describe it, the worst part was that he was cheerfully handed a nearly $170,000 tax bill by the IRS for his 2017 gains. Those are the same gains that didn’t exist anymore in his account, thanks largely to the VIX event. So his net worth actually change substantially more than his account size, due to the IRS debt…………..since the IRS doesn’t much care if you lose the money. The fact you made it within a particular calendar year is all that matters.

There’s seriously no telling how much naivete has been sown, cultivated, and nourished in the “markets” over the past eleven years. There is going to be an entire population of so-called investors that have no knowledge of risk, discretion, or a science fiction concept called a “bear market”.

I swear to God above, if organic markets are ever allowed to return to planet Earth, every trader under the age of 50 is going to be ridiculously easy to fleece. It’s pathetic. Just pathetic.