I’ve been pleasantly surprised that some of my most popular posts are excerpts from the only history book I ever wrote, Panic, Prosperity, and Progress. Over this holiday weekend, I’ll be sharing, over the course of four days, the chapter dedicated to the inflation and bursting of the Japanese bubble of the 1980s. I think you’ll find some interesting parallels with China. You can read the first part here, part two is here, and part three is here.

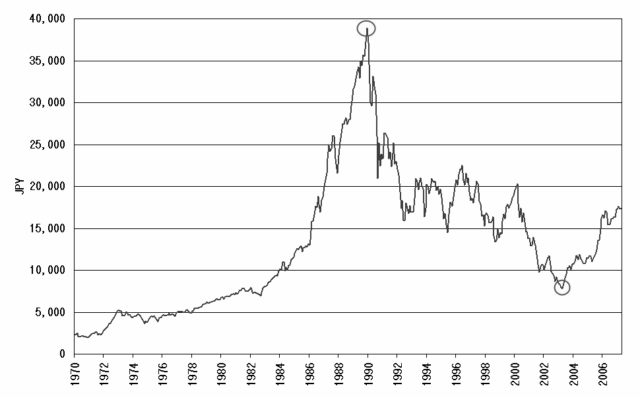

Equities in Japan peaked on the last trading day of the year in 1989. The Nikkei ended the year with a crescendo, and the majority of market observers agreed that the market was not overvalued. There was no reason they should not have expected 1990 to bring in more profits, since the trend has been so strong, so persistent, and so long-lived.

The Bank of Japan, however, had been eyeing the exploding stock and property values with increasing concern, and in January 1990, they took action by raising interest rates. The effect on stocks was swift, and 1990, instead of padding the already-incredible profits of stock owners, the Nikkei went into a free-fall, losing nearly half its value by the end of the year.

A stock market drop that severe is bad news in any market, but in Japan, due to the highly-leveraged and deeply-intertwined corporations, banks, and cross-holdings of stock, the effect was far worse. Just as the creative financial engineering had supercharged the gains of all asset classes during the rise, the exact opposite effect took hold now that the principal fuel for asset appreciation – – the Nikkei 225 – – was shrinking.

Property values had a delayed reaction to the sudden increase in interest rates. For most of 1990, the extraordinary property values stayed aloft. A very similar phenomenon took place a decade later in the Silicon Valley, since the extremely-high prices for homes and, even moreso, office space, did not follow the NASDAQ downward until half a year after the bubble first popped.

The pain to property owners would not be long in coming, however, and given the 100-fold increase in values that had been enjoyed over the years, it is not surprising that such a large portion of asset values were at-risk of disappearing. By August of 1992, the Nikkei was down to 14,309, a loss of about $2 trillion in Japanese equity prices (with more to follow), and, at the same time, real estate assets had dropped by $8 trillion from their peak.

The Bank of Japan did not reverse its decision, in spite of the clearly negative effect it was having on asset values. On the contrary, it kept increasing rates, and it did not resume easing until July 1991, once the horrendous effects were already in full swing.

Damaging Demographics

As the core assets of equities and property values plunged in Japan, concerns about worldwide Japanese domination vanished, and speculation turned to what challenges, as opposed to opportunities, the country might be facing.

Because of Japan’s low birthrate, initially sewn into the cultural fabric in the days after the war to stave off national hunger, the simple demographic fact was that fewer and fewer wage earners would be available to support a larger and larger retired population. The median age in Japan was relatively high, and moving higher, and the trends looked very negative for supporting the national welfare system. Similar projections were calculated for the U.S., but the Japanese situation was more dire.

On top of this, the decades-old guarantee of lifetime employment started to fray at the edges, as companies found it to be fiscally impossible to maintain full employment in an environment of falling demand and shrinking prices. The unemployment rate in Japan had been essentially zero for many years, but a million manufacturing jobs were eliminated between 1992 and 1996, pushing the unemployment rate from 2.1% to double that amount in the same timespan. By 2001, unemployment would stand at 5.6%, a remarkably high rate for a country long-accustomed to assured gainful employment.

There was a subtle cultural reason for the longevity of Japan’s economic problems as well: a deep-set desire to avoid losing face. The huge corporations were, in a sense, anthropomorphized expressions of Japanese culture, and a refusal to admit serious mistakes, declare extraordinarily severe losses, and begin the lengthy healing process was avoided (and, as of this writing, decades later, is still being avoided).

No less a Figure than Alan Greenspan wrote in 2007 that “[t]he Japanese purposely accepted hugely expensive economic stagnation to avoid massive loss of face for many companies and individuals.” Banks, for example, would move bad loans on the books to subsidiaries, thus erasing the liabilities on paper but failing to confront the reality of the situation, which is that the loans would almost certainly never be repaid. Just as accounting gimmicks were used to pad profits on the ascent of assets, so too were different tricks used to tuck away “bad” assets with the hope that they would somehow be remedied at an undetermined point in the future.

At the Tokyo office of Germany’s Deutche Bank, chief economist Ken Courtis succinctly summed up the financial configuration of Japanese finances as having “Himalayan balance sheets and Saharan returns.” In other words, the meager profits still be thrown off from enterprise were dwarfed by the monstrous debts that had been accrued to fund the stratospheric climb in the first place.

The Lost Decades

Predictions from the late 1980s about Japanese becoming the world’s largest economy were swiftly considered out of the question. Instead, in the twenty years from 1990 to 2010, the GDP of the country remained unchanged at about $5.7 trillion. During the same time, the United States (which certainly was not spared its own share of financial and political problems), saw its economy leap from about $7 trillion to nearly $15 trillion. By 2010, the Asian country occupying the second spot on the economic leader board was not Japan, but China.

Although the bulk of the Nikkei’s collapse was in the first several years of its bear market, the losses continued over the years, and by October 2008, the Nikkei printed a value of less than 7,000, an 82% drop from its approximate value of 39,000 almost two decades earlier. Just as the U.S. stock market took almost thirty years to beat its valuations from 1929, after its own Great Depression, Japan likewise would almost certainly not see 1989-level valuations on the Nikkei until well into the future. Indeed, it still hasn’t.

Even though the accounting departments of Japanese corporations were avoiding putting unseemly fiscal realities on paper, some companies and individuals had no choice but to sell, at great losses, assets they had acquired only a few years earlier.

Hawaii’s Westin Maui resort, purchased for $290 million, was sold in 2000 for less than half that price. Another Hawaiian trophy property, the Grand Wailea, produced a similar 50% loss when it was sold for $300 million in 2000, sharply in contrast with the $600 million paid during the peak of Japan’s prosperity a decade earlier. On the continental United States, the famed Pebble Beach golf course was likewise liquidated at a fraction of its purchase price.

Corporate acquisitions by Japanese conglomerates fared no better. When the Rockefeller Center, one of New York’s most famous and iconic properties, was bought by Mitsubishi, it was just another piece of evidence that Japan was taking over America. When Mitsubishi unloaded the property in 1996, they took a $2 billion loss. Sony suffered even worse from its ill-fated purchase of Columbia Pictures, as $2.7 billion was written off the corporate books.

No matter what accounting games may have been going on in Japan, the government’s financial situation was no more straightforward and far more alarming. Whereas the government used to enjoy surpluses, it now found itself having to borrow increasingly large amounts of money through bond issuance in order to support the nation’s welfare system as well as the multitudinous projects created to shore up the country’s employment.

Japan’s percentage of debt compared to its gross domestic product was about 60% in 1990; fifteen years later, it was nearly 200%, and as of this writing, the figure is 230% and growing, requiring the use of the term “quadrillion” to express the debt in terms of Yen.

One might think that with the trillions of dollars of currency generated by the Japanese government to address its economic woes, inflation would be rampant. On the contrary, the astronomically-large debts in the country act as a metaphorical black hole for all the new currency, and deflation has persisted in Japan steadily for over two decades. Those many years of plunging asset values, weak growth, and deflationary pressures led to the coining of the term “lost decades”, used by Japanese to describe the era.

A Perpetual State of Recovery

Central bankers are persistently fearful of two negative opposite possibilities: inflation and deflation. An inflationary environment yields shrinking buying power, the wage/price spiral, and public frustration at the rising cost of goods and services. A hike in interest rates, such as the suffocating increases by the Fed in the early 1980s, usually curtails these problems.

Deflation, however, is far more nettlesome. While the notion of goods and services getting perpetually cheaper might sound appealing to the everyday public, deflation is far more a curse than a blessing. Such an environment creates a harmful desire to hoard cash, since it is usually the only thing that gains value over time. This means that the flow of money in an economy is sharply curtailed, harming employment, wages, and growth. After all, why pay $2000 for a new television when it is likely the same product will cost $1000 in a year?

This kind of deflationary environment is precisely what Japan has experienced not for months, or years, but decades. The public has grown accustomed to a feeling of resignation about job prospects, salaries, and the future. Long-term deflation has a gruesome effect on the public psyche with respect to the economy, and people resort to a combination of fatalism and pessimism.

This is not to say that the Japanese, particularly the government, haven’t made many efforts to turn the situation around, but many of these projects have led to nowhere. One example is the MITI’s “Fifth Generation” computing project, which in the 1980s convinced some industry professionals that Japan would, once and for all, finally own the entire computer industry, from semiconductors to memory to hardware.

The Japanese computer industry poured $450 million into the ill-fated project, which promised to leapfrog the rest of the world by producing breakthrough supercomputing technology and artificial intelligence. Instead, the project produced absolutely nothing, and MITI wound up offering whatever was developed during the project to anyone in the world who wanted it for free. American software and hardware companies could rest easy that Japan would continue to be relegated to making chips and circuit boards, and they would actually lose a lot of that business to Korea and China in any case.

The lifetime employment pledge of Japanese employers was rendered a historical footnote, and increasing numbers of businesses replaced permanent workers with temporary hires that could easily be dismissed and didn’t come with the burden of employee benefits. By 2009, a full third of the Japanese labor force were “temps.”

These everyday citizens had problems of their own left over from the asset bubble. Many of them got caught up in the real estate frenzy and bought residential property on credit. With the bubble fully deflated, a family that paid, for example, $500,000 for a small condominium in 1990 would see its value diminish to about $140,000 a decade later. Residential properties are worth only 10% what they were at the peak of the asset bubble, and families are making payments on mortgages that vastly exceed the value of the property.

A 90% drop in residential real estate is potentially ruinous, but the damage done to commercial real estate values was even more extraordinary. The choicest commercial real estate in Tokyo was fetching $139,000 per square foot in 1990, but a quarter-century later, the same square footage had a value of 1% the peak price. Altogether, stock and property owners in Japan witnessed a mind-boggling $20 trillion drop in value to their holdings between 1990 and 2010.

Japan’s insistence of “saving face” and not making the necessary write-offs and readjustments in the wake of the asset bubble provided nearby Asian countries with superb business opportunities. Even though the 1990s were horrible for Japan, they were fantastic years for most of the rest of the industrialized world, and Korean firms like Samsung level former leaders like Sony far behind in the electronics race.

Meanwhile, the Japanese government would continue to prop up banks and businesses with virtually unlimited amounts of cash, thus creating a nation full of “zombie” companies that, by honest accounting, should have declared bankruptcy years ago. The government also spent $10 trillion on various public works projects between 1991 and 2001 which, while effective at keeping the unemployment rate relatively low, still sank Japan ever-deeper into a national debt for projects that were, in some cases, absolutely unnecessary “make-work”.

The recovery Japan enjoyed in the 1950s, 1960s, and 1970s was one of the most amazing success stories in the history of business. A nearly-ruined nation literally rose from its own ashes and threatened, for a while, to become the indomitable leader of all the economies of the world. However, the country’s hubris at its peak, as well as its reckless lending and overly-cozy relationship between banks, businesses, and the government conspired together to make a bubble whose popping created shock waves that are still keenly felt a quarter-century later.

The last decade of the 20th century and the first decade of the 21st were humbling for Japan as a country and as a people. As the United States struggles with its own fiscal problems and future welfare obligations, Japan has mutated from a country that threatened to take America’s #1 spot on the world stage into something closer to an object lesson in how a country’s finances should not be managed after such a devastating blow. In the halls of U.S. Congress, lawmakers point to Japan as an example of the kind of path the U.S. should refuse to take. Only the future will show how either country untangles itself from their self-made problems.