As we are now in the early stage of a fundamentally-driven gold uptrend, we’re speaking here, not of gold mining companies that actually own and operate mines, but those companies that provide capital to gold mining operations.

Streaming and Royalty companies provide cash up front to develop a mine, and in exchange, once the mine is active they get to buy a certain amount of gold and silver at far below market prices, or get a percentage of the output.

Companies in the royalty/streaming arena are considered lower risk as they have no direct exposure to the operating risk that mining companies generally face.

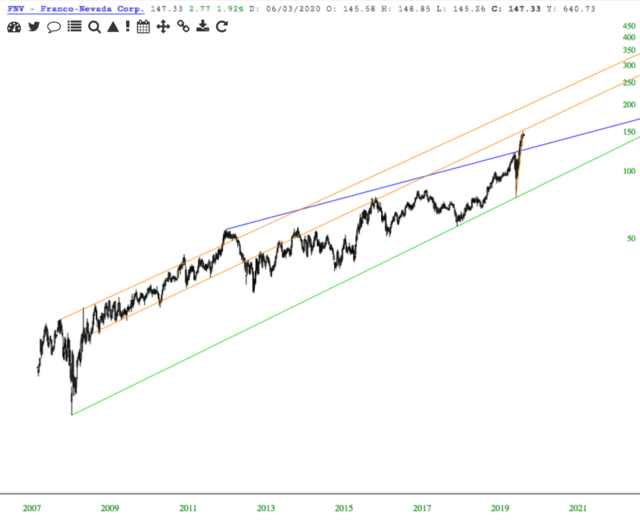

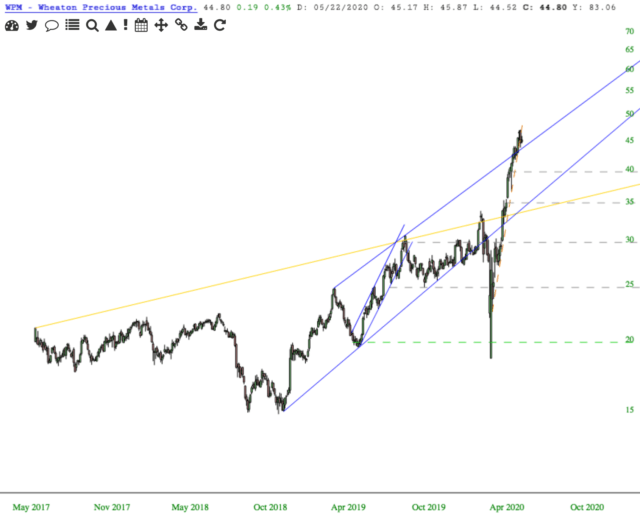

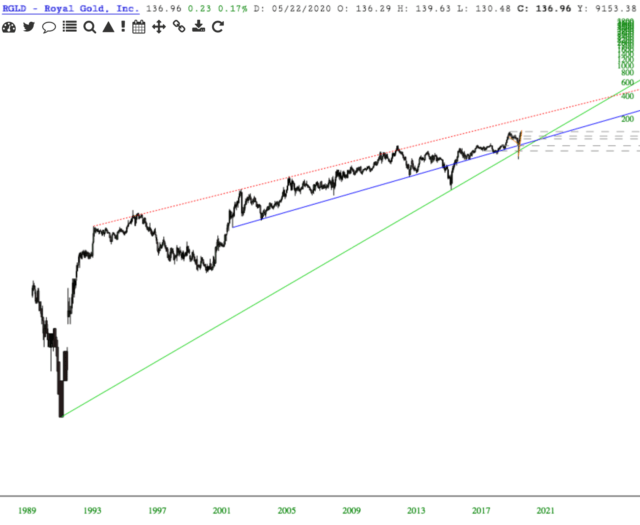

The blue chip streaming/royalty companies are Franco-Nevada [FNV – $27.98B], Wheaton Precious Metals [WPM – $20.08B] and Royal Gold [RGLD – [$8.98B].

It is interesting to note [the obvious] that royalty and streaming companies have few employees. For example, Newmont-Goldcorp [NEM – $50.60B] has 31,600 employees, whereas Franco-Nevada has 42.

While the largest streaming/royalty companies are clear winners, there are smaller companies that deserve consideration. These companies are younger and have a much larger share of potential future streams that are under development. They are riskier, but if their investments work out their potential upside is large.

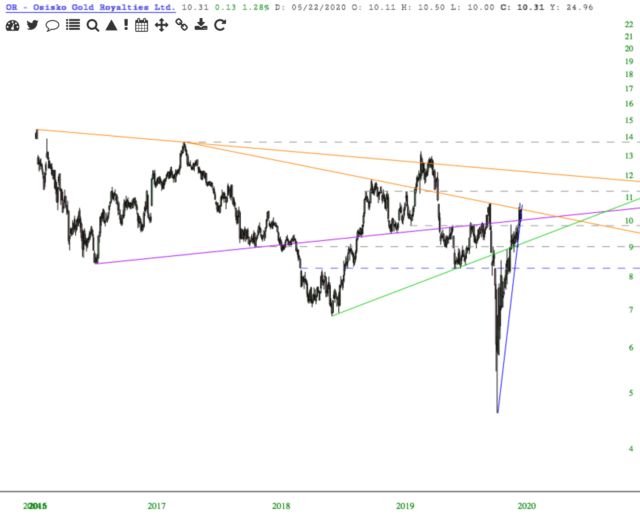

OR [$1.70B] – Osisko Gold Royalties holds a portfolio of approximately 135 royalties, streams and precious metal off-takes in North America, and owns rights to participate in future royalty/stream financings on various projects primarily in Canada.

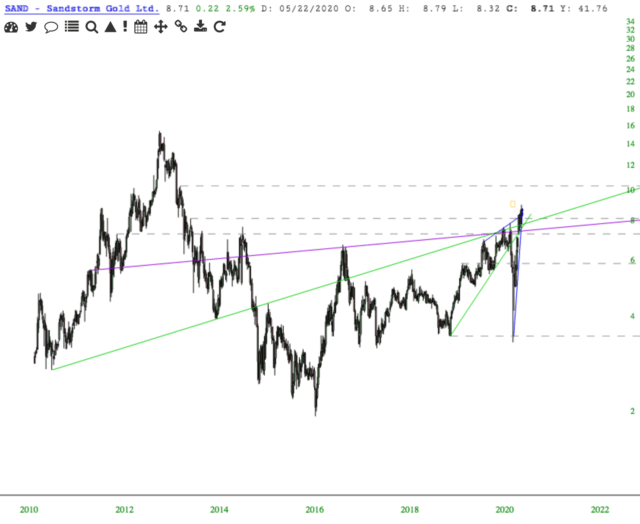

SAND [$1.66B] – Sandstorm Gold has a portfolio of approximately 187 streams and royalties. It has operations in Canada, Mexico, the United States, Mongolia, Burkina Faso, Ecuador, South Africa, Ghana, Botswana, Cote D’Ivoire, Argentina, Brazil, Chile, Peru, Paraguay, Honduras, French Guiana, Turkey, Sweden, and Australia.

MTA [$192.16M] – Metalla Royalty and Streaming owns royalties/streams on deposits operated by some of the biggest and best in the gold and silver space: Agnico Eagle, Newmont-Goldcorp, Pan American Silver, Osisko, and now NGM, a JV between Newmont and Barrick.

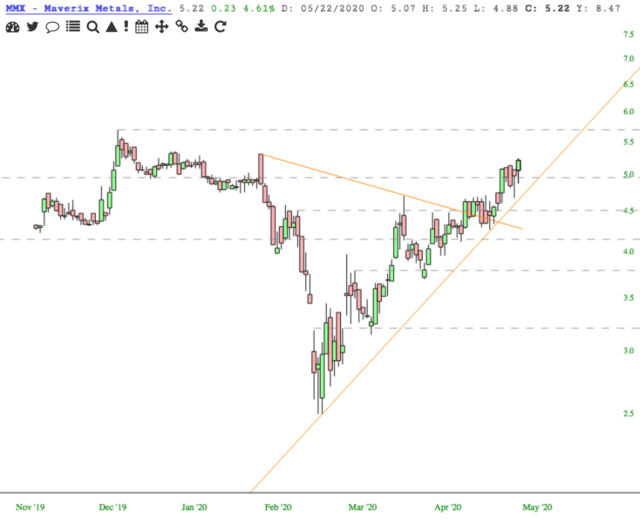

MMX – Maverix Metals holds a portfolio of 46 development and exploration stage royalties in the United States, Canada, Australia and internationally.

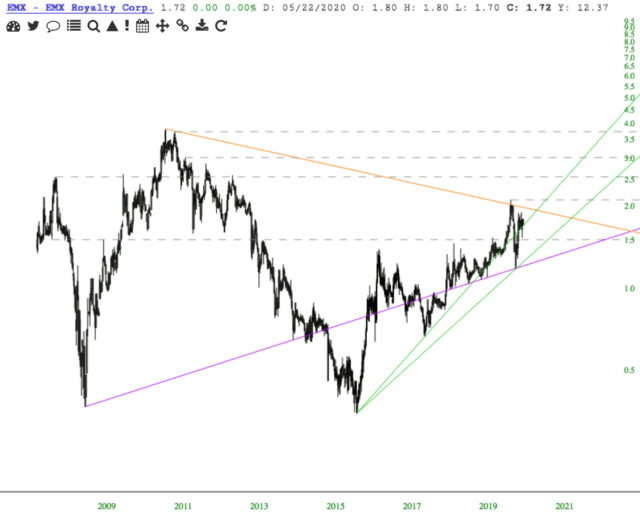

EMX [$143M] – EMX Royalty Corporation explores for gold, silver, copper, molybdenum, lead, zinc, nickel, cobalt, volcanogenic massive sulfide, and iron deposits. Its principal asset is the Leeville royalty property located in Eureka County, Nevada. The company also holds properties in North America, Europe, Turkey, Haiti, and Australia.

In a different vein, here are three Itsy-Bitsy-Risky Micro-Caps [<$50M] – what some may call trash stocks – trading for pennies with narrow floats and low trading volume.

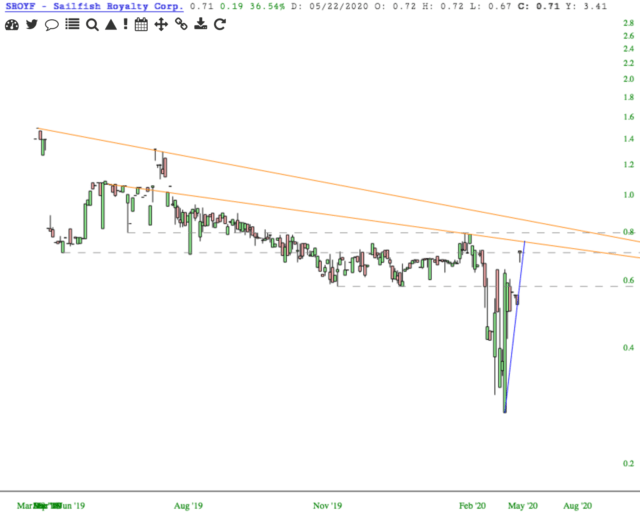

SROYF [$41.30M] – Sailfish Royalty Corp owns the TZ Royalty, which is a 3.5% royalty in the Tocantinzinho gold project in the prolific Tapajos district of northern Brazil; and a gold stream equivalent to a 3% net smelter return (NSR) on the San Albino gold project and a 2% NSR on the rest of the 138 square kilometer area surrounding San Albino in northern Nicaragua.

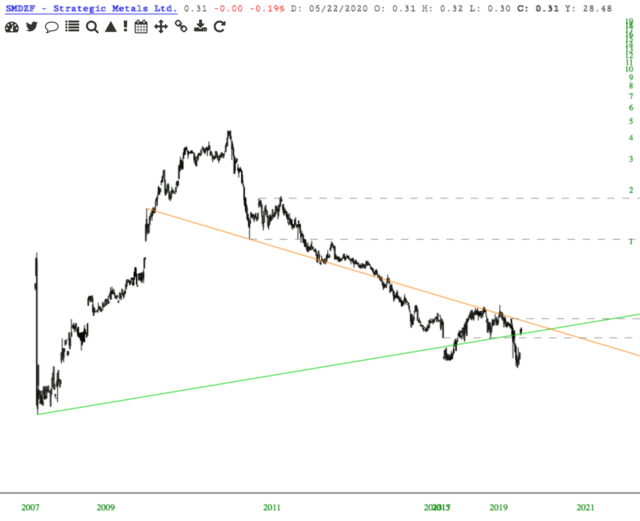

SMDZF [$30.13M] – Strategic Metals explores for gold, silver, lead, zinc, copper, tin, tungsten, vanadium, and lithium metals. It has interests in approximately 120 various exploration properties located in the Yukon Territory, British Columbia, as well as Nunavut and the Northwest Territories, Canada. is a prospect generator and owns, has options on, or is joint venture partner on 130 projects.

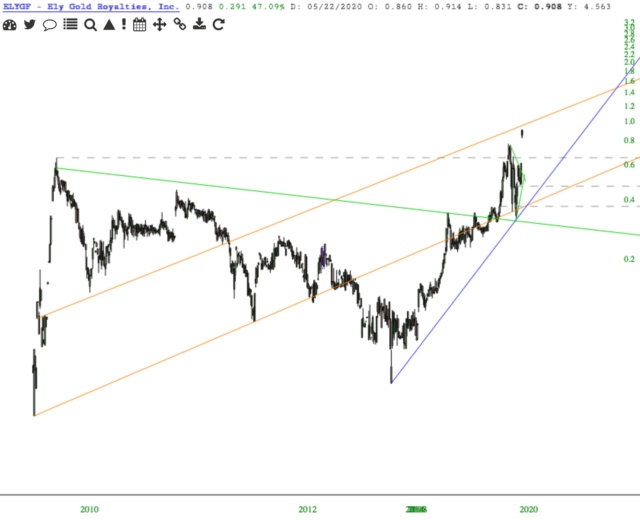

ELYGF – Ely Gold Royalties primarily explores for gold and precious metal deposits and has a portfolio of 42 deeded royalties and 22 optioned properties. It owns interests in approximately 20 properties.