I anticipate June being a month with opportunities for both bulls and bears. More specifically, I am looking for a possible 7-10% correction on $SPY at some point over the next 2-3 weeks.

The June $SPY chart is shown below.

May POC: 282.28

Value High: 296.79

Value Low: 279.46

Not shown on the chart is a Nov /ES POC at 3083. If we see any strength in $SPY to start the month, one interesting setup would be a failed breakout of /ES 3083.

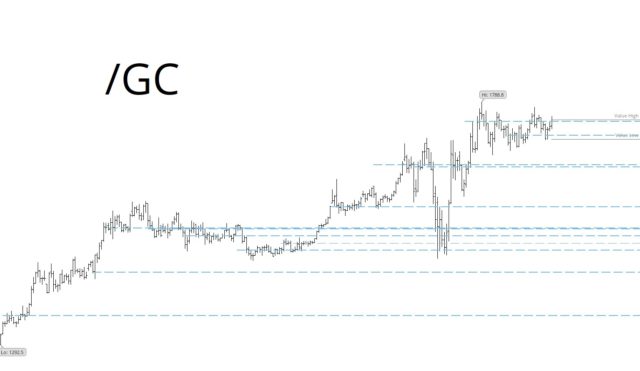

Turning our attention to gold. /GC formed an inverse head and shoulders pattern in March of this year, broke out above that formation in the first half of April, and has since consolidated above the breakout. The metals had a strong day on Friday, and I believe the potential exists for a strong (possibly final for now) upward move this month. For /GC this belief would be invalidated with a move below value low at 1701.90.

June /GC Chart

May POC: 1710.30

Value High: 1746.10

Value Low: 1701.90

Silver had a more explosive move in May, and also looks poised for more upside in June. /SI closed out the month of May at the highs for the month, breaking out above the key 18.09 level I have been discussing as a cluster of POCs. The close of 18.48 equaled the monthly close of August 2019. After that the last monthly high was in 2016.

As we move into June, /SI has now cleared the overhead supply of POCs that developed over the past year of consolidation and crash. Silver continues to be substantially undervalued relative to gold, and could see a short term blowoff this month, if things get rolling to the upside. A break back under 18.09 would invalidate this idea.

June /SI Chart

May POC: 17.84

Value High: 18.51

Value Low: 15.77

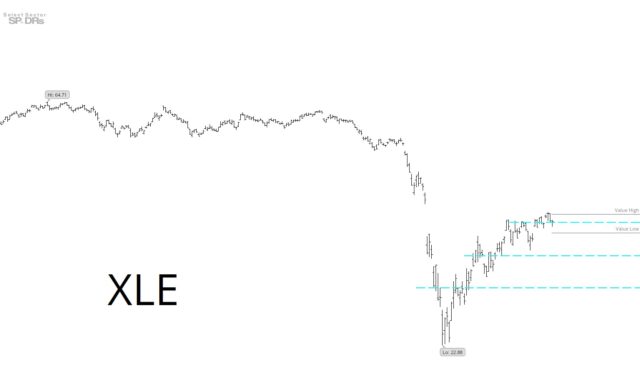

On the bearish front, I think the energy sector may offer some of the best bearish moves of the month. Coming off the crash low, $XLE has had a more modest retrace then the overall market. It is also nearing a gap fill of the 3/6/20 gap, which had a low of 41.86.

As we begin the month of June, I would pay special attention to how $XLE reacts around value high of 40.01. If early in the month it breaks out above that level, good short entries would be a gap fill of 41.86, or a failed breakout of 40.01.

June $XLE Chart

May POC: 38.59

Value High: 40.01

Value Low: 36.94

And finally… for the music lovers. One of my favorite artists, Sarah Jarosz, is releasing her newest album this week. Enjoy the taste below, and pick up a copy of the CD later this week.